Share This Page

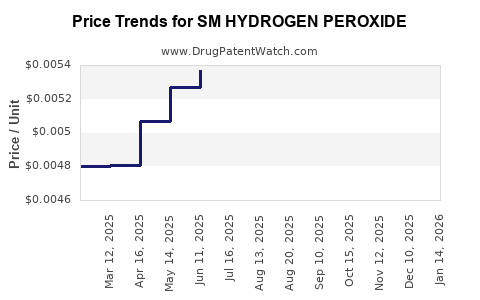

Drug Price Trends for SM HYDROGEN PEROXIDE

✉ Email this page to a colleague

Average Pharmacy Cost for SM HYDROGEN PEROXIDE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| SM HYDROGEN PEROXIDE 3% SOLN | 49348-0179-38 | 0.01911 | ML | 2025-12-17 |

| SM HYDROGEN PEROXIDE 3% SOLN | 49348-0179-38 | 0.01907 | ML | 2025-11-19 |

| SM HYDROGEN PEROXIDE 3% SOLN | 49348-0179-38 | 0.01888 | ML | 2025-10-22 |

| SM HYDROGEN PEROXIDE 3% SOLN | 49348-0179-38 | 0.01881 | ML | 2025-09-17 |

| SM HYDROGEN PEROXIDE 3% SOLN | 49348-0179-37 | 0.00496 | ML | 2025-08-20 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for SM Hydrogen Peroxide

Overview of SM Hydrogen Peroxide

SM hydrogen peroxide (SM H₂O₂) is a stabilized form of hydrogen peroxide utilized predominantly in industrial, pharmaceutical, and cosmetic applications. Its significance stems from its wide-ranging uses, including bleaching, disinfection, wastewater treatment, and as a raw material in chemical synthesis (e.g., propylene oxide production). The demand for high-purity hydrogen peroxide, particularly in pharmaceutical-grade applications, has escalated owing to increased emphasis on sterilization and hygiene, especially in the wake of global health crises.

Market Dynamics and Drivers

Demand Drivers

-

Industrial Applications: The bulk of hydrogen peroxide consumption correlates with paper and pulp bleaching, which accounts for approximately 50-60% of global demand. The increasing global population and economic expansion in emerging markets drive demand for paper packaging and hygiene products, further propelling hydrogen peroxide consumption.

-

Healthcare and Disinfection: The global health crisis catalyzed by COVID-19 has heightened demand for sterilization products. Hydrogen peroxide's broad-spectrum antimicrobial activity makes it indispensable in hospital disinfection, sterilizing equipment, and producing disinfectant solutions.

-

Water Treatment: Hydrogen peroxide is favored in advanced oxidation processes (AOPs) for wastewater treatment, especially in regions facing stringent environmental regulations.

-

Chemical Manufacturing: As a precursor in manufacturing processes such as epoxide synthesis, hydrogen peroxide's role remains critical in chemical industries, providing some insulation against economic volatility.

Supply Chain and Production Factors

-

Manufacturing Concentration: The hydrogen peroxide market is relatively consolidated with key producers spanning North America, Europe, and Asia-Pacific. Major players include Solvay, Evonik Industries, and AkzoNobel, with newer entrants emerging in Asia-Pacific due to burgeoning demand.

-

Raw Material Availability: Production hinges on access to key raw materials, including anthraquinone and oxygen. Fluctuations in raw material prices and supply chain disruptions impact pricing.

-

Environmental and Regulatory Factors: Stricter environmental regulations, particularly regarding the disposal of by-products, influence manufacturing overheads and, consequently, product pricing.

Market Challenges

-

Safety Concerns: Handling high-concentration hydrogen peroxide poses safety risks, necessitating specialized storage and transportation infrastructure, which elevates costs.

-

Pricing Volatility: Raw material costs, energy prices, and geopolitical factors lead to fluctuations in hydrogen peroxide prices.

-

Emerging Substitutes: Advances in alternative bleaching agents and disinfectants could challenge hydrogen peroxide's dominance over time.

Market Segmentation and Regional Overview

By Grade

-

Technical Grade: Primarily for industrial applications like bleaching, wastewater treatment, and chemical synthesis. Typically priced lower and with broader specifications.

-

Pharmaceutical Grade: High purity levels (>99%), used predominantly in sterilization and medical applications. Commands premium pricing and faces stricter regulatory oversight.

By Concentration

-

35-50% Solution: Widely used in industrial applications; major volume segment.

-

Below 35% Solution: Employed in disinfectants and household products.

-

High-Grade (>50%): Specialty applications and integrating into chemical manufacturing.

Regional Market Share

-

Asia-Pacific: Leading the growth with rapid industrialization, urbanization, and expansion in healthcare infrastructure. China, India, and Southeast Asia form the growth core, with China holding the largest regional share.

-

North America: Mature market driven by pharmaceutical, water treatment, and pulp & paper sectors. Emphasis on environmental standards influences demand.

