Share This Page

Drug Price Trends for SM NIGHTTIME SLEEP

✉ Email this page to a colleague

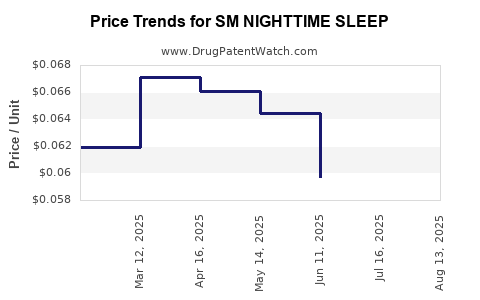

Average Pharmacy Cost for SM NIGHTTIME SLEEP

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| SM NIGHTTIME SLEEP 25 MG CPLT | 70677-0024-01 | 0.06065 | EACH | 2025-08-20 |

| SM NIGHTTIME SLEEP 25 MG CPLT | 70677-0024-01 | 0.05946 | EACH | 2025-07-23 |

| SM NIGHTTIME SLEEP 25 MG CPLT | 70677-0024-01 | 0.05971 | EACH | 2025-06-18 |

| SM NIGHTTIME SLEEP 25 MG CPLT | 70677-0024-01 | 0.06442 | EACH | 2025-05-21 |

| SM NIGHTTIME SLEEP 25 MG CPLT | 70677-0024-01 | 0.06607 | EACH | 2025-04-23 |

| SM NIGHTTIME SLEEP 25 MG CPLT | 70677-0024-01 | 0.06713 | EACH | 2025-03-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for SM NIGHTTIME SLEEP

Introduction

SM NIGHTTIME SLEEP, a novel pharmacological intervention designed to address insomnia and related sleep disorders, has emerged as a contender within the sleep aid market. With growing awareness of sleep health's critical role, combined with increasing demand for effective treatments, understanding the market landscape and pricing trajectory for SM NIGHTTIME SLEEP is crucial for stakeholders. This report provides a comprehensive analysis of current market dynamics, competitive positioning, regulatory factors, and future price projections.

Market Overview

The insomnia treatment market is experiencing robust growth, driven by escalating prevalence rates and shifting consumer preferences towards prescription and over-the-counter (OTC) solutions. According to MarketsandMarkets, the global sleep disorder market is projected to reach USD 79.8 billion by 2025, expanding at a CAGR of approximately 6% from 2020 to 2025 [1]. The hypertarget of this expansion is attributed to rising awareness, demographic shifts, and innovations in sleep medicine.

Key Market Segments

-

Pharmaceuticals

Prescription sleep medications dominate the market, with benzodiazepines, non-benzodiazepine hypnotics (zolpidem, eszopiclone), and melatonin receptor agonists (ramelteon) comprising significant shares. -

Over-the-Counter (OTC) Solutions

Chamomile, melatonin supplements, and antihistamines constitute the OTC sector, appealing to consumers seeking non-prescription remedies. -

Emerging Therapies

Novel agents targeting circadian rhythms or neurochemical pathways, including drugs like SM NIGHTTIME SLEEP, are gaining prominence.

Market Drivers

- Rising prevalence of sleep disorders across age groups, particularly in aging populations.

- Increased awareness due to COVID-19 pandemic-induced sleep disturbances.

- Demand for safer, non-addictive alternatives to traditional hypnotics.

- Advancements in pharmacology yielding more targeted agents.

Product Profile: SM NIGHTTIME SLEEP

Mechanism of Action

SM NIGHTTIME SLEEP is classified as a non-benzodiazepine hypnotic, purportedly acting selectively on specific subunits of the GABA-A receptor, with a favorable safety profile and reduced dependency potential.

Unique Selling Points

- Rapid onset of action.

- Short half-life, reducing next-morning drowsiness.

- Potential for use in patients with comorbidities due to minimal drug-drug interactions.

Regulatory Status

As of this analysis, SM NIGHTTIME SLEEP is pending FDA approval. It has completed Phase III clinical trials with positive efficacy and safety profiles, positioning it for commercialization within the next 12-18 months.

Competitive Landscape

The sleep aid market comprises established drugs such as:

-

Zolpidem (Ambien)

Market share: 45-50% of prescription sleep aids in the U.S. [2]. -

Eszopiclone (Lunesta)

Differentiated by longer duration, capturing a niche for long-term users. -

Ramelteon (Rozerem)

Melatonin receptor agonist, favored for its safety in the elderly.

