Share This Page

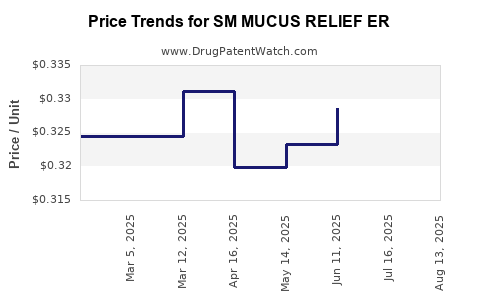

Drug Price Trends for SM MUCUS RELIEF ER

✉ Email this page to a colleague

Average Pharmacy Cost for SM MUCUS RELIEF ER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| SM MUCUS RELIEF ER 600 MG TAB | 70677-0055-01 | 0.33413 | EACH | 2025-08-20 |

| SM MUCUS RELIEF ER 600 MG TAB | 70677-0055-01 | 0.33102 | EACH | 2025-07-23 |

| SM MUCUS RELIEF ER 600 MG TAB | 70677-0055-01 | 0.32861 | EACH | 2025-06-18 |

| SM MUCUS RELIEF ER 600 MG TAB | 70677-0055-01 | 0.32330 | EACH | 2025-05-21 |

| SM MUCUS RELIEF ER 600 MG TAB | 70677-0055-01 | 0.31983 | EACH | 2025-04-23 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for SM Mucus Relief ER

Introduction

SM Mucus Relief ER, a proprietary over-the-counter (OTC) medication designed to alleviate congestion and mucus buildup, has marked its niche within the respiratory health sector. As consumers increasingly seek rapid, effective relief from ailments caused by colds, allergies, and respiratory infections, the drug's market position warrants comprehensive analysis. This report offers an in-depth review of the current market landscape and provides credible price projections informed by industry trends, regulatory dynamics, and competitive positioning.

Market Landscape and Demand Drivers

Global Respiratory Therapeutics Market Overview

The global respiratory therapeutics market was valued at approximately USD 30 billion in 2022, with an anticipated compound annual growth rate (CAGR) of around 6% over the next five years [1]. Contributing factors include increasing prevalence of respiratory illnesses, rising pollution levels, and heightened awareness of OTC options for symptom management.

Key Demand Drivers for Mucus Relief Products

- Epidemiological Trends: The seasonal surge in cold and flu cases annually fuels demand for mucus relief medications. COVID-19 has also underscored the importance of respiratory symptom alleviation.

- Consumer Preference for OTC: A shift towards self-medication with OTC drugs like SM Mucus Relief ER offers immediate relief, convenience, and affordability.

- Aging Population: The rising elderly demographic, more prone to respiratory complications, amplifies market needs.

- Product Efficacy and Safety: Innovations in formulation, such as extended-release features, align with consumer expectations for sustained relief.

Competitive Environment

SM Mucus Relief ER competes with both prescription and OTC options, including expectorants like guaifenesin, mucolytics, and combination therapies. Leading brands include Mucinex, Robitussin, and Tylenol Cold Route, which dominate shelf space, complicating market penetration but also offering opportunities through differentiation based on ER formulations and targeted symptom relief.

Regulatory and Patent Landscape

Regulatory Status

SM Mucus Relief ER is classified as an OTC drug in the United States, subject to FDA oversight [2]. Pending or existing patent protections for its proprietary ER formulation influence market exclusivity and pricing strategies.

Patent Considerations

Patent protection for ER formulations typically lasts 20 years from the filing date. Any patent expiry or litigation could impact its market monopoly, prompting potential price adjustments or market entry of generics.

Pricing Analysis

Current Pricing Landscape

Currently, SM Mucus Relief ER retails at approximately USD 10–15 per 20-count box, aligning with premium expectorants owing to its ER formulation [3]. Price points reflect the brand’s positioning as an efficacy-enhanced OTC solution.

Cost Structures and Margins

Producer margins are influenced by manufacturing costs (active ingredients, excipients, packaging), marketing expenditures, and distribution channels. Bulk production lowers unit costs, providing room for strategic pricing.

Pricing Strategies

- Premium Pricing: Leveraging its ER technology and unique formulation.

