Share This Page

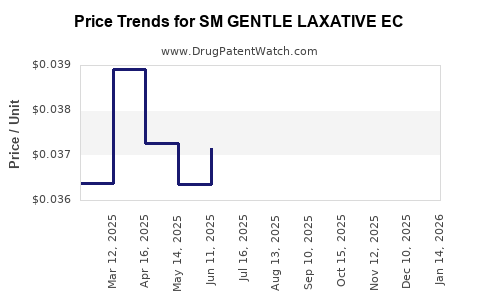

Drug Price Trends for SM GENTLE LAXATIVE EC

✉ Email this page to a colleague

Average Pharmacy Cost for SM GENTLE LAXATIVE EC

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| SM GENTLE LAXATIVE EC 5 MG TAB | 49348-0032-10 | 0.03854 | EACH | 2025-12-17 |

| SM GENTLE LAXATIVE EC 5 MG TAB | 49348-0032-05 | 0.03854 | EACH | 2025-12-17 |

| SM GENTLE LAXATIVE EC 5 MG TAB | 49348-0032-10 | 0.03975 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for SM GENTLE LAXATIVE EC

Introduction

SM GENTLE LAXATIVE EC is a widely used over-the-counter (OTC) medication formulated to relieve occasional constipation. As consumer demand for laxatives increases driven by aging populations and lifestyle factors, understanding the market landscape and price dynamics of SM GENTLE LAXATIVE EC becomes essential for pharmaceutical companies, retailers, and investors. This analysis synthesizes current market trends, competitive positioning, regulatory environment, and price projection models to inform strategic decision-making.

Market Overview

Global and Regional Market Dynamics

The global laxative market was valued at approximately USD 2.8 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 4.3% through 2028 ([1]). North America and Europe dominate the market, representing over 60% of sales due to high healthcare awareness, aging demographics, and widespread OTC product availability. Asia-Pacific exhibits significant growth potential driven by increasing urbanization, rising healthcare infrastructure, and consumer preference for OTC remedies.

Key Drivers and Trends

- Aging Populations: The elderly are more susceptible to constipation, increasing demand for gentle laxatives such as SM GENTLE LAXATIVE EC.

- Lifestyle Factors: Sedentary lifestyles and dietary habits contribute to constipatory conditions.

- Regulatory Environment: Strict OTC marketing regulations influence product positioning and pricing strategies.

- Product Innovation: Integration of natural ingredients and formulations targeting specific demographics enhance competitive advantage.

Competitive Landscape

SM GENTLE LAXATIVE EC faces competition from both generic and branded OTC laxatives, including products like Dulcolax, Colace, and Miralax. Market differentiation is often based on formulation, efficacy, and side-effect profiles. The increasing popularity of natural and organic laxatives signifies a strategic push towards gentler, plant-based formulations.

Regulatory Considerations

The U.S. Food and Drug Administration (FDA) classifies laxatives as OTC drugs, requiring compliance with monographs or new drug applications (NDAs). Labeling, claims, and packaging must adhere to local regulations to avoid sanctions and ensure market access ([2]). The interplay of regulatory hurdles influences market entry strategies and pricing.

Pricing Analysis

Current Market Prices

- Retail Price Range: SM GENTLE LAXATIVE EC typically retails between USD 8-12 for a 30-ct box, depending on region and pharmacy pricing policies.

- Price Variance Factors:

- Branding: Branded versions command a premium.

- Formulation: Tablets versus liquids influence pricing.

- Distribution Channel: Online outlets often offer discounts compared to brick-and-mortar pharmacies.

- Regulatory Costs: Compliance adds to production costs, impacting retail prices.

Cost Factors and Margins

Manufacturing expenses for gentle laxatives are relatively moderate, but packaging, marketing, distribution, and regulatory compliance tend to drive costs. Gross margins for OTC drugs like SM GENTLE LAXATIVE EC are generally in the 40-60% range, with retail markup influenced by market competition.