-

Europe: Focused on sustainable production and ecological applications. Regulatory stringency impacts manufacturing costs.

-

Rest of the World: Emerging markets in Latin America and Africa are witnessing increasing adoption of hydrogen peroxide, especially in water treatment.

Price Trends and Forecasts

Historical Pricing Overview

Recent historical data indicates that hydrogen peroxide prices have experienced moderate volatility, primarily driven by raw material costs and regional supply-demand dynamics. As of 2022-2023, the average price of technical-grade hydrogen peroxide (50%) in Asia-Pacific ranged around $0.70 - $0.90 per kg, with pharmaceuticals-grade prices reaching $2.50 - $3.00 per kg.

Projected Price Movements

-

Short-term Outlook (Next 2 Years): Prices are expected to remain relatively stable, with slight upward pressure attributable to supply chain constraints, raw material cost rises, and increased environmental regulation costs. The global supply chain disruptions—exacerbated by geopolitical tensions and pandemic recovery efforts—may sustain higher procurement costs.

-

Medium to Long-term Outlook (3-5 Years): Prices for SM hydrogen peroxide are projected to increase at an annual rate of 3-5%, considering factors such as:

- Expansion of demand in Asian markets driven by infrastructure projects.

- Continued regulatory tightening, especially concerning safety and environmental standards.

- Potential capacity additions by major producers aiming to meet rising demand.

- Technological advances leading to higher purity requirements, which might marginally elevate costs.

Influencing Factors

-

Raw Material Costs: Availability and pricing of anthraquinone and oxygen will influence production costs.

-

Energy Markets: As energy-intensive processes dominate hydrogen peroxide manufacturing, fluctuations in electricity and natural gas prices significantly affect pricing.

-

Environmental Regulations: Stricter emissions and waste management policies may increase manufacturing costs, translating into higher prices.

-

Market Competition and Capacity Expansion: Investments by leading manufacturers, particularly in Asia-Pacific, could soften prices temporarily but are unlikely to offset upward trends driven by demand growth.

Strategic Implications for Investors and Industry Stakeholders

-

Rising Demand in Emerging Markets: Firms should consider strategic placements in Asia-Pacific, where demand growth remains robust.

-

Focus on High-Purity Segments: The pharmaceutical and healthcare segments command premium prices; investing in advanced purification capabilities offers higher margins.

-

Supply Chain Resilience: Companies should evaluate diversification of raw material sourcing and capacity expansion to mitigate regional disruptions.

-

Environmental Compliance: Proactive investments in greener production technologies can reduce long-term costs and align with regulatory trajectories.

-

Pricing Risks: Volatile raw material costs necessitate strategic hedging and flexible contracting to maintain margin stability.

Key Takeaways

-

The hydrogen peroxide market, especially for SM hydrogen peroxide, is poised for moderate growth driven by industrial, healthcare, and environmental applications, predominantly in Asia-Pacific and North America.

-

Price stability in the short term is likely, but with a medium-term upward bias due to raw material costs, environmental regulations, and increasing demand for high-purity grades.

-

Strategic investments in capacity, technological innovation, and supply chain resilience can provide competitive advantages amidst evolving market conditions.

-

Industry participants should monitor geopolitical developments, environmental policies, and technological advances, as these factors significantly influence supply, demand, and pricing.

-

Companies that differentiate through sustainability and purification capabilities can capture higher-margin segments and mitigate volatility.

FAQs

Q1: What are the primary applications driving demand for SM hydrogen peroxide?

A1: Major uses include paper and pulp bleaching, pharmaceutical sterilization, disinfectants, wastewater treatment, and chemical synthesis, with healthcare and environmentally driven applications contributing significantly to growth.

Q2: How do regional regulations influence hydrogen peroxide prices?

A2: Stricter environmental and safety regulations increase manufacturing compliance costs, which are often passed on to consumers, leading to higher prices, especially in Europe and North America.

Q3: What factors could lead to a decline in hydrogen peroxide prices?

A3: Overcapacity due to new capacity expansions, technological breakthroughs reducing production costs, or substitutes replacing hydrogen peroxide in key applications could suppress prices.

Q4: Which region offers the most growth potential for hydrogen peroxide producers?

A4: The Asia-Pacific region, particularly China and India, presents the most significant growth opportunities driven by rapid industrialization and expanding healthcare infrastructure.

Q5: How might technological advances impact the hydrogen peroxide market?

A5: Innovations that improve production efficiency, enable higher purity levels, or reduce environmental impact can create competitive advantages and influence market pricing dynamics.

Sources:

- MarketsandMarkets: Hydrogen peroxide market analysis, 2023.

- Grand View Research: Hydrogen peroxide market size, forecast, and trends, 2023.

- ICIS Chemical Business: Price trend reports, 2023.

- Company Financial Reports: Solvay, Evonik, AkzoNobel 2022-2023.

- Environmental Agency Publications: Regulatory standards for chemical manufacturing, 2022.

More… ↓