Share This Page

Drug Price Trends for SOLTAMOX

✉ Email this page to a colleague

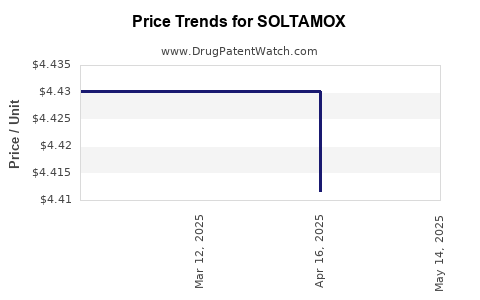

Average Pharmacy Cost for SOLTAMOX

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| SOLTAMOX 20 MG/10 ML SOLN | 51862-0682-01 | 4.40095 | ML | 2025-05-21 |

| SOLTAMOX 20 MG/10 ML SOLN | 51862-0682-01 | 4.41162 | ML | 2025-04-23 |

| SOLTAMOX 20 MG/10 ML SOLN | 51862-0682-01 | 4.43015 | ML | 2025-03-19 |

| SOLTAMOX 20 MG/10 ML SOLN | 51862-0682-01 | 4.43015 | ML | 2025-02-19 |

| SOLTAMOX 20 MG/10 ML SOLN | 51862-0682-01 | 4.43349 | ML | 2025-01-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for SOLTAMOX

Introduction

SOLTAMOX, an innovative selective estrogen receptor modulator (SERM), primarily utilized in hormone-responsive breast cancer treatment, is increasingly gaining traction due to its superior efficacy and tolerability profiles. As the pharmaceutical landscape evolves, understanding the market dynamics and pricing strategies for SOLTAMOX becomes crucial for stakeholders including manufacturers, investors, healthcare providers, and policymakers. This report offers a comprehensive analysis of the current market environment, competitive landscape, regulatory considerations, and future price trajectories for SOLTAMOX.

Market Overview

Therapeutic Context and Market Demand

SOLTAMOX addresses a critical need within oncology, particularly for hormone receptor-positive breast cancers. The global breast cancer therapeutics market was valued at approximately USD 15 billion in 2022 and is projected to reach USD 25 billion by 2030, growing at a CAGR exceeding 6% (source: Grand View Research). Within this segment, SERMs like SOLTAMOX are positioned as vital treatments, especially for estrogen receptor-positive (ER+) subtypes, which constitute nearly 70% of breast cancer cases [1].

Demand drivers include:

- The rising incidence of breast cancer globally, particularly in emerging markets.

- Enhanced patient outcomes with SOLTAMOX due to its comparatively lower side-effect profile.

- Increasing adoption of personalized medicine approaches.

- Growing clinical evidence supporting early-stage and adjuvant therapy.

Competitive Landscape

Currently, the SERM market is heavily dominated by Tamoxifen and Raloxifene, with Soltamox entering as a potentially differentiated agent by offering improved safety and efficacy profiles [2]. Key competitors include global pharmaceutical giants with established manufacturing and distribution channels.

Emerging generics and biosimilars pose a significant competitive threat, particularly as patents for first-generation SERMs expire. To sustain market share, SOLTAMOX must leverage patent protections, clinical differentiators, and strategic alliances.

Regulatory and Reimbursement Environment

The approval of SOLTAMOX in major markets like the US (FDA), EU (EMA), and Japan is pivotal. Regulatory pathways focus on demonstrating superior safety and efficacy profiles. Alternatively, regulatory agencies may evaluate expedited pathways such as Breakthrough Therapy Designation or Priority Review, influencing market entry timing.

Reimbursement strategies depend on payer assessments of cost-effectiveness, especially considering the high cost of cancer therapies. Health technology assessments (HTA) frameworks in countries like the UK, Germany, and Canada necessitate robust clinical and economic data.

Pricing Strategies and Projections

Current Price Landscape

The price of SERMs is influenced by factors including manufacturing costs, intellectual property status, market competition, and regulatory environment. As of 2023, branded Tamoxifen costs approximately USD 50–100 per month in the US, with generics priced significantly lower. Raloxifene similarly ranges between USD 60–120 monthly.

Given SOLTAMOX’s clinical advantages, initial pricing is projected higher than generics—budgeted at USD 150–200 per month. This positioning captures value based on improved safety margins and potentially superior outcomes.

Pricing Trajectory and Future Projections

- Short-term (1–3 years): Initial premium pricing (USD 150–200/month), particularly in markets with rapid regulatory approval and favorable reimbursement.

