Share This Page

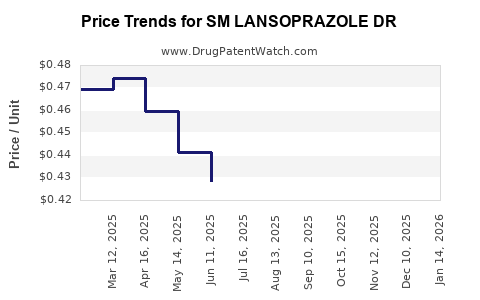

Drug Price Trends for SM LANSOPRAZOLE DR

✉ Email this page to a colleague

Average Pharmacy Cost for SM LANSOPRAZOLE DR

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| SM LANSOPRAZOLE DR 15 MG CAP | 70677-0124-01 | 0.42362 | EACH | 2025-12-17 |

| SM LANSOPRAZOLE DR 15 MG CAP | 70677-0124-01 | 0.43495 | EACH | 2025-11-19 |

| SM LANSOPRAZOLE DR 15 MG CAP | 70677-0124-01 | 0.44583 | EACH | 2025-10-22 |

| SM LANSOPRAZOLE DR 15 MG CAP | 70677-0124-01 | 0.45025 | EACH | 2025-09-17 |

| SM LANSOPRAZOLE DR 15 MG CAP | 70677-0124-01 | 0.44272 | EACH | 2025-08-20 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for SM Lansoprazole DR

Introduction

The pharmaceutical landscape for proton pump inhibitors (PPIs) continues to evolve, driven by increasing prevalence of gastroesophageal reflux disease (GERD), peptic ulcers, and other acid-related disorders. Among this class, SM Lansoprazole DR, a delayed-release formulation, has gained attention for its enhanced pharmacokinetics and potential therapeutic advantages. This report provides a comprehensive market analysis and price projection insights for SM Lansoprazole DR, considering current industry trends, regulatory environment, competitive landscape, and economic drivers.

Market Overview

Global Market Dynamics

The global PPI market was valued at approximately $13 billion in 2022, with a compound annual growth rate (CAGR) of approximately 4.5% projected through 2030 (source: Grand View Research). This growth stems from the increasing incidence of acid-related disorders, rising adoption of PPIs as first-line therapy, and expanding aging populations. Lansoprazole, as one of the longstanding, widely prescribed PPIs, commands substantial market share, especially in North America, Europe, and parts of Asia.

Segment Positioning of SM Lansoprazole DR

SM Lansoprazole DR intends to differentiate itself through:

- Improved bioavailability due to delayed-release technology.

- Potential for reduced dosing frequency.

- Improved tolerability, adhering to the current trend of personalized medicine.

In terms of therapeutic indications, it aligns with GERD, Zollinger-Ellison syndrome, and peptic ulcer disease.

Market Drivers

- Increasing Incidence of Acid Disorders: The rising prevalence of GERD, peptic ulcers, and Barrett’s esophagus amplifies demand for PPIs, including Lansoprazole derivatives.

- Shift Toward Generic and Cost-Effective Formulations: Patent expirations and the entrance of generic formulations intensify price competition; however, differentiated formulations like SM Lansoprazole DR can command premium pricing.

- Patient Preference and Compliance: Enhanced formulations that improve dosing convenience and tolerability are more likely to achieve better patient adherence, attracting prescriber preference.

- Regulatory Approvals: Successful clinical trials and regulatory clearance can catalyze market entry and adoption.

Key Growth Regions:

- North America: Largest share, driven by high disease prevalence and healthcare expenditure.

- Europe: Significant market owing to aging demographics.

- Asia-Pacific: Rapid growth driven by expanding healthcare infrastructure and increasing GERD prevalence.

Competitive Landscape

The PPI segment is highly competitive, with key players including Pfizer (Prevacid), AstraZeneca (Nexium), and generic manufacturers. Lansoprazole's original formulations face substantial generic competition. Differentiated formulations like SM Lansoprazole DR could carve niche markets, accentuating the importance of patent protections, clinical advantages, and marketing strategies.

Key Competitors for DR Formulations:

- Takeda's Dexilant (dexlansoprazole): Known for dual-release technology, providing sustained acid suppression.

- Generic Lansoprazole Brands: Price-sensitive markets see robust competition.

Regulatory Landscape

Regulatory approval is pivotal. For SM Lansoprazole DR, securement of regulatory clearances (FDA, EMA, and similar authorities) will influence market access and pricing. Demonstrating bioequivalence, safety, and efficacy determines competitive feasibility. Post-approval, health authority evaluations of clinical data and manufacturing compliance shape market confidence.

