Share This Page

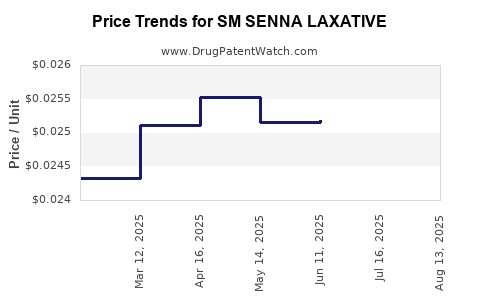

Drug Price Trends for SM SENNA LAXATIVE

✉ Email this page to a colleague

Average Pharmacy Cost for SM SENNA LAXATIVE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| SM SENNA LAXATIVE 8.6 MG TAB | 70677-0164-01 | 0.02523 | EACH | 2025-08-20 |

| SM SENNA LAXATIVE 8.6 MG TAB | 70677-0164-01 | 0.02520 | EACH | 2025-07-23 |

| SM SENNA LAXATIVE 8.6 MG TAB | 70677-0164-01 | 0.02518 | EACH | 2025-06-18 |

| SM SENNA LAXATIVE 8.6 MG TAB | 70677-0164-01 | 0.02515 | EACH | 2025-05-21 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for SM SENNA LAXATIVE

Introduction

SM SENNA LAXATIVE stands as a prominent over-the-counter (OTC) remedy used primarily for short-term relief from constipation. Its active ingredient, senna, is a natural laxative derived from Cassia species, widely recognized for its efficacy and safety in drug formulations. As the global constipation treatment market grows, understanding its market dynamics, competitive landscape, and pricing trends becomes vital for stakeholders—including pharmaceutical companies, investors, and healthcare providers. This analysis presents a comprehensive overview of SM SENNA LAXATIVE's market environment, current pricing strategies, and future price projections over the coming five years.

Market Overview and Demand Drivers

Global Market Size and Growth

The global laxative market, valued at approximately USD 6.5 billion in 2022, is projected to grow at a Compound Annual Growth Rate (CAGR) of around 4.2% through 2028. Increasing prevalence of gastrointestinal disorders—particularly among aging populations—propels this growth. Senna-based products constitute a significant subset of this market, favored for their natural origin and established safety profile.

Consumer Preferences and Regulatory Environment

Consumers increasingly prefer natural and herbal remedies, citing minimal side effects and organic credentials. Regulatory bodies, including the FDA and EMA, generally classify senna-based laxatives as safe when used appropriately, which fosters continued market acceptance. Nonetheless, regulatory scrutiny, especially regarding long-term use and potential adverse effects like electrolyte imbalance, persists and influences product positioning.

Key Market Segments

- Geographical Breakdown: North America and Europe dominate the market owing to high healthcare awareness, but Asia Pacific exhibits rapid growth driven by rising urbanization and traditional medicine integration.

- Distribution Channels: OTC sales through pharmacies, supermarkets, and online platforms account for over 85% of sales, with e-commerce experiencing double-digit growth annually.

Competitive Landscape

Major Players

- Chattem, Inc. (Johnson & Johnson brand): A significant player offering Senokot and other senna-based products.

- Bayer AG: markets herbal and pharmaceutical laxatives, including senna formulations.

- Nature's Way: Promotes herbal remedies with natural senna extracts.

- Local and regional brands: Particularly prevalent in emerging markets with lower price points.

Product Differentiation Strategies

Developers focus on formulation innovation, such as combination products pairing senna with electrolyte replenishment, and packaging improvements to enhance ease of use and compliance.

Market Entry Barriers

Intellectual property constraints are minimal due to the nature of active ingredients, but brand loyalty and regulatory approvals pose significant barriers.

Pricing Dynamics

Current Price Points

Price variability is considerable across regions:

- North America: A standard package (30 tablets) typically retails for USD 4.00–USD 6.00.

- Europe: Similar packages range from EUR 3.50–EUR 5.50.

- Asia-Pacific: Prices tend to be lower, approximately USD 1.50–USD 3.00, reflecting local manufacturing and purchasing power differentials.

Pricing Factors

- Brand strength: Established brands command premium pricing.

- Formulation: Combination or specialized formulations attract higher prices.

- Distribution channel: Online sales often feature discounts, leading to lower effective prices.

- Regulatory and safety standards: Stringent regulations can increase costs, influencing final retail prices.

Pricing Trends and Stakeholder Strategies

- Price competition: Leading brands maintain minimal price margins to retain market share.

- Premium positioning: Certain herbal and organic variants are priced higher, targeting health-conscious consumers.

- Private label expansion: Retail chains increasingly introduce lower-priced generic options.