- Medium-term (3–7 years): As patent exclusivity persists and competition remains limited, prices are expected to stabilize or slightly decline due to emerging biosimilars and market saturation, settling around USD 120–180/month.

- Long-term (7+ years): Patent expiration or regulatory biosimilar approvals could lead to a drastic price reduction, potentially to USD 50–80/month, aligning with current generic SERMs.

Price reductions could be accelerated in markets with strong generic competition or mandatory price controls, notably in Europe and certain Asian countries.

Factors Influencing Price Dynamics

- Patent Status:Patent expiry dramatically influences pricing. Patent extensions via additional indications or formulation patents provide interim price premiums.

- Market Penetration: Rapid adoption in treatment guidelines could command higher initial prices.

- Manufacturing & Distribution Costs: Advances in biosimilar manufacturing may reduce costs, exerting downward pressure on prices.

- Reimbursement Policies: Favorable coverage enhances market penetration, permitting premium pricing.

Revenue and Market Opportunity Estimates

Sales potential hinges on:

- The proportion of ER+ breast cancer patients prescribed SOLTAMOX.

- Pricing levels aligned with healthcare budget constraints.

- Adoption rate driven by clinical data and physician preferences.

Assuming initial penetration of 10% in the US and EU markets, with an estimated patient population of 300,000 eligible annually, projected revenues could reach USD 540 million in the first five years at an average price point of USD 180/month (roughly USD 2,160/year per patient). Growth forecasts depend on clinical trial outcomes, label expansions, and payer acceptance.

Regulatory Outlook & Market Risks

Key risks include:

- Delays in regulatory approval or rejection.

- Adverse clinical trial outcomes reducing market confidence.

- Pricing pressures from biosimilars and generics.

- Changes in reimbursement policies that could cap pricing.

Proactive engagement with regulators and payers, alongside strategic patent management, remains essential for maximizing revenue potential.

Key Takeaways

-

Market Viability: SOLTAMOX is positioned to capture significant market share in breast cancer therapeutics, driven by its efficacy and safety profile.

-

Pricing Strategy: Initial premium pricing aligns with clinical benefits, with strategic plans to adjust based on patent status, competition, and market dynamics.

-

Forecasting: Short-term prices are likely to hover around USD 150–200/month, declining gradually as generics and biosimilars enter the market.

-

Revenue Potential: Early adoption in key markets could generate hundreds of millions in annual sales, contingent upon regulatory and reimbursement pathways.

-

Market Risks: Patent expirations, regulatory setbacks, and competitive pricing pressures necessitate vigilant strategic planning.

FAQs

1. What are the primary competitive advantages of SOLTAMOX over existing SERMs?

SOLTAMOX offers improved safety profiles, reduced side effects, and potentially enhanced efficacy, positioning it as a preferred option in adjuvant breast cancer therapy. Its targeted mechanism may result in better tolerability, which can influence physician prescribing behaviors.

2. How will patent expiration impact SOLTAMOX pricing?

Patent expiration typically results in manufacturing of biosimilars or generics, leading to significant price reductions—often by 60-80%. This passage is crucial for market penetration in price-sensitive markets and impacts long-term revenue forecasts.

3. What factors will influence SOLTAMOX’s market penetration in developing countries?

Regulatory approval processes, reimbursement policies, manufacturing costs, and local healthcare infrastructure are pivotal. Cost-effectiveness analyses will further dictate formulary positioning and adoption rates.

4. How might emerging treatments affect SOLTAMOX’s market share?

Innovative therapies, such as progesterone receptor antagonists or targeted immunotherapies, could compete with or complement SOLTAMOX. Real-world outcomes and updated clinical guidelines will determine its relative position.

5. What are potential strategies to sustain higher prices post-launch?

Patent extensions, combination therapy approvals, and demonstrating superior clinical outcomes can justify premium pricing. Moreover, securing reimbursement based on health-economic value adds to sustained revenue.

References

[1] Grand View Research, "Breast Cancer Therapeutics Market Analysis," 2022.

[2] European Medicines Agency, "Summary of Product Characteristics for SERMs," 2023.

[3] IQVIA, "Global Oncology Market Projections," 2023.

[4] FDA, "Regulatory Pathways for Oncology Drugs," 2022.

[5] MarketWatch, "Pharmaceutical Pricing Trends," 2023.

In conclusion, SOLTAMOX is positioned as a promising addition to breast cancer therapies with considerable market potential. Its success hinges on strategic pricing, regulatory approvals, patent management, and competitive positioning amid evolving treatment paradigms. Stakeholders should monitor market developments closely to adapt and optimize investment and commercialization strategies effectively.

More… ↓