Share This Page

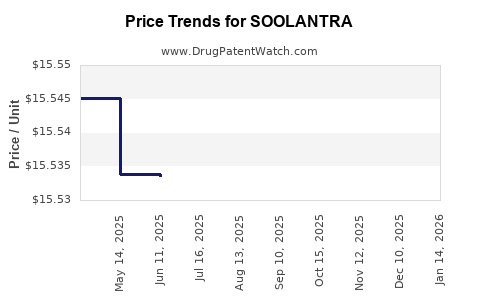

Drug Price Trends for SOOLANTRA

✉ Email this page to a colleague

Average Pharmacy Cost for SOOLANTRA

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| SOOLANTRA 1% CREAM | 00299-3823-45 | 15.51622 | GM | 2025-12-17 |

| SOOLANTRA 1% CREAM | 00299-3823-45 | 15.50840 | GM | 2025-11-19 |

| SOOLANTRA 1% CREAM | 00299-3823-45 | 15.51623 | GM | 2025-10-22 |

| SOOLANTRA 1% CREAM | 00299-3823-45 | 15.52854 | GM | 2025-09-17 |

| SOOLANTRA 1% CREAM | 00299-3823-45 | 15.52886 | GM | 2025-08-20 |

| SOOLANTRA 1% CREAM | 00299-3823-45 | 15.52611 | GM | 2025-07-23 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for SOOLANTRA

Introduction

SOOLANTRA (ixekizumab) is a biologic drug primarily prescribed for the treatment of moderate to severe plaque psoriasis. Since its approval by the FDA in 2016, SOOLANTRA has positioned itself as a significant contender in the dermatology therapeutic market. As with many biologic agents, its market prospects are influenced by evolving healthcare policies, competitive dynamics, and validation from clinical outcomes. This analysis explores the current market landscape, competitive environment, regulatory factors, and provides projections for SOOLANTRA's pricing trajectory over the next five years.

Market Overview and Therapeutic Landscape

The global psoriasis market is characterized by steady growth, driven by increasing prevalence, patient awareness, and advances in biologic treatments. The American Academy of Dermatology estimates that approximately 7.5 million adults in the U.S. live with psoriasis, with about 30% suffering from moderate to severe disease, qualifying them for biologic therapy like SOOLANTRA. The global market is projected to reach USD 16.8 billion by 2027, with a compounded annual growth rate (CAGR) of approximately 7.4% between 2022 and 2027 [1].

Competitive Environment

SOOLANTRA faces competition from multiple biologic agents, including Humira (adalimumab), Cosentyx (secukinumab), and Stelara (ustekinumab). These drugs have established market positions with substantial patient and physician familiarity. However, SOOLANTRA's unique positioning lies in its targeted mechanism of action, dosing schedule, and emerging biosimilar options, which could influence its market share and pricing strategies.

Regulatory and Price Considerations

Biologics are typically priced in the range of USD 30,000 to USD 60,000 annually per patient, depending on dosing and country-specific factors. The drug’s pricing is influenced by factors such as patent protection, manufacturing costs, reimbursement policies, and competition from biosimilars once patents expire. As of 2023, SOOLANTRA remains under patent protection in major markets like the U.S. and EU, with exclusivity expected to extend into the late 2020s [2].

Market Dynamics Influencing Price Trajectory

-

Patent Expiry and Biosimilar Entry: Patent expiration is the primary driver of price reductions in biologics. The impending expiration of patents could lead to biosimilar introductions, pressuring prices downward.

-

R&D and Manufacturing Costs: Innovator costs remain high, supporting premium pricing models during patent exclusivity periods.

-

Reimbursement Policies: Shifts toward value-based pricing and payer negotiations directly impact final patient costs.

-

Market Penetration and Uptake: Increased adoption driven by real-world evidence and expanded indications can support higher pricing during early phases.

Price Projections (2023–2028)

Short-term Perspective (2023–2024)

In the immediate future, SOOLANTRA’s list price is expected to remain stable within the USD 45,000–USD 50,000 range annually in most markets, supported by patent protection and current demand. Rebate and discount levels offered to payers will likely fluctuate, affecting net prices. Given the absence of biosimilar competition in the next 1–2 years, upward pressure on list prices is unlikely.

Medium-term Outlook (2025–2026)

As patent protection nears expiration (anticipated around 2026–2027 in key jurisdictions), biosimilar entrants are expected, potentially leading to significant price erosion—estimations suggest reductions of 20–40% in list prices. Strategic pricing approaches, such as differential pricing or value-based discounts, will become prevalent.

Long-term Forecast (2027–2028)

Post-biosimilar entry, SOOLANTRA and similar biologics are projected to experience a substantial price decline, possibly stabilizing at 50–60% discount from peak list prices. Market share shifts favoring biosimilars will influence the remaining prices, with the likelihood of tiered pricing in different regions.

Key Price Influencers

- Patent litigation and extensions

- Regulatory approvals for new indications

- Adoption rates in emerging markets

- Payer and insurer negotiations

Market Entry and Revenue Potential

The total addressable market for SOOLANTRA hinges heavily on the prevalence of psoriasis and patient access. Currently, the drug's revenue contribution is moderate relative to established biologics, but expansion into additional indications such as psoriatic arthritis could elevate its market share and price utilization.

Key Takeaways

- Stable Pricing in the Short Term: SOOLANTRA’s list price is expected to remain stable at approximately USD 45,000–USD 50,000 annually through 2024, barring significant market shifts.

- Patent Expiry Pressures: Entry of biosimilars around 2026–2027 will likely trigger a sharp reduction in prices, potentially halving current list prices.

- Market Expansion Opportunities: Expanding indications and uptake into emerging markets could sustain revenue streams despite impending biosimilar competition.

- Reimbursement Trends: Pay-for-performance models and value-based pricing are rising, impacting net prices and patient access strategies.

- Pricing Differentiation Strategies: Manufacturers may adopt tiered, region-specific pricing to maintain competitiveness and maximize lifetime revenue.

FAQs

Q1: Will SOOLANTRA's price increase or decrease in the next year?

Based on current patent protections and market dynamics, SOOLANTRA's list price is expected to remain relatively stable through 2024, with potential reductions coinciding with biosimilar entry thereafter.

Q2: How will biosimilar competition affect SOOLANTRA's pricing?

Biosimilar entrants typically lead to a 20–40% decrease in prices, which could substantially impact SOOLANTRA's market share and revenue, depending on regional patent statuses and market acceptance.

Q3: Are there opportunities for SOOLANTRA to command premium pricing?

Yes, by demonstrating superior efficacy in specific patient subgroups or expanding indications, SOOLANTRA might sustain premium pricing through differentiated clinical value.

Q4: Which regions will most influence the drug’s future pricing?

The U.S. and European Union are primary markets driven by high reimbursement levels, but emerging markets in Asia and Latin America will increasingly influence global price strategies.

Q5: What strategies can manufacturers deploy to sustain profitability?

Implementing value-based pricing models, expanding indications, fostering patient adherence, and negotiating favorable reimbursement agreements are key strategies to sustain profitability amidst upcoming biosimilar competition.

References

- Grand View Research. Psoriasis Market Size, Share & Trends Analysis Report. 2022.

- U.S. Food and Drug Administration. Biologic Drug Patent Status and Exclusivity Data. 2023.

More… ↓