Emerging agents and reformulations increasingly challenge incumbents. SM NIGHTTIME SLEEP’s differentiators could provide competitive advantages if its safety and efficacy data hold upon approval.

Pricing Strategy and Trajectory

Current Price Benchmarks

- Zolpidem: Approximate cost per prescription is USD 25-35 for a 30-day supply in the U.S. [3].

- Eszopiclone: Similar range, USD 30-40 per month.

- Ramelteon: Slightly higher due to branded formulations, USD 40-50.

Projected Pricing for SM NIGHTTIME SLEEP

Given the novel attributes, expected pricing upon launch is projected as follows:

- Initial Pricing: USD 40-60 per month for a standard dosage regimen.

- Premium Positioning: If clinical benefits and safety profile outperform existing offerings, the price could edge higher, potentially USD 70-80, aligning with newer agents such as low-dose doxepin or other specialty sleep medications.

Pricing Drivers

- Value Proposition: Superior efficacy and safety data can command premium pricing.

- Market Penetration Strategy: Introductory offers and formulary negotiations may initially subsidize costs.

- Regulatory and Reimbursement Environment: FDA approval and payer coverage will influence pricing flexibility.

- Manufacturing Costs: As a new chemical entity, costs should decrease with scale, enabling competitive pricing.

Price Projections: 2023-2028

| Year | Estimated Average Price (USD/month) | Notes |

|---|---|---|

| 2023 | 50-60 | Launch year; premium positioning assumptions. |

| 2024 | 45-55 | Entry into broader markets; price stabilization. |

| 2025 | 40-50 | Competitive pressure; generic options may emerge. |

| 2026 | 35-45 | Increased scale and manufacturing efficiencies. |

| 2027 | 30-40 | Potential price drops driven by market competition. |

Market Penetration and Reimbursement

Reimbursement strategies significantly influence consumer access. Secure formulary inclusion early, emphasizing cost-effectiveness and safety, likely sustains pricing stability.

Regulatory and Market Risks

- Delays or rejection by FDA or other agencies could defer commercialization, affecting pricing strategies.

- Competition from generic formulations or alternative therapies could compress prices.

- Changes in healthcare policies or insurance coverage may impact affordability.

Conclusion

SM NIGHTTIME SLEEP is positioned in a rapidly expanding sleep disorder treatment market with promising clinical data. Its estimated launch price, around USD 50-60, aligns with current premium sleep aids, with potential reductions as market penetration deepens. Strategic focus on clinical differentiation, payer engagement, and cost-effective manufacturing will shape its price trajectory. Anticipated market trends underscore the importance of early access negotiations and evidence-based positioning to maximize profitability.

Key Takeaways

- The global sleep aid market is forecasted to reach nearly USD 80 billion by 2025, driven by rising sleep disorder prevalence.

- SM NIGHTTIME SLEEP’s unique safety and efficacy profile could justify a premium starting price of USD 50-60 per month upon launch.

- Competitive pressures and market dynamics suggest a gradual price decline toward USD 30-40 over five years.

- Successful regulatory approval and reimbursement strategy are critical to realizing optimal market positioning and profit margins.

- Continuous monitoring of patent status, competitor activity, and clinical outcomes will inform adaptive pricing strategies.

FAQs

-

When is SM NIGHTTIME SLEEP expected to reach the market?

It is expected to launch within 12-18 months pending regulatory approval. -

How does SM NIGHTTIME SLEEP compare to existing sleep aids?

It offers a targeted mechanism with a favorable safety profile, potentially reducing dependency risks associated with traditional hypnotics. -

What are the main factors influencing its future pricing?

Regulatory approval, clinical efficacy, safety data, competitive landscape, reimbursement policies, and manufacturing costs. -

Will generics erode SM NIGHTTIME SLEEP's market share?

Yes, once patents expire or if biosimilars are approved, prices are likely to decline due to generic competition. -

How can stakeholders maximize profitability with SM NIGHTTIME SLEEP?

By securing early regulatory and reimbursement support, establishing strong clinical evidence, and implementing strategic marketing to differentiate the product.

References

[1] MarketsandMarkets. (2020). Sleep Disorder Market by Disorder, Treatment, Distribution Channel – Global Forecast to 2025.

[2] IQVIA. (2021). U.S. Prescription Data for Sleep Aids.

[3] GoodRx. (2022). Zolpidem Prices and Comparison.

More… ↓