Last updated: July 27, 2025

Introduction

Sodium Bicarbonate, commonly referred to as baking soda, holds significant relevance within multiple sectors, including pharmaceuticals, food processing, industrial manufacturing, and healthcare. Its versatility, affordability, and established safety profile—endorsed by regulatory agencies such as the FDA—position it as a staple ingredient across these industries. Recent market dynamics and evolving regulatory landscapes influence the supply chain, demand patterns, and pricing mechanisms for sodium bicarbonate. This analysis underscores current market trends, competitive forces, and future price trajectories to assist stakeholders in strategic decision-making.

Market Overview

Global Demand and Applications

The worldwide sodium bicarbonate market was valued at approximately USD 1.2 billion in 2022, with projections indicating an annual growth rate (CAGR) of around 4% from 2023 to 2030 [1]. This growth is primarily driven by increased demand in pharmaceutical manufacturing, particularly as an antacid, pH buffer in medical products, and in hospital settings. The food industry benefits from its use as a leavening agent, acidity regulator, and preservative. Industrial applications in water treatment, chemical synthesis, and fire suppression also bolster overall demand.

Regional Market Dynamics

- North America: The largest market, propelled by strong healthcare infrastructure, high consumer awareness, and stringent regulatory standards demanding pharmaceutical-grade sodium bicarbonate.

- Europe: Noted for sustainable manufacturing practices and strict quality standards, with steady growth driven by pharmaceutical and food sectors.

- Asia-Pacific: The fastest-growing segment, benefiting from expanding healthcare infrastructure, urbanization, and a burgeoning food industry. China and India are leading producers and consumers.

- Latin America and the Middle East & Africa: Show moderate growth, primarily driven by industrial applications.

Supply Chain and Regulatory Influences

Major producers include Solvay, FMC Corporation, and Tata Chemicals, positioning the market with significant capacity and technological expertise. The supply chain is relatively stable; however, recent disruptions due to global logistics issues have temporarily impacted prices. Environmental regulations concerning manufacturing waste and emissions influence operational costs, particularly in regions with stringent environmental standards.

In pharmaceutical-grade sodium bicarbonate, industry standards such as USP (United States Pharmacopeia) and EP (European Pharmacopoeia) enforce purity criteria, adding to manufacturing costs but ensuring high-quality output. Regulatory oversight impacts entry barriers and compliance costs, which in turn influence pricing strategies.

Market Drivers and Challenges

Drivers

- Healthcare and Pharmaceutical Growth: The rise in chronic respiratory conditions and acid-related disorders increases demand for sodium bicarbonate-based medications.

- Food Industry Expansion: Growing consumer preference for clean-label and natural products elevates demand for baking-related ingredients.

- Environmental Applications: Increasing use in wastewater treatment and in fire extinguishers promotes steady industrial consumption.

Challenges

- Price Volatility: Fluctuations in raw material costs, primarily due to shifts in natural resource prices and energy costs, impact profitability.

- Environmental Regulations: Stricter emission standards and waste disposal regulations elevate production costs, potentially leading to price increases.

- Emerging Competition: Substitute chemicals (e.g., potassium bicarbonate) and alternative processing methods may erode market share for sodium bicarbonate.

Price Analysis and Projections

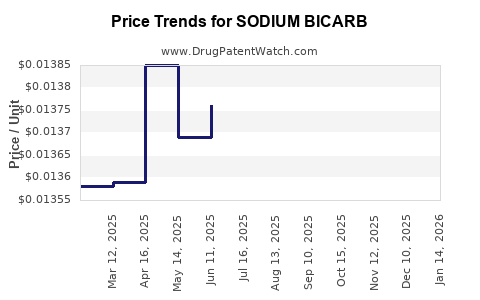

Historical Pricing Trends

Over the past five years, the wholesale price of pharmaceutical-grade sodium bicarbonate has oscillated between USD 400 and USD 600 per metric ton, largely reflective of raw material costs and regulatory compliance costs [2]. Food-grade prices have hovered slightly lower, averaging USD 300–USD 500 per ton.

Future Price Trends

Based on current market drivers, supply stability, and regulatory environment, the price of sodium bicarbonate is projected to increase modestly at a CAGR of approximately 2.5% from 2023 to 2030. Factors influencing this include:

- Raw Material Cost Inflation: Increased reliance on natural mineral sources for production, which are sensitive to energy prices, potentially elevates costs.

- Environmental Compliance: Investments in greener manufacturing processes may initially raise operational costs but could stabilize long-term pricing.

- Demand for Pharmaceutical Grade: Growth in healthcare applications sustains premium pricing segments, possibly widening margin disparities.

Scenario Analysis

- Optimistic Scenario: Accelerated demand in emerging markets and technological innovations reduce production costs, stabilizing or slightly decreasing prices.

- Pessimistic Scenario: Supply chain disruptions, raw material shortages, or stricter regulations escalate prices beyond 10% by 2030.

Strategic Implications for Stakeholders

Investors and manufacturers should monitor technological advances that optimize extraction and production methods, fostering cost efficiencies. Regulatory compliance adherence can facilitate premium market positioning, particularly in pharmaceuticals. Diversification across industry segments buffers against sector-specific fluctuations, stabilizing revenue streams.

Key Takeaways

- The sodium bicarbonate market is poised for steady growth driven by healthcare, food, and industrial sectors, with demand momentum expected to sustain through 2030.

- Price trajectories forecast moderate increases, primarily influenced by raw material costs and environmental regulations.

- Regional disparities highlight strategic opportunities; Asia-Pacific presents high-growth opportunities, while North America and Europe prioritize quality and regulatory adherence.

- Supply chain resilience and technological innovation are critical to managing cost pressures and maintaining competitive pricing.

- Stakeholders should consider diversification and investment in sustainable production to capitalize on emerging trends and regulatory landscapes.

FAQs

1. What factors mainly influence sodium bicarbonate prices?

Raw material costs, energy prices, environmental regulations, manufacturing efficiencies, and demand from healthcare, food, and industrial sectors are primary determinants.

2. How does regulatory compliance impact market prospects?

Strict quality and safety standards, especially in pharmaceuticals, can increase production costs but also create premium market segments with higher profit margins.

3. What regions are expected to experience the highest growth?

The Asia-Pacific region is projected to experience rapid growth driven by expanding healthcare infrastructure and industrialization.

4. Are there significant substitutes for sodium bicarbonate in industrial applications?

Yes, chemicals such as potassium bicarbonate and other buffering agents can serve as alternatives, potentially affecting supply and prices.

5. How might environmental regulations influence future supply?

Enhanced environmental standards may raise production costs, reduce supply flexibility, and consequently elevate prices unless offset by technological innovation.

Sources

[1] Market Research Future, “Sodium Bicarbonate Market Analysis & Forecast,” 2022.

[2] Industry reports from IQVIA, Transparency Market Research, and industry publications.