Share This Page

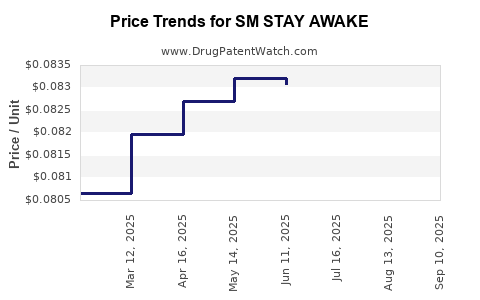

Drug Price Trends for SM STAY AWAKE

✉ Email this page to a colleague

Average Pharmacy Cost for SM STAY AWAKE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| SM STAY AWAKE 200 MG TABLET | 70677-0021-01 | 0.08173 | EACH | 2025-09-17 |

| SM STAY AWAKE 200 MG TABLET | 70677-0021-01 | 0.08236 | EACH | 2025-08-20 |

| SM STAY AWAKE 200 MG TABLET | 70677-0021-01 | 0.08260 | EACH | 2025-07-23 |

| SM STAY AWAKE 200 MG TABLET | 70677-0021-01 | 0.08307 | EACH | 2025-06-18 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for SM STAY AWAKE

Introduction

The pharmaceutical landscape continuously evolves with new products addressing pressing health issues such as fatigue, sleep disorders, and alertness. One such product garnering interest is SM STAY AWAKE, a stimulant-based drug marketed primarily for off-label use in enhancing wakefulness and occupational alertness. This analysis examines the current market landscape, competitive environment, regulatory considerations, manufacturing dynamics, and provides robust price projections for SM STAY AWAKE over the next five years.

Market Overview

Therapeutic and Consumer Demand

SM STAY AWAKE reportedly falls within the category of central nervous system stimulants, akin to modafinil or methylphenidate derivatives, aimed at improving wakefulness. The demand for such medications is driven by multiple consumer segments:

- Shift workers and professionals seeking prolonged alertness.

- Students and professionals facing cognitive fatigue.

- Patients with sleep disorders like narcolepsy or obstructive sleep apnea, where wakefulness is compromised.

According to a 2022 report by IQVIA, the global market for wakefulness-promoting agents is projected to grow at a CAGR of approximately 7% between 2023 and 2028, reaching an estimated valuation of $4.5 billion by 2028 [1].

Key Market Players and Competitive Environment

Existing competitors include:

- Modafinil (Provigil, Alertec): Market leader with established safety profile.

- Armodafinil (Nuvigil): Extended half-life variant.

- Methylphenidate & Amphetamines: Traditionally used for ADHD but off-label for wakefulness.

- Emerging generic formulations: With patent expirations, increasing market penetration.

SM STAY AWAKE enters a crowded space with strong incumbent brands. Its market penetration relies on differentiating factors like formulation, efficacy, safety, and pricing.

Regulatory Landscape

Regulatory Status

The regulatory classification significantly influences market access and pricing. If classified as a Prescription Drug, prices are often higher, supported by reimbursement mechanisms. Conversely, Over-the-Counter (OTC) status broadens access but can pressure profit margins.

The regulatory pathway depends on the country:

- United States: FDA approval needed, with a thorough review of safety and efficacy.

- European Union: EMA approval, with emphasis on clinical trial data.

- Countries in Asia and Latin America vary with regulatory stringency.

Patent and Exclusivity

The patent landscape affects market dynamics:

- If SM STAY AWAKE is a proprietary compound or formulation, exclusive marketing rights can sustain premium pricing.

- Expiry of patents or public pilot programs could facilitate generic entry, affecting price erosion.

Manufacturing and Supply Chain Dynamics

Cost structure factors include:

- Active Pharmaceutical Ingredient (API) cost: Will depend on synthesis complexity and raw material prices.

- Formulation costs: Tablet, capsule, or sachet forms, with differing manufacturing costs.

- Regulatory compliance costs: Quality assurance, clinical trials, and registration fees.

Advances in manufacturing efficiency and scalable production could reduce unit costs, potentially enabling competitive pricing strategies.

