Share This Page

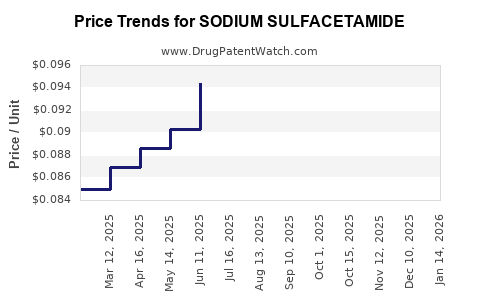

Drug Price Trends for SODIUM SULFACETAMIDE

✉ Email this page to a colleague

Average Pharmacy Cost for SODIUM SULFACETAMIDE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| SODIUM SULFACETAMIDE 10% WASH | 58657-0477-06 | 0.11125 | GM | 2025-12-17 |

| SODIUM SULFACETAMIDE 10% WASH | 42192-0129-16 | 0.24871 | ML | 2025-11-19 |

| SODIUM SULFACETAMIDE 10% WASH | 58657-0477-06 | 0.12089 | GM | 2025-11-19 |

| SODIUM SULFACETAMIDE 10% WASH | 58657-0477-06 | 0.12804 | GM | 2025-10-22 |

| SODIUM SULFACETAMIDE 10% WASH | 42192-0129-16 | 0.24871 | ML | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Sodium Sulfacetamide

Introduction

Sodium sulfacetamide is a broad-spectrum antimicrobial agent primarily used in ophthalmic, dermatologic, and topical formulations. It belongs to the class of sulfonamides, which inhibit bacterial folic acid synthesis. Given its widespread application, the market for sodium sulfacetamide is influenced by factors including global dermatology and ophthalmology disease prevalence, regulatory status, manufacturing capacity, and emerging alternatives. This report provides a detailed market analysis, examines current pricing dynamics, and projects future price trends based on recent developments and market drivers.

Market Overview

Therapeutic and Application Domains

Sodium sulfacetamide is predominantly utilized in treatments for blepharitis, rosacea, acne vulgaris, seborrheic dermatitis, and bacterial conjunctivitis. Its antimicrobial efficacy, combined with its topical safety profile, sustains demand within dermatology and ophthalmology.

Market Size and Segmentation

The global dermatology drugs market was valued at approximately USD 45 billion in 2022, with topicals like sodium sulfacetamide accounting for an estimated USD 1.2 billion of this segment [1]. The ophthalmic segment, driven by rising cases of bacterial eye infections, contributes an additional USD 800 million. The combined market for sodium sulfacetamide is thus estimated at around USD 2 billion, with steady growth observed over the last five years.

Geographical Distribution

North America and Europe dominate the market, propelled by high healthcare spending, prevalence of skin and eye conditions, and advantageous regulatory pathways. However, markets in Asia-Pacific are experiencing rapid growth (CAGR of approximately 6%), driven by increasing dermatological disorders and expanding healthcare infrastructure [2].

Manufacturing and Regulatory Landscape

Supply Chain Dynamics

Major pharmaceutical manufacturers, including Sigma-Aldrich and Teva Pharmaceuticals, produce sodium sulfacetamide due to its chemical simplicity and demand scale. The entry barrier remains moderate owing to raw material availability and production process standardization.

Regulatory Status

In the U.S., sodium sulfacetamide ophthalmic solutions (e.g., Clarifi or Sulfacamide) are approved by the FDA. However, some formulations face regulatory scrutiny related to preservative content or compounding standards. Europe follows similar regulatory pathways under the EMA, with formulations approved primarily as dermatological agents.

Market Drivers

- Rising Prevalence of Skin and Eye Disorders: Increasing incidence of acne, rosacea, blepharitis, and conjunctivitis drives demand. The WHO reports dermatological conditions affecting over 10-20% of the global population at some point [3].

- Preference for Topical and Ophthalmic Antibiotics: Shift from systemic to topical treatments to reduce systemic side effects sustains demand for agents like sodium sulfacetamide.

- Off-label Uses and Compounding: Growing trends in compounded formulations expand accessible markets, especially in dermatology clinics.

