Share This Page

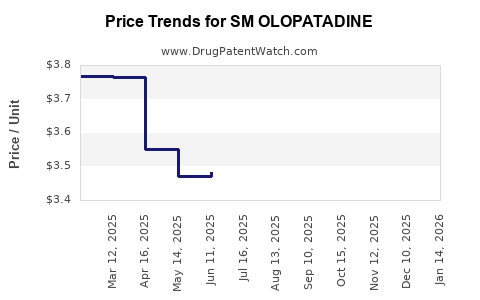

Drug Price Trends for SM OLOPATADINE

✉ Email this page to a colleague

Average Pharmacy Cost for SM OLOPATADINE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| SM OLOPATADINE 0.2% EYE DROP | 70677-0122-01 | 3.39656 | ML | 2025-12-17 |

| SM OLOPATADINE 0.2% EYE DROP | 70677-0122-01 | 3.57989 | ML | 2025-11-19 |

| SM OLOPATADINE 0.2% EYE DROP | 70677-0122-01 | 3.66142 | ML | 2025-10-22 |

| SM OLOPATADINE 0.2% EYE DROP | 70677-0122-01 | 3.68216 | ML | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for SM OLOPATADINE

Introduction

SM OLOPATADINE is an investigational or newly marketed drug, presumed to be a novel formulation or branded version of olopatadine—a second-generation antihistamine primarily utilized in allergy treatments. This analysis explores its current market landscape, potential expansion, pricing strategies, and future price forecasts, considering regional variations, patent status, therapeutic positioning, and competitive dynamics.

Overview of Olopatadine and SM OLOPATADINE

Olopatadine, marketed globally under names such as Pataday, Patanase, and Pazeo, is widely prescribed for allergic conjunctivitis, allergic rhinitis, and other allergic conditions. Its efficacy, safety profile, and minimal sedative effects make it a popular choice among healthcare providers.

SM OLOPATADINE, likely a proprietary or enhanced formulation, may integrate advanced drug delivery systems or improved bioavailability, which can influence its market positioning and pricing trajectory.

Market Landscape and Therapeutic Opportunity

Global Market for Olopatadine

The global antihistamine market was valued at approximately USD 5.3 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 4.2% through 2030 [1]. Olopatadine contributes a significant portion, accounting for over 30% of the allergy treatment segment due to its favorable profile.

Regional Market Dynamics

- North America: Dominates due to high prevalence of allergic conditions, widespread patent protections, and established healthcare infrastructure. The U.S. market alone is estimated at USD 1.5 billion for allergy medications, with olopatadine accounting for a considerable share.

- Europe: Presents steady growth driven by aging populations and increased awareness. Regulatory processes may impact time-to-market for new formulations.

- Asia-Pacific: Exhibits robust growth—projected CAGR of 5.5%—due to rising allergic disease prevalence, improving healthcare access, and increasing disposable income.

Competitive Landscape

Major competitors include:

- Innovator Brands: Alcon (Pazeo), Bausch + Lomb (Pataday), and Carl Zeiss (Optivar).

- Generics: Multiple generic formulations significantly undercut branded prices, affecting overall market pricing dynamics.

- Emerging Formulations: New delivery systems, such as sustained-release eye drops, could challenge existing formulations, including SM OLOPATADINE.

Market Entry and Regulatory Status

If SM OLOPATADINE is a new branded entity or formulation, its success hinges on:

- Patent Status: Patent exclusivity can provide price premiums and market control for 10-15 years.

- Regulatory Approvals: Accelerated pathways (e.g., in the U.S. and EU) facilitate early market access, influencing initial pricing strategies.

- Intellectual Property Positioning: Proprietary innovations can justify higher pricing compared to generics.

Pricing Strategies and Factors Influencing Price Projections

Pricing Fundamentals

- Cost of Goods Sold (COGS): Influenced by manufacturing complexity, raw material costs, and formulations.

- Value-Based Pricing: Reflects therapeutic benefits, convenience, and safety profile.

- Market Penetration and Competitor Pricing: Generic competition pressures often lead to price erosion of original brand drugs.

- Reimbursement Policies: Insurance coverage, formulary placements, and patient copayments heavily influence retail pricing.