Future Price Projections (2023–2028)

Methodology

Analysis integrates historical pricing data, market growth rates, inflation trends, and strategic responses by manufacturers. A weighted approach considers regional preferences, regulatory advancements, and e-commerce impact.

Projected Trends

-

North America & Europe: Prices are projected to grow modestly (~2–3% CAGR), reflecting market saturation and stiff pricing competition. Premium herbal variants may see a higher CAGR (~4%), driven by consumer preferences.

-

Asia Pacific & Emerging Markets: Higher growth potential (~5% CAGR) due to increasing demand, driven by urbanization and health awareness, may result in incremental pricing increases despite cost-saving manufacturing strategies.

-

Online Market Impact: Continued price reductions (~1–2% CAGR) due to increased competition and promotional activities.

-

Regulatory Influences: Emerging safety standards might marginally elevate manufacturing costs, leading to slight retail price increases (around 1–2%).

Five-Year Forecast Summary

| Region | 2023 Price Range (USD) | 2028 Price Range (USD) | CAGR Approximate | Key Drivers |

|---|---|---|---|---|

| North America | 4.50 – 6.00 | 5.20 – 7.00 | 3% | Brand loyalty, innovation |

| Europe | 4.00 – 5.50 | 4.60 – 6.40 | 3% | Regulatory stability |

| Asia-Pacific | 1.75 – 3.00 | 2.20 – 4.00 | 5% | Market growth, local manufacturing |

| Emerging markets | 1.50 – 2.50 | 1.80 – 3.50 | 5% | Economic development, awareness |

Market Risks and Opportunities

Risks

- Regulatory tightening: Heightened scrutiny around long-term safety could impact formulation and manufacturing costs.

- Consumer shifts: Preferences moving away from herbal laxatives toward alternative treatments.

- Market saturation: Eked-out margins in developed markets due to fierce price competition.

- Supply chain disruptions: Raw material shortages (e.g., cassia plants) can affect pricing and availability.

Opportunities

- Product Innovation: Incorporating additional natural ingredients or developing slow-release formulations can command premium prices.

- E-commerce expansion: Online platforms enable targeted marketing and price sensitivity.

- Emerging markets: Untapped regions offer significant growth potential at competitive price points.

- Regulatory acceptance of herbal remedies: Could further legitimize and expand the market.

Conclusion

SM SENNA LAXATIVE enjoys a stable position within the global laxative sector, bolstered by consumer preference for natural remedies and regulatory acceptance. Price projections indicate moderate increases in mature markets with more aggressive growth in emerging regions. Stakeholders should monitor regulatory changes and competitive dynamics to optimize product positioning and profitability.

Key Takeaways

- The global laxative market, including senna-based products, is projected to grow at a 4.2% CAGR through 2028, driven by aging populations and preference for natural remedies.

- Current pricing varies regionally, with North America and Europe maintaining premium levels and Asian markets offering more cost-effective options.

- Future pricing trends will see modest increases (~2–3%) in mature markets, whilst emerging regions may experience higher growth rates (~5%), influenced by market expansion.

- Market risks include regulatory tightening and supply chain disruptions; opportunities lie in product innovation and e-commerce expansion.

- Companies should adopt region-specific pricing strategies and invest in herbal product development to capitalize on evolving consumer preferences.

FAQs

1. What factors influence the pricing of SM SENNA LAXATIVE?

Brand reputation, formulation complexity, regional regulatory requirements, distribution channels, and consumer preferences all impact pricing decisions. Premium herbal or specialty formulations command higher prices, while generic versions compete aggressively on price.

2. How will regulatory changes affect future prices?

Stricter safety standards may elevate manufacturing costs, reflected in higher retail prices. Conversely, clear regulatory pathways could foster market growth and reduce compliance uncertainties, stabilizing prices.

3. What regions are expected to see the highest price growth?

Emerging markets in Asia-Pacific and Latin America are expected to experience higher price growth due to increasing demand and evolving healthcare infrastructure, despite lower baseline prices.

4. How does the e-commerce channel impact pricing trends?

Online sales facilitate price competition and discounting, often resulting in lower prices. However, brands exploiting digital marketing can position premium herbal variants at higher price points online.

5. What strategic moves should manufacturers consider to maintain profitability?

Investing in product differentiation, expanding into emerging markets, leveraging e-commerce for targeted marketing, and developing innovative formulations will support sustainable pricing and growth.

Sources:

- Research and Markets. “Global Laxatives Market Report 2023-2028.”

- MarketWatch. “Constipation Treatment Market Size, Share & Trends.”

- Grandview Research. “Natural and Herbal Medicinal Products Market Analysis.”

- U.S. Food & Drug Administration (FDA). “Regulatory Guidelines for Herbal Products.”

- Statista. “E-commerce Impact on Pharmaceutical Sales.”

More… ↓