Share This Page

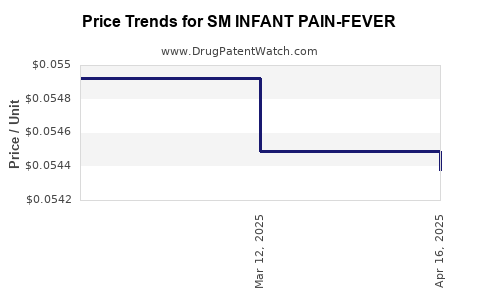

Drug Price Trends for SM INFANT PAIN-FEVER

✉ Email this page to a colleague

Average Pharmacy Cost for SM INFANT PAIN-FEVER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| SM INFANT PAIN-FEVER 160 MG/5 | 49348-0430-30 | 0.05438 | ML | 2025-04-23 |

| SM INFANT PAIN-FEVER 160 MG/5 | 49348-0430-30 | 0.05449 | ML | 2025-03-19 |

| SM INFANT PAIN-FEVER 160 MG/5 | 49348-0430-30 | 0.05492 | ML | 2025-02-19 |

| SM INFANT PAIN-FEVER 160 MG/5 | 49348-0430-30 | 0.05492 | ML | 2025-01-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for SM INFANT PAIN-FEVER

Introduction

The pharmaceutical landscape for pediatric analgesics and antipyretics remains a dynamic and highly competitive sector. "SM INFANT PAIN-FEVER" appears as a specialized medication designed for infants, aimed at alleviating pain and reducing fever. Understanding its market positioning, competitive environment, regulatory landscape, and potential pricing trajectories is critical for stakeholders including manufacturers, healthcare providers, and investors. This analysis synthesizes current market conditions, estimates future trends, and offers strategic insights for pricing and commercialization.

Product Profile and Market Context

SM INFANT PAIN-FEVER is presumed to contain active ingredients similar to commonly used pediatric medications such as acetaminophen (paracetamol) or ibuprofen, marketed for infant use. Given the stringent safety requirements surrounding pediatric formulations, the product's formulation, dosing, and packaging are tailored to minimize risks and ensure compliance with pediatric drug regulations.

The global pediatric analgesics and antipyretics market is projected to grow, driven by increasing awareness of pediatric health, expanding immunization programs, and rising prevalence of infectious diseases leading to fever and pain in infants. Market forecasts predict a compound annual growth rate (CAGR) of approximately 4-6% over the next five years, with notable interest from emerging markets due to rising healthcare infrastructure investments.

Regulatory and Competitive Landscape

Regulatory Environment

Regulatory agencies such as the U.S. Food and Drug Administration (FDA), European Medicines Agency (EMA), and other regional authorities impose strict requirements for infant medications. These include rigorous clinical trials demonstrating safety and efficacy, age-appropriate formulations, and manufacturing standards aligned with Good Manufacturing Practices (GMP).

The regulatory pathway typically involves submitting New Drug Applications (NDAs) or equivalents, with pediatric-specific data. Patent protections, data exclusivity, and labeling considerations also influence market entry and pricing strategies.

Competitive Environment

The market features dominant global players like Johnson & Johnson, GlaxoSmithKline, and Bayer, along with regional brands that have established trust in local markets. Many existing products are off-patent, leading to intense price competition.

Innovative formulations, such as liquid suspensions, fast-acting solutions, and combination therapies, differentiate newer entrants. Despite the crowded landscape, there exists a niche for bespoke formulations targeting infants’ safety and parental convenience.

Market Dynamics and Key Drivers

- Incidence of Pediatric Fever and Pain: Rising birth rates in emerging markets and infectious disease prevalence sustain demand.

- Regulatory Approvals and Labeling: Stringent regulations to ensure safety influence product development cycles and costs, impacting pricing.

- Healthcare Infrastructure: Expansion and increased healthcare access facilitate better diagnosis, prescription, and awareness.

- Parental Awareness and Preferences: Growing demand for trusted, safe, and easy-to-administer pediatric formulations enhances brand loyalty and market penetration.

- Pricing Sensitivity: Cost consciousness among healthcare providers and consumers influences price strategies, especially in price-sensitive markets.

