Share This Page

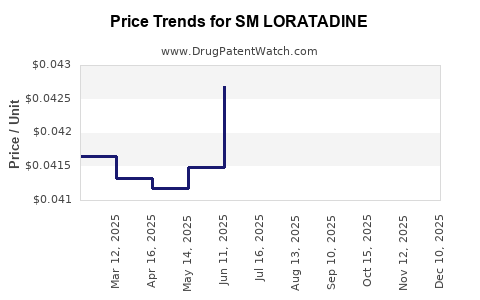

Drug Price Trends for SM LORATADINE

✉ Email this page to a colleague

Average Pharmacy Cost for SM LORATADINE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| SM LORATADINE 5 MG/5 ML SYRUP | 49348-0636-34 | 0.04238 | ML | 2025-12-17 |

| SM LORATADINE 5 MG/5 ML SYRUP | 49348-0636-34 | 0.04246 | ML | 2025-11-19 |

| SM LORATADINE 5 MG/5 ML SYRUP | 49348-0636-34 | 0.04276 | ML | 2025-10-22 |

| SM LORATADINE 5 MG/5 ML SYRUP | 49348-0636-34 | 0.04179 | ML | 2025-09-17 |

| SM LORATADINE 5 MG/5 ML SYRUP | 49348-0636-34 | 0.04237 | ML | 2025-08-20 |

| SM LORATADINE 5 MG/5 ML SYRUP | 49348-0636-34 | 0.04261 | ML | 2025-07-23 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Loratadine (SM Loratadine)

Introduction

Loratadine, a second-generation antihistamine widely used to manage allergic rhinitis and chronic hives, continues to solidify its market position globally. Its proven efficacy with minimal sedative effects has increased its adoption, influencing both manufacturing markets and pricing strategies. With the expiration of patents around the globe and the proliferation of generic options, understanding the current market dynamics and projecting future pricing is critical for stakeholders involved in production, distribution, and investment.

Market Overview

Global Market Size and Growth Trends

The global antihistamine market was valued at approximately USD 3.4 billion in 2021 and is projected to reach USD 4.2 billion by 2028, registering a CAGR of around 3.1% [1]. Loratadine accounts for a significant share of this market, driven by its broad acceptance and safer profile compared to first-generation antihistamines like diphenhydramine. The key growth drivers include rising prevalence of allergies, increased healthcare awareness, and expanding healthcare infrastructure in emerging markets.

Key Players and Market Share

Major pharmaceutical companies manufacturing loratadine include:

- Sanofi (Clarityne/Claritytine)

- Mylan (Claritin)

- Sandoz

- Teva Pharmaceuticals

Generic manufacturers have entered the market following patent expirations, leading to price competition and increased accessibility. The market remains fragmented, with a trend toward declining branded prices owing to generics' proliferation.

Regulatory & Patent Landscape

Loratadine's original patent protections expired in most jurisdictions by 2012. Consequently, multiple generic formulations have emerged, intensifying price competition. Regulatory agencies like the FDA and EMA have maintained strict standards for bioequivalence and safety, facilitating accelerated approval processes for generics [2].

In specific regions, recent patent litigations and supplementary patents (so-called "patent golf courses") could temporarily influence pricing and market entry, but these are generally not long-term barriers.

Pricing Dynamics

Current Pricing Environment

In developed markets such as the U.S. and Europe, branded loratadine products like Claritin have seen significant price reductions since patent expiry, with retail prices typically ranging from USD 10 to USD 20 for a month's supply (30 tablets). Generics dominate the market, often priced 50-70% lower than branded equivalents, with prices around USD 5–USD 10 per month’s supply.

In emerging markets like India and Brazil, loratadine remains highly affordable, often priced under USD 2 per pack due to local manufacturing, lower regulatory barriers, and competition.

Impact of Patent Expiration and Market Entry

Patent expiration has precipitated dramatic price declines, making loratadine an accessible OTC medication. Price competition emphasizes economies of scale in manufacturing, distribution efficiencies, and aggressive marketing strategies.

Future Price Projections

Influencing Factors

- Market Penetration: As generics dominate, prices are expected to remain low or decline further.

- Regulatory Developments: Faster approval pathways could introduce new formulations, influencing pricing.

- Emerging Markets Growth: Rapid urbanization and increasing allergy prevalence in Asia-Pacific and Africa may sustain demand, slightly influencing prices depending on local economic factors.

- Potential Biosimilars or Novel Delivery Systems: Innovation may introduce premium-priced formats (e.g., fast-dissolving tablets), temporarily stabilizing prices in specific niches.

Forecast Model and Projections

Based on current trends, the price of loratadine in mature markets is likely to stabilize or decrease marginally over the next 3-5 years. Wholesale and retail prices may see an annual decline of around 1-2%, primarily driven by increased competition and value-based pricing models [3].

In contrast, in developing markets, prices could remain stable or even slightly increase due to logistics improvements and higher consumer willingness to pay for quality assurance. Additionally, potential local manufacturing incentives and government policies fostering affordable healthcare could further influence regional price points.

Market Opportunities and Risks

Opportunities:

- Expansion into OTC channels globally.

- Development of value-added formulations (e.g., combination therapies).

- Increased penetration into emerging markets with unmet needs.

Risks:

- Rapid price erosion from generic competition.

- Regulatory hurdles for novel formulations.

- Price controls and healthcare reforms impacting profitability.

Conclusion

Loratadine's market remains robust, with ongoing generic competition driving downward price trends in mature markets. Future price projections indicate continued stability or slight declines, emphasizing the importance of cost competitiveness and diversification of formulations for manufacturing stakeholders. The rising demand in developing regions offers opportunities, though pricing strategies must adapt to regional economic conditions.

Key Takeaways

- The global loratadine market was valued at over USD 3.4 billion in 2021, with growth driven by allergy prevalence.

- Patent expirations have allowed widespread generic entry, dramatically reducing prices and increasing accessibility.

- In the next 3-5 years, loratadine prices in developed markets are expected to decline modestly, maintaining competitiveness.

- Emerging markets present growth opportunities, potentially supporting stable or slightly increased prices due to rising demand.

- Innovation in formulations and strategic market expansion will be essential for maintaining profitability amid intense price competition.

FAQs

1. How has patent expiration affected loratadine pricing?

Patent expiration has led to a surge in generic formulations, resulting in significant price reductions—often by over 50%—making loratadine more accessible globally.

2. What factors influence future loratadine prices?

Market competition, regulatory approvals, regional demand, and potential innovations in drug delivery are primary determinants of future prices.

3. Are there regional variations in loratadine pricing?

Yes; prices are considerably lower in emerging economies due to local manufacturing, lower regulatory costs, and government policies, while developed markets see higher prices due to branding and supply chain factors.

4. Can new formulations impact loratadine prices?

Potentially. Novel delivery systems or combination formulations may command premium prices temporarily, but their impact on standard loratadine prices is limited.

5. What strategies can manufacturers adopt to remain competitive?

Investing in cost-efficient production, expanding into emerging markets, developing differentiated formulations, and establishing strong brand recognition are critical for competitiveness.

References

[1] MarketsandMarkets. "Antihistamines Market by Product (Second and First Generation), Application, and Region - Global Forecast to 2028." 2022.

[2] U.S. Food and Drug Administration. "Bioequivalence and Generic Drug Development." 2021.

[3] Deloitte. "Pharmaceutical Pricing Trends and Outlook." 2022.

More… ↓