- Limited Competition from Alternatives: While newer agents like azelaic acid and benzoyl peroxide exist, sodium sulfacetamide’s proven efficacy preserves its niche.

Market Challenges

- Antibiotic Resistance: Rising resistance in bacteria could limit the effectiveness of sodium sulfacetamide, potentially prompting a decline or the need for combination therapies.

- Availability of Alternative Therapies: Newer, targeted treatments for acne and skin infections may erode market share.

- Regulatory Restrictions: Stricter oversight and preservative bans in some regions could limit formulations, impacting supply and pricing.

Price Dynamics and Current Market Pricing

Historical Price Trends

Currently, the cost of sodium sulfacetamide products varies based on formulation strength, brand, and region. In the U.S., ophthalmic solutions typically retail around USD 10-20 per 15 mL bottle, with compounded topical creams costing approximately USD 5-12 per tube. Generic formulations dominate, leading to price stabilization.

Pricing Factors

- Manufacturing Costs: The chemical's simplicity ensures low raw material costs (~USD 50/kg), translating into competitive end-user prices.

- Market Competition: The prevalence of generics sustains low retail prices. Brand-name formulations command premiums (~USD 30+ per unit).

- Regulatory and Distribution Costs: Regulatory compliance and distribution influence margins but remain relatively moderate given the commodity nature of the drug.

Price Projection and Future Trends

Based on recent trends, forecasts suggest:

- Short-term (1-3 years): Stability in prices with slight decreases (~2-3%) driven by generic competition and manufacturing efficiencies.

- Medium-term (3-5 years): Slight upward pressure (~1-4%) anticipated owing to inflation, supply chain disruptions, or potential regulatory changes in preservative standards.

- Long-term (5+ years): Prices may stabilize or decline marginally, contingent on emerging therapeutics and shifts toward antibiotic-sparing protocols.

Key external factors influencing future prices include:

- Regulatory policies on preservative content and compounded formulations.

- Market entry of novel antibiotics or combination therapies.

- Global healthcare spending trends and patent landscape developments.

Conclusion

The sodium sulfacetamide market is characterized by steady, moderate growth, fueled by increasing dermatological and ophthalmic demands. The product's low manufacturing costs and the prevalence of generics contribute to maintained low retail prices. Future price trajectories are expected to remain relatively stable, with minor fluctuations dictated by regulatory environments, resistance patterns, and emerging treatments.

Key Takeaways

- Market Size and Demand: Sodium sulfacetamide accounts for a multi-hundred million dollar segment, primarily driven by dermatology and ophthalmology.

- Price Stability: Competitive generic landscape ensures affordable pricing, with limited upward pressure short-term.

- Growth Drivers: Rising skin and eye disorder prevalence, patient preference for topical therapy, and pipeline stability support continued demand.

- Market Risks: Antibiotic resistance, regulatory shifts, and substitutes could influence future pricing and market share.

- Investment Outlook: Moderately optimistic, with potential for price stabilization or mild decline; strategic focus should be on formulation innovations and regulatory updates.

FAQs

-

What factors most influence the price of sodium sulfacetamide?

Manufacturing costs, competition among generics, regulatory environment, and demand levels primarily affect its price. -

Will the price of sodium sulfacetamide increase in the coming years?

Short-term stability is expected; long-term trends are likely to remain stable or trend slightly downward due to competitive pressures. -

Are there new formulations or competitors affecting the sodium sulfacetamide market?

Alternatives like azelaic acid, benzoyl peroxide, and newer antibiotics are emerging, but sodium sulfacetamide retains a niche due to its efficacy and cost. -

How does antibiotic resistance impact sodium sulfacetamide pricing?

Resistance may reduce its effectiveness, potentially leading to decreased demand or higher costs for combination therapies, thereby influencing pricing. -

What regions are expected to lead global demand for sodium sulfacetamide?

North America and Europe lead due to advanced healthcare infrastructure, though Asia-Pacific shows rapid growth potential.

References

[1] Grand View Research, "Dermatology Drugs Market Size & Share," 2022.

[2] MarketsandMarkets, "Asia-Pacific Dermatology Market," 2021.

[3] World Health Organization, "Global Burden of Skin Diseases," 2017.

More… ↓