Pricing Strategies and Economic Considerations

Pricing of SM Lansoprazole DR hinges upon multiple factors:

- Patent Status: Exclusive market access allows premium pricing. Patent expiry introduces generic competition, reducing prices.

- Formulation Differentiation: Innovative delayed-release technology justifies higher prices.

- Market Penetration Goals: Early-stage pricing may focus on premium positioning to recoup development costs, with subsequent adjustment toward competitive levels.

- Pricing Benchmarks: Market leaders in Lansoprazole formulation command prices ranging from $8 to $15 per prescription in the US (source: GoodRx). Price premiums for novel formulations can reach 20-30%.

Projected Price Trajectories:

- Short-term (1-2 years post-launch): Premium pricing in the range of $12–$18 per prescription, reflecting formulation advantages and exclusive rights.

- Medium-term (3-5 years): As patent protection wanes, prices could decline to $5–$8 with generic entries.

- Long-term (beyond 5 years): With generic market dominance, prices could fall below $5 per prescription, mirroring similar trends observed with other PPIs.

Factors Influencing Price Trends:

- Regulatory and Patent Expirations: Accelerate price erosion.

- Market Penetration Rates: Increased adoption reduces average costs due to economies of scale.

- Health Insurance Coverage: Favorably influences patient affordability and prescribing patterns.

- Use of Biosimilars and Generics: Intensifies price competition.

Market Potential and Revenue Projections

Based on current epidemiology and prescriptive data, annual sales potential for SM Lansoprazole DR can be estimated:

- Estimated Patient Population: In North America, approximately 15 million individuals suffer from GERD, with around 50% prescribed PPIs regularly.

- Average Prescriptions per Patient per Year: Estimated at 2–4.

- Market Penetration: Conservative initial penetration of 10–15% among target patients in the first three years.

Assuming premium pricing at $15 per prescription:

- First-year revenue estimate: $300 million (approximate, assuming 20 million prescriptions filled in the first year within target markets).

- Growth over 5 years: As the market matures and penetration expands, revenues could surpass $1 billion globally, especially if adoption extends into emerging markets with high GERD prevalence.

Challenges and Risks

- Market Saturation & Competition: Entry of generics and other novel formulations may suppress pricing.

- Regulatory Delays: Pending approvals or post-market restrictions could impact revenue.

- Patent Litigation: Potential patent challenges could shorten exclusivity periods.

- Healthcare Policy Changes: Cost-containment pressures and formulary restrictions could influence uptake.

Key Takeaways

- Market potential for SM Lansoprazole DR remains significant, especially in established markets with high GERD prevalence.

- Premium pricing is justified initially through technological differentiation, but price erosion is inevitable as patent protections expire.

- Strategic positioning with clinical data demonstrating better efficacy or tolerability can provide a competitive edge.

- Market entry timing influences revenue; early approval and adoption will maximize profitability.

- Emerging markets present long-term opportunities as healthcare infrastructure and disease prevalence expand.

FAQs

1. What distinguishes SM Lansoprazole DR from existing lansoprazole formulations?

SM Lansoprazole DR utilizes delayed-release technology that enhances bioavailability and potentially improves therapeutic efficacy, enabling flexible dosing and improved patient adherence compared to traditional formulations.

2. How will patent expiration impact pricing strategies?

Patent expiration will introduce generics, leading to significant price reductions. To optimize revenue, the company may focus on extending exclusivity via formulation patents or clinical differentiation until comparable generics enter the market.

3. What are the key challenges to market penetration for SM Lansoprazole DR?

Major challenges include regulatory approval timelines, reimbursement policy constraints, competition from established generics, and physician reluctance to switch from familiar therapies.

4. Which markets offer the highest revenue potential for SM Lansoprazole DR?

North America remains the most lucrative, followed by Europe and Asia-Pacific, driven by disease prevalence, healthcare infrastructure, and payer willingness to adopt differentiated formulations.

5. Will the increasing prevalence of biosimilars affect the PPI market?

While biosimilars are more relevant to biologics, the overall PPI market faces mounting generic competition, which is likely to exert downward pressure on prices and profits over time.

References

- Grand View Research. Proton Pump Inhibitors Market Size, Share & Trends Analysis Report (2023).

- GoodRx. Typical Pricing Data for Lansoprazole (2022).

- MarketWatch. Pharmaceutical Industry Trends and Forecasts (2022).

- FDA Regulatory Approvals Database (2023).

More… ↓