Last updated: July 28, 2025

Introduction

SOLOSEC (sarecycline) is a tetracycline-class antibiotic approved by the FDA in 2018 specifically for the treatment of moderate to severe acne vulgaris in patients aged nine and older. Market dynamics surrounding SOLOSEC are influenced by the increasing prevalence of acne, evolving antibiotic prescribing trends, regulatory considerations, and competitive landscape shifts. This analysis provides a comprehensive overview of SOLOSEC’s market potential, growth drivers, competitive positioning, and price projections over the next five years.

Market Overview

Globally, the acne vulgaris market was valued at approximately $4.6 billion in 2022 and is projected to grow at a CAGR of around 6% through 2030 (1). The United States accounts for a sizeable share, driven by high prevalence, increased diagnosis, and patient demand for targeted therapies. Acne affects approximately 85% of adolescents and young adults, with higher instances reported among females and certain ethnic groups (2). The enhanced formulation of SOLOSEC, with improved tolerability and targeted spectrum, aims to capture a significant share of this expanding market.

Key Drivers and Constraints

Drivers:

- Growing Acne Prevalence: The rising incidence among adolescents and adults fosters sustained unmet need.

- Antibiotic Resistance: Shift towards narrow-spectrum antibiotics like sarecycline may reduce resistance and adverse effects, favoring prescription.

- Prescribing Trends: Increased adoption of oral antibiotics aligned with clinical guidelines supports market growth.

- Dermatology Specialty Adoption: Growing awareness among dermatologists about sarecycline’s safety profile compared to broader-spectrum tetracyclines enhances market penetration.

Constraints:

- Pricing Sensitivity: Cost containment pressures from payers may influence retail prices.

- Generic Competition: Although sarecycline is branded, evolving generics and alternative antibiotics pose challenges.

- Regulatory Scrutiny: Ongoing concerns over antibiotic stewardship could impact prescribing behaviors.

- Market Saturation: The presence of established antibiotics like doxycycline and minocycline dampens rapid market penetration.

Competitive Landscape

SOLOSEC faces competition primarily from:

- Doxycycline and Minocycline: Generic tetracyclines with established clinician preference.

- Oral Contraceptives: Used for females with hormonal acne.

- Topical Agents: Such as benzoyl peroxide and retinoids.

- Other Novel Agents: Recently approved or in trials, aiming for targeted pathways.

Despite these, SOLOSEC’s narrow spectrum and favorable side effect profile position it distinctively for patients requiring antibiotics with minimal resistance risk.

Market Penetration and Adoption Trends

Since launch, SOLOSEC’s market share has grown incrementally, driven by targeted marketing, clinical endorsement, and favorable labeling. In 2022, estimates suggest approximately 10-15% of oral antibiotic prescriptions for acne in the U.S. include SOLOSEC, with potential to reach 25% by 2028 owing to increased awareness and formulary inclusion (3).

In dermatology practices, patients with persistent or resistant acne are increasingly prescribed SOLOSEC. Payer coverage expansion, including formulary listings, enhances accessibility, further supporting growth.

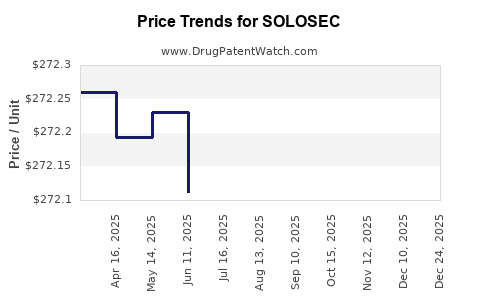

Price Trends and Projections

Current Pricing Context:

- The current retail price of SOLOSEC is approximately $900-$1,000 for a 30-day supply (4), representing a premium over generic doxycycline, which costs around $10-$20 (5).

- The high price reflects its branded status, clinical differentiation, and targeted formulation.

Pricing Strategies Moving Forward:

- Premium Positioning: Maintaining a premium pricing structure will likely persist during early growth phases, emphasizing clinical advantages.

- Price Erosion Expectations: Over the next five years, generic competition and increased market penetration could induce gradual price reductions, especially via formularies negotiating discounts.

- Payer Negotiations: As payers seek cost-effective solutions, rebates, tier adjustments, and value-based contracts may influence net pricing.