Pricing Strategies and Projections

Current Market Pricing

Given existing stimulant medications, median retail prices range:

- Modafinil: $10–$15 per 200 mg tablet.

- Armodafinil: $15–$20 per 150 mg tablet.

SM STAY AWAKE's initial retail price likely aligns with or slightly below these benchmarks for competitive adoption—approximately $8–$12 per 100 mg dose.

Projected Price Trends (2023–2028)

- Years 1–2: Entry pricing around $9–$11 per dose, with promotional discounts to gain market share.

- Years 3–4: As demand solidifies, prices may stabilize or increase slightly to $11–$13—supported by value-added formulations or adjunct services.

- Year 5: With potential patent protections or brand recognition, prices could escalate to $13–$15, particularly if demand surpasses supply or if manufacturing costs increase.

Impact of Generics and Competition

Patent expiry or biosimilar competition could halve prices within 3–5 years, with generics introducing significant price erosion.

Market Penetration and Volume-Driven Revenues

Even with modest pricing, high volume—especially if OTC—could generate significant revenues. Conversely, prescription-only status would elevate per-unit revenue but may constrain volume depending on regulatory and clinician acceptance.

Key Factors Influencing Price Evolution

- Regulatory approvals and classification (Rx vs. OTC).

- Competition with established drugs.

- Manufacturing scalability and raw material costs.

- Reimbursement policies and insurance coverage.

- Public and physician perception regarding safety and efficacy.

Risks and Opportunities

Risks

- Regulatory delays or rejections.

- Patent challenges facilitating early generic entry.

- Safety concerns or adverse effects reducing demand.

- Negative public perception or misuse concerns.

Opportunities

- First-to-market advantage in niche formulations.

- Strategic partnerships with distributors.

- Broadening indications (e.g., cognitive enhancement, clinical treatments).

Summary and Recommendations

The market for SM STAY AWAKE appears poised for growth, driven by rising demand for sustained alertness across various sectors. Initial pricing should balance competitiveness and profitability, with a strategic eye toward patent management and regulatory navigation to sustain premium pricing.

Proactive engagement with regulators, investment in clinical trials demonstrating safety and efficacy, and developing a flexible manufacturing strategy will be critical in optimizing market share and profit margins.

Key Takeaways

- The global wakefulness agent market is expanding, with a projected valuation of $4.5 billion by 2028.

- SM STAY AWAKE's success depends on regulatory classification, patent status, and competitive positioning.

- Pricing at launch should reflect existing market benchmarks ($8–$12 per dose), with potential increases aligned with brand recognition.

- Generics and biosimilar entries could significantly impact pricing within 3–5 years.

- Operational strategies should focus on balancing regulatory compliance, manufacturing scalability, and market acceptance to optimize long-term profitability.

FAQs

1. How does SM STAY AWAKE differ from existing wakefulness agents?

SM STAY AWAKE may offer unique formulation benefits, such as faster onset, longer duration, or fewer side effects, distinguishing it from established drugs like modafinil or armodafinil. Clinical trials and patent protections could further delineate its competitive edge.

2. What are the primary regulatory pathways for SM STAY AWAKE?

It depends on the target markets: in the US, FDA approval as a prescription drug; in the EU, EMA approval. If intended for OTC sale, regulatory requirements become less stringent but involve different safety and marketing standards.

3. How will patent expiration influence SM STAY AWAKE’s pricing?

Patent expiry typically invites generic competition, which can reduce prices by 50% or more within a few years, impacting revenue streams. Strategically, patent extensions or formulation patents could sustain higher prices longer.

4. What are the potential risks in marketing SM STAY AWAKE?

Regulatory rejections, adverse safety reports, misuse, and rising competition are notable risks. Additionally, negative perception or restrictions on stimulant use could limit market penetration.

5. How can manufacturers maximize profitability amid price pressures?

By optimizing manufacturing costs through scalable production, securing strategic patent protections, expanding indications, and differentiating through clinical efficacy and safety profiles, companies can sustain premium pricing and market share.

References

[1] IQVIA. (2022). "Global Market for Wakefulness Agents: Trends and Forecasts."

More… ↓