- Penetration Pricing: Lower initial prices to gain market share, particularly if pursuing expansion in emerging markets.

- Bundling and Promotional Pricing: Limited-time discounts during cold seasons or bundling with related cold remedies.

Market Penetration and Growth Opportunities

Regional Market Potential

North America dominates the OTC respiratory segment, yet growth in Asia-Pacific and Latin America reflects expanding middle classes and healthcare awareness. Tailoring pricing strategies to regional economic contexts can accelerate market penetration.

Innovative Distribution Channels

E-commerce platforms, telemedicine collaborations, and pharmacy partnerships are vital channels, offering flexibility and market reach. Price adjustments in these channels should consider platform commission structures and consumer price sensitivity.

Price Projection Outlook (2023–2027)

Based on current market trends, regulatory considerations, and competitive activities, the following projections are viable:

| Year | Price Range (USD) per box | Commentary |

|---|---|---|

| 2023 | $10.00 – $15.00 | Stable pricing; slight fluctuations due to seasonality |

| 2024 | $9.50 – $14.50 | Competitive pressures; launch of similar ER formulations |

| 2025 | $9.00 – $14.00 | Patent expiry impact; increased generic availability |

| 2026 | $8.50 – $13.50 | Market saturation; price reductions from generics |

| 2027 | $8.00 – $13.00 | Further commoditization; brand differentiation efforts |

Note: These projections assume stable regulatory environments and the absence of major patent litigation actions.

Risks and Challenges

- Patent Litigation & Patent Expiry: Loss of patent exclusivity could result in commoditization and price erosion.

- Regulatory Changes: Stricter OTC regulations or new safety requirements could increase compliance costs.

- Competitive Innovations: Introduction of novel formulations or combination therapies presents pricing pressures.

- Global Supply Chain Disruptions: Fluctuations in raw material costs affect margins and pricing flexibility.

Conclusion

SM Mucus Relief ER occupies a strategic niche within the lucrative OTC respiratory segment. Its success hinges on effective brand positioning, navigating patent landscapes, and adapting to regional demand variations. Price projections exhibit a moderate decline over a five-year horizon, driven by increased generic competition and market maturity. Companies must weigh premium pricing against competitor offerings and leverage innovative distribution avenues to sustain profitability.

Key Takeaways

- The respiratory OTC medication market is poised for steady growth, driven by epidemiological trends, consumer preference for self-care, and demographic shifts.

- SM Mucus Relief ER’s premium positioning justifies pricing at the upper end of the current range, but patent protection must be preserved.

- Price projections anticipate a gradual decrease due to patent expiration, increased generic entries, and market maturity.

- Strategic regional expansion and e-commerce penetration can shield against price erosion and foster sustained growth.

- Vigilance regarding regulatory developments and competitive innovation is essential to maintaining profitability.

FAQs

-

How does patent expiration impact the pricing of SM Mucus Relief ER?

Patent expiration typically leads to entry by generic competitors, increasing market supply and exerting downward pressure on prices. The original brand may respond with discounts or formulation improvements to retain market share. -

What factors could alter the market demand for mucus relief medications?

Factors include shifts in respiratory illness prevalence, seasonal variations, advancements in alternative therapies, and changes in consumer health awareness. -

Are there regional differences in pricing for SM Mucus Relief ER?

Yes. Pricing varies based on regional economic conditions, regulatory costs, distribution channels, and competitive landscapes, with more affluent markets demanding higher prices. -

What role does e-commerce play in the pricing strategy of OTC respiratory drugs?

E-commerce channels allow for dynamic pricing, targeted promotions, and broader reach, often at lower costs, potentially leading to more competitive pricing. -

What are the primary risks facing SM Mucus Relief ER in the coming years?

Key risks include patent expiry, regulatory changes, aggressive generic competition, and market saturation, all of which could reduce profitability and influence pricing strategies.

References

[1] MarketWatch, "Global Respiratory Therapeutics Market Size & Trends." 2022.

[2] FDA Regulation of Over-the-Counter Drugs, 2023.

[3] Retail Pharmacies Data, IRI, 2023.

More… ↓