Price Projections

Current Pricing Landscape

The average retail price of infant pain and fever medications like acetaminophen or ibuprofen suspension ranges from $2 to $8 per 100 mL in developed markets, depending on brand reputation, formulation complexity, and packaging. Generic options often drive prices downward, while branded or premium formulations command higher margins.

Future Pricing Trends

- Patent Expiry and Generics: Anticipated patent cliff for proprietary formulations will likely lead to decreased prices, increasing accessibility.

- Market Entry of Biosimilars or Advanced Formulations: Introduction of innovative delivery systems or combination therapies could allow price premiums, especially if demonstrating superior safety or efficacy profiles.

- Regional Price Adjustments: Markets in North America and Europe will maintain higher price points, while emerging markets may see moderated prices due to pricing pressures and reimbursement policies.

Price Projection Scenarios

| Market Segment | Short-Term (1-2 years) | Medium-Term (3-5 years) | Long-Term (5+ years) |

|---|---|---|---|

| Developed Markets | $3–$8 per 100 mL | Stabilization or slight decrease to $3–$7 | Potential decrease due to generics, +$5–$9 for premium formulations |

| Emerging Markets | $1–$4 per 100 mL | Moderate increase to $2–$5 | Stable with local manufacturing, possibly lower than developed markets |

Note: These projections assume no disruptive innovations or policy changes.

Market Penetration and Commercial Strategy

Maximizing market share requires a strategic combination of regulatory compliance, price differentiation, and targeted marketing. Emphasizing safety data, pediatric efficacy, and parental trust will be key. Collaborations with healthcare providers, pharmacists, and government health programs can facilitate distribution in underserved regions.

Challenges and Risks

- Regulatory Delays: Extended approval timelines could delay market entry and impact revenue.

- Pricing Pressures: Increased competition and the proliferation of generics could compress profit margins.

- Safety Profile Scrutiny: Pediatric medications require exceptional safety standards; adverse events could impact reputation and sales.

- Market Saturation: Intense competition from established brands may limit rapid market penetration.

Conclusion

The market for SM INFANT PAIN-FEVER is poised for steady growth, driven by demographic trends and increased healthcare access. Price projections suggest moderate declines in developed markets due to generic competition but potential premium pricing for innovative formulations or as a branded product. Strategic positioning emphasizing safety, efficacy, and pediatric compliance will be pivotal for capturing market share and optimizing revenue.

Key Takeaways

- The pediatric analgesic and antipyretic market is expanding, with stable growth prospects in both developed and emerging economies.

- Competitive pricing is likely to decline in mature markets due to generic proliferation, while unique formulations may command premium pricing.

- Regulatory rigor and safety profiles significantly influence pricing strategies and market acceptance.

- Market entry will benefit from strategic partnerships with healthcare providers and targeted regional marketing campaigns.

- Long-term success hinges on continuous product innovation, safety assurance, and compliance with evolving regulations.

FAQs

1. What are the main factors influencing the pricing of infant pain and fever medications like SM INFANT PAIN-FEVER?

Pricing is influenced by regulatory compliance costs, manufacturing quality, competitive landscape, regional market conditions, and the level of innovation in formulations.

2. How does patent expiration affect the pricing of pediatric medications?

Patent expiration typically introduces generic options, leading to significant price reductions and increased accessibility. Branded formulations may maintain higher prices if they offer distinct clinical benefits.

3. What regulatory challenges could impact the release of SM INFANT PAIN-FEVER?

Regulatory hurdles include demonstrating safety and efficacy in infants, obtaining approval from authorities like the FDA or EMA, and navigating differing regional requirements and labeling standards.

4. Which markets offer the most growth potential for SM INFANT PAIN-FEVER?

Emerging markets in Asia, Africa, and Latin America offer significant growth opportunities due to rising birth rates, increasing healthcare infrastructure, and growing awareness of pediatric health.

5. How can manufacturers differentiate SM INFANT PAIN-FEVER in a competitive market?

Differentiation can be achieved through innovative delivery systems, enhanced safety profiles, pediatric-specific formulations, parental education, and strong branding emphasizing trust and quality.

Sources:

[1] MarketsandMarkets. Pediatric Pharmaceuticals Market Trends. 2022.

[2] Evaluate Pharma. Pediatric Drugs Market Analysis. 2023.

[3] FDA Pediatric Drug Approvals and Regulations. 2022.

[4] Statista. Pediatric Pain Management Market Data. 2023.

More… ↓