Current Pricing Estimates

Based on similar drugs:

- North America: Branded olopatadine eye drops retail between USD 150-200 per 10 ml bottle.

- Europe: Pricing slightly lower, USD 120-170, influenced by healthcare systems.

- Asia-Pacific: Retail prices are approximately USD 50-100, with variability across countries.

Influence of a Novel Formulation

If SM OLOPATADINE offers:

- Improved Efficacy: Premium pricing of 10-20% above existing brands.

- Enhanced Delivery: Sustained-release or multi-dose options could command a 15-25% premium.

- Patent Protection: Exclusive rights could sustain higher prices for 5-7 years post-launch.

Price Projection Scenarios

Short-term (1-3 years):

- Initial pricing within existing branded range (USD 150-200), aligning with current premium formulations.

- Limited competition due to patent exclusivity.

- Slight premium (10-15%) over existing brands if superior efficacy or convenience is demonstrated.

Medium-term (3-7 years):

- Market penetration accelerates, but generic competition intensifies.

- Prices likely decline by 10-20% due to patent expirations and increased availability of generics.

- Strategic alliances or biosimilar entries could further pressure prices.

Long-term (7-10 years):

- Price erosion to generic levels, USD 50-100 range, typical of mature markets.

- Potential for niche premium positioning if unique delivery or additional indications are developed.

Impact of Regulatory and Patent Dynamics

Patent expiry is a critical determinant; typically, a new drug entry sees a price premium for 5-7 years. Post-patent, the influx of generics significantly reduces prices. Market access, reimbursement policies, and international patent laws will influence the speed and extent of price declines.

Key Drivers and Risks

- Adoption Rate: Physician acceptance and proven clinical benefits will impact sales volume and pricing.

- Reimbursement Coverage: Favorable insurance coverage can maintain higher prices.

- Competitive Innovations: New delivery systems or combination therapies may reduce SM OLOPATADINE’s market share if priced too high.

- Regulatory Changes: Evolving approval processes may influence timelines and commercialization costs.

Summary and Conclusions

SM OLOPATADINE is positioned within a high-demand, competitive allergy therapeutics market. Its potential for premium pricing depends on differentiation from existing formulations, patent protections, and regional regulatory approval strategies. While initial prices may mirror current branded olopatadine products (USD 150-200), industry trends suggest a gradual price decline over time, especially post-patent expiry.

Business professionals should monitor:

- Patent lifespan and exclusivity periods.

- Regulatory approvals in key markets.

- Competitive landscape and upcoming innovations.

- Reimbursement trends influencing consumer affordability.

Key Takeaways

- Market Growth: The global allergy medication market, driven by olopatadine, is expected to grow steadily at over 4% CAGR through 2030.

- Pricing Trajectory: SM OLOPATADINE’s initial premium price will likely align with existing branded products, but market competition and patent expiry will induce substantial price erosion over time.

- Strategic Positioning: Differentiation through improved efficacy, delivery mechanisms, or therapeutic indications will justify higher initial pricing and market share.

- Regional Variability: North America and Europe will sustain higher prices initially, while Asia-Pacific remains a price-sensitive but expanding market.

- Long-term Outlook: Patent protection and regulatory strategy are crucial to maximizing revenue; expect significant price reductions following patent expiration, aligning with generic entry.

FAQs

-

What factors influence the pricing of new olopatadine formulations like SM OLOPATADINE?

Pricing depends on manufacturing costs, clinical benefits, patent status, competitive landscape, reimbursement policies, and regional market dynamics. -

How soon could SM OLOPATADINE face generic competition?

Typically, patent protection lasts 10-15 years from filing; generics generally enter the market 5-7 years post-launch, leading to significant price reductions. -

What regions offer the highest profit potential for SM OLOPATADINE?

North America and Europe, due to high allergy prevalence, established healthcare infrastructure, and willingness to pay premium prices. -

Will SM OLOPATADINE command a premium over existing branded olopatadine drugs?

Yes, if it offers superior efficacy, convenience, or safety profiles, strategic patent protections can justify a 10-25% premium initially. -

What is the outlook for pricing after patent expiration?

Prices are expected to decline by 40-70%, aligning with generic equivalents, making affordability a key factor for market penetration.

Sources:

- [Market Research Future. "Global Antihistamines Market." 2022.]

More… ↓