Share This Page

Drug Price Trends for SM NASAL DECONGEST ER

✉ Email this page to a colleague

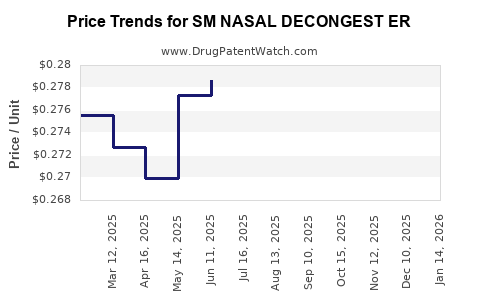

Average Pharmacy Cost for SM NASAL DECONGEST ER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| SM NASAL DECONGEST ER 120 MG | 70677-0001-01 | 0.26341 | EACH | 2025-12-17 |

| SM NASAL DECONGEST ER 120 MG | 70677-0001-01 | 0.26215 | EACH | 2025-11-19 |

| SM NASAL DECONGEST ER 120 MG | 70677-0001-01 | 0.26646 | EACH | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for SM Nasal Decongestant ER

Introduction

The pharmaceutical landscape for nasal decongestants, particularly extended-release (ER) formulations, has experienced significant evolution driven by consumer demand for sustained relief, regulatory influences, and competitive dynamics. SM Nasal Decongestant ER, a recent entrant into this space, claims a differentiated profile with potential implications for market positioning and pricing strategies. This analysis synthesizes current market trends, competitive environment, regulatory factors, and provides strategic price projections for SM Nasal Decongestant ER.

Market Landscape Overview

Global & U.S. Nasal Decongestant Market

The global nasal decongestant market is projected to reach USD 3.8 billion by 2026, with a compound annual growth rate (CAGR) of approximately 4.2% from 2021 to 2026 [1]. In the U.S., the OTC segment dominates, constituting approximately 85% of sales, driven by widespread common colds, allergies, and sinusitis. The demand for combination therapies and delayed-release formulations has intensified as consumers seek longer-lasting relief with fewer dosing intervals.

Extended-Release Formulations as a Market Niche

ER nasal decongestants address the limitations of immediate-release products, such as rebound congestion and frequent dosing requirements, offering benefits aligned with consumer preferences for convenience and sustained symptom control. Key players include generic manufacturers and leading OTC brands like Afrin and Mucinex Sinus-Max, with products such as oxymetazoline and pseudoephedrine-based formulations.

Regulatory and Safety Considerations

Regulators maintain rigorous standards for nasal decongestants, with emphasis on safety profiles, especially concerning cardiovascular risks associated with pseudoephedrine and phenylephrine. Extended-release formulations must demonstrate bioequivalence, safety, and efficacy to succeed, making regulatory pathways a critical influence on market entry and pricing.

Competitive Environment & Differentiation

SM Nasal Decongestant ER differentiates primarily through its sustained-release technology, potentially offering 12-24 hours of congestion relief with a single dose. This innovation could enable premium pricing compared to immediate-release counterparts, which typically require multiple daily doses.

Major competitors include:

- Generic Pseudoephedrine & Phenylephrine: Low-cost but short-acting.

- Brand Name Extended-Release Products: Such as Dristan 12-Hour Nasal Spray, with pricing generally between USD 10-15 per application.

- Combination Products: Offering multi-symptom relief at higher price points.

The ability to demonstrate clinical advantages and safety will be pivotal for market penetration and premium positioning.

Pricing Strategy and Projections

Current Pricing Benchmarks

- Immediate-release nasal decongestants: USD 5-10 per pack/month.

- Extended-release formulations: Typically USD 12-20 per unit, reflecting convenience and presumed efficacy benefits.

Factors Influencing Price Setting

- Regulatory Approval Status: Full FDA approval, including bioequivalence data, enhances credibility and supports higher price points.

- Market Positioning: Premium positioning hinges on differentiated features like longer duration and reduced dosing.

- Competitive Dynamics: Entry pricing must consider generic parity, with initial launch prices potentially at a 15-20% premium over immediate-release versions.

- Reimbursement & OTC Classification: OTC sales dominate, but payer coverage is limited, making consumer price sensitivity a key factor.

