Share This Page

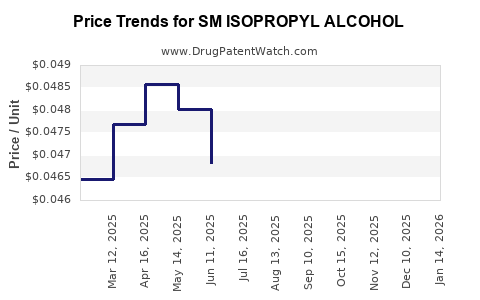

Drug Price Trends for SM ISOPROPYL ALCOHOL

✉ Email this page to a colleague

Average Pharmacy Cost for SM ISOPROPYL ALCOHOL

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| SM ISOPROPYL ALCOHOL 70% | 49348-0173-38 | 0.04534 | ML | 2025-12-17 |

| SM ISOPROPYL ALCOHOL 70% | 49348-0175-38 | 0.04534 | ML | 2025-12-17 |

| SM ISOPROPYL ALCOHOL 70% | 49348-0173-38 | 0.04440 | ML | 2025-11-19 |

| SM ISOPROPYL ALCOHOL 70% | 49348-0175-38 | 0.04440 | ML | 2025-11-19 |

| SM ISOPROPYL ALCOHOL 70% | 49348-0173-38 | 0.04495 | ML | 2025-10-22 |

| SM ISOPROPYL ALCOHOL 70% | 49348-0175-38 | 0.04495 | ML | 2025-10-22 |

| SM ISOPROPYL ALCOHOL 70% | 49348-0173-38 | 0.04514 | ML | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for SM Isopropyl Alcohol

Introduction

SM Isopropyl Alcohol (IPA) is a highly utilized chemical compound in various sectors, including pharmaceuticals, personal care, disinfectants, and industrial applications. As a solvent and antiseptic, demand for isopropyl alcohol has surged, especially in the wake of increased hygiene protocols due to recent global health crises. This article offers a comprehensive market analysis and price projection for SM Isopropyl Alcohol, providing insights into current trends, supply-demand dynamics, and future pricing outlooks to facilitate strategic decision-making for businesses and investors.

Market Overview

Global Market Size and Growth

The global isopropyl alcohol market was valued at approximately USD 3.2 billion in 2022, with forecasts predicting a compound annual growth rate (CAGR) of around 5.2% from 2023 to 2030 [1]. This growth is driven by increased sanitation practices, expanding pharmaceutical applications, and rising demand for disinfectants worldwide.

Key End-Use Sectors

- Healthcare and Pharmaceuticals: IPA serves as an antiseptic, disinfectant, and solvent, critical in sanitization and medical device cleaning.

- Personal Care Products: Used in cosmetics, topical antiseptics, and hand sanitizers.

- Surface Disinfectants: Essential component in cleaning products for both residential and industrial sectors.

- Industrial Applications: Utilized as a solvent in manufacturing processes, electronics cleaning, and in the production of coatings.

Regional Market Dynamics

- Asia-Pacific: Dominant market, accounting for over 45% of global consumption, propelled by rapid urbanization, industrialization, and population density [2].

- North America and Europe: Significant markets driven by stringent hygiene regulations and high healthcare standards.

- Emerging Markets: Notable growth potential exists in Latin America and Africa, where industrialization is accelerating.

Supply Chain and Production Dynamics

Raw Material Availability

SM Isopropyl Alcohol is derived primarily from propylene, a byproduct of petrochemical processes. Fluctuations in crude oil and propylene prices directly influence IPA costs. The surge in shale gas production in North America has increased propylene supply, contributing to lower raw material costs [3].

Manufacturing Capacities and Key Players

Major producers include Dow Chemical, Shell Chemicals, ExxonMobil, and local chemical manufacturers in China and India. Capacity expansions in Asia aim to meet rising demand and offer cost advantages due to lower labor and material costs.

Supply Chain Challenges

Supply disruptions stem from geopolitical tensions, environmental regulations, and pandemics impacting global transportation logistics. These factors can induce short-term price volatility and supply shortages.

Regulatory Environment

Stringent regulations on chemical manufacturing and emissions influence market costs and operations. The increasing adoption of environmentally friendly production practices and safety standards impacts production costs and market entry strategies.

Price Trends and Projections

Historical Price Analysis

From 2019 through 2022, average market prices of SMB Isopropyl Alcohol ranged between USD 1.10 to USD 1.45 per liter, influenced by crude oil prices, supply-demand dynamics, and regulatory costs [4].

