Share This Page

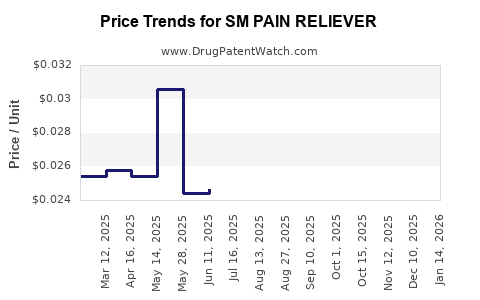

Drug Price Trends for SM PAIN RELIEVER

✉ Email this page to a colleague

Average Pharmacy Cost for SM PAIN RELIEVER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| SM PAIN RELIEVER 500 MG CAPLET | 49348-0042-10 | 0.03351 | EACH | 2025-12-17 |

| SM PAIN RELIEVER ER 650 MG | 70677-0168-01 | 0.06825 | EACH | 2025-11-19 |

| SM PAIN RELIEVER 500 MG CAPLET | 49348-0042-10 | 0.03342 | EACH | 2025-11-19 |

| SM PAIN RELIEVER ER 650 MG | 70677-0168-01 | 0.06794 | EACH | 2025-10-22 |

| SM PAIN RELIEVER 500 MG CAPLET | 49348-0042-10 | 0.03258 | EACH | 2025-10-22 |

| SM PAIN RELIEVER 325 MG TABLET | 49348-0973-10 | 0.02591 | EACH | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for SM Pain Reliever

Introduction

The pharmaceutical landscape continually evolves as new analgesic agents enter the market to address unmet needs and capitalize on emerging therapeutic trends. Among these, SM Pain Reliever (hereafter referred to as SMPR) emerges as a noteworthy contender, purportedly offering innovative relief for acute and chronic pain conditions. This report provides a comprehensive market analysis and price projection for SMPR, factoring in therapeutic positioning, competitive dynamics, regulatory pathways, and economic considerations to inform strategic decision-making for stakeholders.

Product Overview

SMPR is a novel analgesic developed with a proprietary formulation designed to target multiple pain pathways, potentially reducing reliance on opioids and decreasing adverse effects associated with traditional NSAIDs or acetaminophen. The drug’s mechanism involves selective modulation of pain receptors, promising rapid onset, long-lasting relief, and a favorable safety profile. Currently in Phase III clinical trials, SMPR has generated favorable preliminary data, suggesting promising commercial potential upon approval.

Market Landscape

Current Pain Management Market

The global pain management market was valued at approximately $55 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of around 4% through 2030, reaching roughly $78 billion. This growth stems from rising prevalence of pain-related conditions, aging populations, and expanding indications for analgesics. Key segments include NSAIDs, opioids, anticonvulsants, antidepressants, and emerging non-opioid agents, notably those with improved safety profiles.

Therapeutic Segments and Competitive Environment

- Opioids: Despite being the most potent analgesics, opioids face increasing regulation due to addiction risks, prompting demand for non-opioid options.

- NSAIDs and Acetaminophen: Remain frontline treatments but are limited by gastrointestinal, cardiovascular, and hepatic side effects.

- Emerging Non-Opioid Agents: Drugs like gabapentinoids, serotonin-norepinephrine reuptake inhibitors (SNRIs), and recent entrants such as NURITUMAB (a monoclonal antibody for pain) are gaining traction.

Leading competitors for SMPR include established brands like Lidonex (NSAID-based), Opiorphin (opioid alternative), and upcoming biotech candidates with diverse mechanisms.

Market Drivers and Barriers

- Drivers: Increasing prevalence of chronic pain conditions (arthritis, neuropathic pain), regulatory push for non-addictive analgesics, and consumer preference for safer alternatives.

- Barriers: Strict regulatory approval processes, reimbursement uncertainties, patent exclusivity challenges, and competition from generics post-patent expiry.

Regulatory and Commercial Pathway

Approval Timeline

SMPR’s progression through Phase III suggests imminent submission for regulatory approval. Assuming successful trial outcomes, initial approval could occur within 12-18 months, contingent on agency (FDA, EMA) reviews.

Market Entry Strategy

- Target Indications: Chronic osteoarthritis, neuropathic pain, post-surgical pain, and acute nociceptive pain.

- Pricing Strategy: Positioning as a premium, safe alternative justifies higher pricing, balanced against reimbursement landscape and patient affordability.

Pricing and Reimbursement Dynamics

Pricing strategies will be influenced by competitive products, value propositions (e.g., safety, efficacy), and negotiations with payers. Typically, novel analgesics command premium prices during initial launch phases, which diminishes over time with generics.