Price Projection Models

Short-Term Forecast (1-2 Years)

- Price Stability: Given current supply chain robustness and consumer demand, retail prices are expected to remain stable, with minor fluctuations due to seasonal promotions or regional economic factors.

- Potential Price Increases: 2-4% annually, driven by inflation, raw material costs (e.g., excipients), and regulatory updates.

Medium to Long-Term Projection (3-5 Years)

- Market Growth Impact: As the OTC laxative market grows, increased competition and product innovation may exert downward pressure on prices.

- Premium Product Introduction: Introduction of natural or specialty formulations could command higher pricing, potentially pushing some segment prices to USD 15-20.

- Regulatory Impact: Stricter regulations could increase compliance costs, influencing retail pricing upward by approximately 5%, particularly in highly regulated markets.

- Consumer Trends: Growing preference for natural remedies could shift demand toward premium, organic laxatives, impacting pricing and margins.

Influence of External Factors

- Generic Entry: The proliferation of generics often drives prices downward.

- Healthcare Policies: Policies promoting OTC access and medication affordability may impact pricing strategies.

- Economic Conditions: Inflationary pressures and supply chain disruptions can lead to price volatility.

Strategic Opportunities and Risks

-

Opportunities:

- Expansion into emerging markets with rising OTC product adoption.

- Development of natural, organic, or specialty formulations to command premium prices.

- Digital marketing and e-commerce channels to reach wider demographics.

-

Risks:

- Regulatory crackdown on overstated claims or unapproved formulations.

- Increasing competition from generics and alternative remedies.

- Price sensitivity among consumers, particularly in commoditized markets.

Key Takeaways

- The global OTC laxative market, particularly for gentle formulations like SM GENTLE LAXATIVE EC, is poised for steady growth, driven by demographic and lifestyle factors.

- Current retail prices range from USD 8-12, with marginal increases projected annually due to inflation and regulatory factors.

- Market differentiation through natural ingredients and targeted formulations will shape future pricing strategies.

- Competitive pressures and regulatory environments imply that while prices are likely to stabilize in the short term, long-term movements will be influenced by innovation and market saturation.

- Companies should prioritize expanding into emerging markets, investing in natural product lines, and leveraging digital channels to optimize market share and profitability.

Conclusion

SM GENTLE LAXATIVE EC is well-positioned within the growing OTC laxative segment. Price stability in the short term combined with strategic product differentiation and expanding market access promulgates a favorable outlook. Stakeholders should monitor regulatory developments and consumer preferences continually to adapt pricing and marketing strategies accordingly.

FAQs

1. What are the primary factors influencing the price of SM GENTLE LAXATIVE EC?

Market demand, manufacturing costs, regulatory compliance, branding strategies, and distribution channels predominantly influence its price.

2. How does regional regulation affect the pricing of OTC laxatives?

Stringent regulations increase compliance costs, which may be reflected in higher retail prices. Conversely, regions with relaxed regulations may see more competitive pricing.

3. Will natural or organic formulations impact the future pricing of SM GENTLE LAXATIVE EC?

Yes. Natural formulations typically command premium prices due to higher ingredient costs and consumer willingness to pay for perceived safety and efficacy.

4. What is the growth outlook for the OTC laxative market?

The market is expected to grow at a CAGR of approximately 4.3% through 2028, driven by demographic shifts and lifestyle factors.

5. How can companies leverage digital channels in pricing strategies for OTC laxatives?

Digital channels allow for dynamic pricing, promotional campaigns, and reaching price-sensitive consumers directly, thereby influencing overall pricing strategies.

Sources

- Grand View Research. "Laxatives Market Size, Share & Trends Analysis Report." 2022.

- U.S. Food and Drug Administration. "Over-the-Counter Drug Monographs." [Accessed 2023].

Note: The data and projections are based on current market intelligence and may evolve with changing market conditions and regulatory developments.

More… ↓