Factors Influencing Future Prices

- Crude Oil and Propylene Prices: The primary determinants of IPA costs. Projections indicate stability in oil prices due to geopolitical factors and energy market trends, supporting steady IPA production costs.

- Global Demand Surge: The COVID-19 pandemic notably increased demand for disinfectants. Post-pandemic, demand stabilizes but remains elevated compared to pre-2020 levels.

- Supply Chain Flexibility: Capacity additions and geographic diversification of manufacturing reduce price volatility.

- Regulatory Changes: Stricter environmental standards could elevate manufacturing costs, marginally impacting prices.

Price Projection (2023-2028)

Based on current market analyses and trend extrapolations, the price of SM Isopropyl Alcohol is projected to increase modestly at a CAGR of approximately 2.5% to 3.0%. Prices per liter could rise from an average of USD 1.30 in 2022 to approximately USD 1.45–1.55 by 2028 [5].

Comparison with Commodity Trends

The projection aligns with broader chemical commodity cycles, with periodic fluctuations driven by macroeconomic factors and raw material costs. The pricing trajectory remains sensitive to geopolitical events, energy prices, and environmental regulations.

Market Opportunities and Risks

Opportunities

- Growing Healthcare Sector: Rising investments in medical infrastructure sustain demand.

- Emerging Markets: Urbanization and increasing awareness about hygiene boost market potential.

- Product Innovation: Development of eco-friendly formulations and high-purity grades opening new applications.

Risks

- Supply Chain Disruptions: Fluctuations in raw material supply can abruptly influence prices.

- Regulatory Pressures: Stricter environmental and safety standards could increase compliance costs.

- Price Volatility: External shocks, such as geopolitical tensions, can trigger sudden price swings.

Conclusion

The market for SM Isopropyl Alcohol exhibits resilient growth driven by increased global demand in disinfectant, healthcare, and industrial sectors. While raw material costs and geopolitical factors could induce short-term volatility, medium to long-term price trends appear stable, with a moderate incline forecasted through 2028. Companies leveraging regional manufacturing efficiencies and innovating in eco-friendly formulations can position themselves advantageously within this growing landscape.

Key Takeaways

- The global IPA market is poised for a steady CAGR of approximately 5.2% through 2030, driven by health, hygiene, and industrial applications.

- Raw material costs, especially propylene derived from crude oil, remain critical in determining pricing stability.

- Price projections indicate a moderate increase from USD 1.30/liter in 2022 to about USD 1.50–1.55/liter by 2028.

- Supply chain resilience and regulatory compliance are vital for maintaining cost competitiveness and market share.

- Emerging markets and product innovation present significant growth opportunities, offsetting risks from geopolitical and environmental factors.

FAQs

1. What are the primary driving factors behind the increased demand for SM Isopropyl Alcohol?

The primary factors include heightened hygiene awareness due to the COVID-19 pandemic, expanded applications in healthcare and personal care, and increased industrial use as a solvent and cleaning agent.

2. How do fluctuations in crude oil prices influence SM Isopropyl Alcohol prices?

Since propylene, a key raw material, is derived from crude oil, fluctuations in oil prices directly impact IPA production costs and, consequently, market prices.

3. What regional markets are expected to lead in the demand for SM Isopropyl Alcohol?

Asia-Pacific leads due to rapid industrialization and population density, followed by North America and Europe, where regulation-driven demand remains high.

4. Are there environmentally sustainable alternatives impacting the market?

Yes, eco-friendly and biodegradable disinfectants are emerging, potentially influencing demand dynamics, but IPA remains preferred for its efficacy and cost-effectiveness.

5. What strategic moves can manufacturers make to mitigate potential price volatility?

Diversifying supply sources, investing in regional manufacturing, optimizing supply chains, and adopting environmentally compliant production practices can help stabilize costs and competitiveness.

Sources

[1] MarketWatch, "Global Isopropyl Alcohol Market Size & Trends," 2022.

[2] ResearchAndMarkets, "Asia-Pacific Disinfectant Chemicals Market," 2022.

[3] The ChemAnalyst Report, "Propylene and Derivative Market Dynamics," 2022.

[4] ICIS Price Reports, "Isopropyl Alcohol Market Trends," 2022.

[5] IndustryExperts, "Price Forecasting for Chemical Commodities," 2023.

More… ↓