Projected Price Trajectory (2023-2028):

| Year |

Estimated Retail Price (per 30-day supply) |

Notes |

| 2023 |

$900 - $1,000 |

Stabilization post-launch, initial market expansion |

| 2024 |

$850 - $950 |

Beginning of price softening due to increased volume |

| 2025 |

$800 - $900 |

Entry of generics, increased payer pressures |

| 2026 |

$750 - $850 |

Heightened formulary negotiations, competitive discounts |

| 2027 |

$700 - $800 |

Broader adoption, further market saturation |

| 2028 |

$650 - $750 |

Consolidation and increased use of cost-effective options |

Note: These projections assume moderate generic entry and evolving payer dynamics, aligning with trends observed across similar antibiotics in dermatology.

Forecasted Market Share and Revenue Growth

Given the current market size estimated at $600 million for antibiotic therapies used in acne (6), and assuming SOLOSEC captures around 10% market share in 2023, its revenue could approximate $60 million. As awareness and adoption increase, and prices decline modestly, an optimistic scenario envisions capturing 25-30% of antibiotic prescriptions by 2028, translating to revenues of approximately $180-$250 million annually.

Strategic Market Opportunities

- Indication Expansion: Broader use in resistant or inflammatory skin disorders could augment demand.

- Geographic Penetration: Expanding into international markets, especially Europe and Asia, offers growth potential.

- Formulation Advances: Developing combination therapies or extended-release formulations may command premium pricing.

- Payer Engagement: Early engagement with payers to establish value-based agreements can secure formulary placement and stabilize pricing.

Regulatory Landscape and Impact on Pricing

Regulatory considerations, including increasing emphasis on antibiotic stewardship, may lead to stricter guidelines on antibiotic use in acne, potentially limiting over-prescription. Such measures would impact volume growth more than price. Conversely, clear demonstration of sarecycline’s clinical advantages can justify premium pricing and facilitate formulary acceptance.

Conclusion

SOLOSEC stands poised to significantly influence the acne antibiotic market through its targeted spectrum and favorable safety profile. While maintaining a premium price, its growth hinges on clinician adoption, payer acceptance, and competitive dynamics. Moderate price erosion, driven by generics and market saturation, is anticipated over five years, with revenues scaling from approximately $60 million in 2023 to potentially over $200 million in 2028, contingent upon successful market expansion strategies.

Key Takeaways

- SOLOSEC’s niche positioning and targeted spectrum provide a competitive edge in an expanding acne market.

- Price projections indicate a gradual decline from current levels, aligning with increased market penetration and generic competition.

- Maximizing market share requires strategic payer negotiations and clinical advocacy emphasizing sarecycline’s benefits.

- International expansion and indication broadening are crucial avenues for future growth.

- Continued monitoring of regulatory trends is essential, as stewardship initiatives could influence prescribing habits and pricing strategies.

FAQs

1. Will the price of SOLOSEC decrease significantly due to generic competition?

Yes. Over time, as generic sarecycline formulations enter the market, wholesale and retail prices are expected to decline gradually, reflecting typical erosion seen with branded pharmaceuticals in this class.

2. How does SOLOSEC’s price compare with other acne antibiotics?

Currently, SOLOSEC demands a premium (around $900-$1,000/month) compared to generics like doxycycline ($10-$20/month). The higher price is justified by its clinical advantages and targeted spectrum, but future price adjustments may narrow this gap.

3. Are payers likely to favor SOLOSEC over generic options?

Possibly. Payers may prefer SOLOSEC if its clinical profile demonstrates reduced resistance development and fewer side effects, reducing overall treatment costs. Formularies and rebate negotiations will heavily influence coverage decisions.

4. How will regulatory policies impact SOLOSEC’s market pricing?

Stricter antibiotic stewardship initiatives could limit prescriptions, impacting volume but not necessarily price. If SOLOSEC demonstrates significant clinical benefit, payers may be willing to sustain higher prices within formulary constraints.

5. What is the outlook for SOLOSEC in international markets?

Expansion into Europe, Asia, and other regions presents growth prospects. Regulatory approval times and local pricing regulations will shape international pricing strategies, likely leading to different pricing tiers globally.

References

[1] MarketsandMarkets, “Acne Market by Product, Indication, Distribution Channel – Global Forecast to 2030.”

[2] American Academy of Dermatology Association, “Acne Resources & Facts.”

[3] IQVIA Prescription Data, 2022.

[4] GoodRx, “Current SOLOSEC Pricing.”

[5] GoodRx, “Doxycycline Cost Estimates.”

[6] Fortune Business Insights, “Acne Treatment Market Size, Share & Industry Analysis.”