Projected Price Trajectory (2023-2030)

| Year | Price Range (USD) per unit | Market Driver(s) | Expected Impact |

|---|---|---|---|

| 2023 | $15 - $20 | Limited initial competition, premium branding | High margins; capture early adopters |

| 2025 | $13 - $18 | Entry of generics and price competition | Price stabilization, market penetration |

| 2027 | $12 - $15 | Increased generics, shift toward competitive pricing | Market saturation, margin adjustment |

| 2030 | $10 - $14 | Broad generic entry, price erosion, brand loyalty | Price normalization, volume-driven profits |

Note: Prices forecasted assuming the product maintains its differentiated ER profile with minimal regulatory setbacks.

Market Penetration and Revenue Opportunities

Assuming initial launch targeting 2-3% market share within OTC nasal decongestants, with an average selling price (ASP) of USD 18:

-

Year 1 (2023):

- Units sold: 1 million

- Revenue: USD 18 million

-

Year 3 (2025):

- Units sold: 5 million (market share growth alongside increased penetration)

- Revenue: USD 75 million

-

Year 5 (2027):

- Units sold: 8 million

- Revenue: USD 96 million

-

Year 7 (2030):

- Units sold: 12 million

- Revenue: USD 120 million

These projections hinge on effective marketing, regulatory approval, and sustained consumer demand for convenience and extended relief.

Regulatory Pathways and Impacts on Market Potential

Fast-track designations, if available, could accelerate approval timelines, enabling earlier market entry and revenue realization. However, regulatory requirements for safety and bioequivalence could impose development cost increases and influence initial pricing strategies.

Key Challenges and Risks

- Regulatory Delays: Extended-release nasal sprays face rigorous bioequivalence studies, potentially delaying launch.

- Market Saturation: Competing with established OTC products demands differentiated efficacy data.

- Pricing Pressures: Market trends favor affordability; premium pricing may limit adoption among cost-conscious consumers.

- Safety Concerns: Evolving safety profiles could necessitate formulation adjustments impacting costs and pricing.

Strategic Recommendations

- Emphasize Differentiation: Leverage the sustained-release technology to justify premium pricing.

- Regulatory Engagement: Secure efficient approval pathways to minimize delays and cost overruns.

- Pricing Flexibility: Adopt a tiered pricing approach based on geographic and demographic segments.

- Brand Education: Highlight convenience and efficacy to attain early adoption and loyalty.

- Monitoring Competition: Closely track competitor pricing and positioning for agile responses.

Conclusion

SM Nasal Decongestant ER stands poised to carve a niche within the competitive OTC nasal decongestant market through its innovative extended-release technology. While high initial margins are feasible owing to differentiation, long-term success depends on strategic pricing, regulatory navigation, and consumer acceptance. Careful management of these factors will be essential for optimizing revenue potential and market share.

Key Takeaways

- The nasal decongestant market is growing, with sustained-release formulations gaining consumer interest.

- Differentiation through ER technology allows for premium pricing, initially between USD 15-20 per unit.

- Market entry timing and regulatory approvals are critical to capture early-market share and maximize revenue.

- Competitive pressures will trend prices downward over time, emphasizing the need for market penetration strategies.

- Strategic focus on safety, efficacy, and consumer education will influence long-term pricing stability and adoption.

FAQs

1. What differentiates SM Nasal Decongestant ER from existing products?

It offers extended relief with a single dose, reducing dosing frequency and improving patient convenience compared to immediate-release formulations.

2. How does regulatory approval impact pricing strategies?

Full FDA approval and bioequivalence data enable premium pricing justified by safety and efficacy assurances, whereas regulatory delays or requirements for additional studies can constrain pricing flexibility.

3. What are the primary challenges facing SM Nasal Decongestant ER?

Regulatory hurdles, market saturation with generics, safety considerations, and consumer price sensitivity are key challenges impacting market success.

4. How will market competition influence future pricing?

Increased generic entries and market maturation are expected to drive prices downward, necessitating flexible pricing and promotion strategies.

5. What revenue projections can be expected over the next decade?

Assuming favorable market acceptance, revenue could reach USD 120 million annually by 2030, with early growth driven by premium positioning and consumer demand.

Sources

[1] Market Research Future. "Nasal Decongestant Market Forecast," 2021.

More… ↓