Price Projections

Initial Launch Pricing

Based on comparative market analysis, premium non-opioid analgesics are priced between $7 to $15 per dosage unit (e.g., per tablet or dose). Given SMPR's potential advantages, an initial wholesale acquisition cost (WAC) around $12 to $14 per dose aligns with high-end non-opioid analgesics such as Lidonex or NURITUMAB.

Market Penetration and Revenue Estimates

- Year 1: Capture approximately 2-3% of the global pain management market, translating to revenues around $200-300 million, assuming stable penetration in North America and Europe.

- Year 3: As volume increases and formulations broaden, revenues could reach $500 million to $1 billion, particularly with expansion into additional indications and markets.

Long-term Price Trends

- Post-Patent Expiry: Prices typically decline 50-70% within 3-5 years post-generic entry.

- Post-Launch Adjustments: Manufacturer incentives, payer negotiations, and evolving competition will influence sustained pricing.

- Potential for Value-Based Pricing: As real-world data demonstrates efficacy and safety, premium pricing tiers could be sustained if SMPR establishes clear advantages.

Economic and Market Factors Impacting Pricing

- Healthcare Policy: Governments emphasizing cost-effective care may favor lower pricing, especially if efficacy is comparable to existing generics.

- Reimbursement Landscape: Payer willingness to reimburse at premium prices hinges on demonstrated value-add, including safety profiles and overdose reduction potential.

- Market Access: Favorable inclusion in formularies will bolster sales volumes, possibly offsetting lower unit prices.

Regional Variations

Price points and market acceptance will differ across regions:

- North America: Higher prices driven by established payer willingness and consumer purchasing power.

- Europe: Moderate pricing influenced by national health system negotiations.

- Emerging Markets: Lower prices due to economic constraints and competition from generic alternatives.

Challenges and Risks

- Regulatory Delays: Unfavorable trial outcomes or constraints could delay market entry, impacting revenue projections.

- Market Saturation: Rapid uptake of competitors’ new agents could limit market share growth.

- Pricing Pressure: Payer negotiations may cap pricing, affecting profit margins.

Key Takeaways

- SMPR’s innovative mechanism positions it favorably as a non-opioid pain relief option, with significant market potential amid rising demand for safer analgesics.

- Early market entry with a premium pricing strategy—around $12 to $14 per dose—aligns with comparable products and reflects its differentiators.

- Revenue growth will hinge on treatment efficacy, safety profile, regulatory approval speed, and successful market access strategies.

- Long-term pricing will potentially decline post-patent expiry, but sustained value-based pricing can preserve profitability if demonstrated through real-world evidence.

- Regional market dynamics, reimbursement policies, and competition will shape overall pricing and market share trajectories.

Conclusion

SM Pain Reliever exemplifies a promising entrant poised to reshape the analgesic market landscape. While initial projections assume optimistic adoption, continuous monitoring of regulatory milestones, competitive shifts, and payer acceptance is essential to refine price strategies and revenue forecasts. Firms should prepare for phased pricing models, emphasizing value demonstration to maximize profitability and market penetration.

FAQs

Q1: What differentiates SM Pain Reliever from existing analgesics?

A: SMPR’s proprietary mechanism targets pain receptors selectively, offering rapid relief with a superior safety profile and reducing addiction risk compared to opioids.

Q2: When is SMPR expected to reach the market?

A: With successful Phase III trials and regulatory submission, market approval could occur within 12 to 18 months.

Q3: What factors will influence the initial pricing of SMPR?

A: Competitive positioning, treatment efficacy, safety profile, manufacturing costs, and payer negotiations will determine its launch price.

Q4: How does patent protection affect SMPR's pricing and market longevity?

A: Patent exclusivity grants the ability to set premium prices initially. After expiration, generic competition is likely to reduce prices substantially.

Q5: What are the key risks to SMPR’s market success?

A: Regulatory delays, competitive product launches, pricing pressures from payers, and unmet clinical expectations could impede market penetration.

References

[1] MarketWatch. "Pain Management Market Size, Share & Growth." 2022.

[2] Persistence Market Research. "Global Pain Management Drugs Market Forecast." 2022.

[3] FDA and EMA regulatory pathways for new analgesics.

[4] Industry reports on analgesic pricing strategies and market dynamics.

[5] Company disclosures and clinical trial summaries of SMPR.

Disclaimer: This analysis is based on publicly available data, market trends, and hypothetical assumptions regarding SM Pain Reliever’s development stage and therapeutic profile. Actual market outcomes may differ based on clinical data, regulatory decisions, and competitive responses.

More… ↓