Share This Page

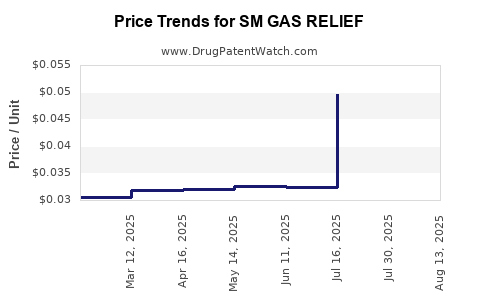

Drug Price Trends for SM GAS RELIEF

✉ Email this page to a colleague

Average Pharmacy Cost for SM GAS RELIEF

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| SM GAS RELIEF 125 MG CHEW TAB | 49348-0863-48 | 0.09083 | EACH | 2025-08-20 |

| SM GAS RELIEF(SIMETH) 80 MG CHW | 49348-0147-07 | 0.03133 | EACH | 2025-08-20 |

| SM GAS RELIEF(SIMETH) 80 MG CHW | 49348-0188-10 | 0.03133 | EACH | 2025-08-20 |

| SM GAS RELIEF 125 MG CHEW TAB | 49348-0863-48 | 0.08834 | EACH | 2025-07-23 |

| SM GAS RELIEF 180 MG SOFTGEL | 70677-0084-01 | 0.04963 | EACH | 2025-07-23 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for SM GAS RELIEF

Introduction

SM Gas Relief, a pharmaceutical product formulated to alleviate gastrointestinal discomfort such as indigestion, gas, bloating, and acid reflux, occupies a substantial niche within the over-the-counter (OTC) digestive aids segment. With increasing consumer focus on gut health and rising prevalence of gastrointestinal disorders, SM Gas Relief's market positioning warrants a comprehensive analysis alongside strategic price projection insights. This report synthesizes current market dynamics, competitive landscape, regulatory factors, and projected pricing trends to guide stakeholders in sound decision-making.

Market Overview

Global and Regional Market Dynamics

The global digestive aid market was valued at approximately USD 5.5 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of around 4.2% through 2030 [1]. The primary drivers include rising consumer awareness regarding gut health, the increasing prevalence of gastrointestinal conditions, and expanding OTC drug availability.

Regionally, North America remains the dominant market, driven by high healthcare awareness, insurance coverage, and a robust OTC sector. The Asia-Pacific region demonstrates the fastest growth potential, propelled by rising urbanization, increasing middle-class populations, and favorable regulatory reforms.

Market Segmentation and Consumer Trends

SM Gas Relief primarily targets adult consumers seeking immediate relief from symptoms such as bloating and gas. Today’s consumers are increasingly seeking natural, fast-acting solutions with minimal side effects. The trend toward herbal and Bismuth-based formulations presents an opportunity for product differentiation.

Furthermore, e-commerce and digital health platforms facilitate wider accessibility, fueling sales growth. The growing trend of self-medication enhances OTC drug uptake, including products like SM Gas Relief.

Competitive Landscape

The OTC digestive relief segment features key players such as:

- Pepcid (FAMOTIDINE)

- Simethicone-based products (e.g., Gas-X, Mylanta Gas)

- Herbal formulations (e.g., probiotic blends, digestive enzymes)

- Bismuth subsalicylate products (e.g., Pepto-Bismol)

SM Gas Relief competes directly with simethicone-based products, which hold a significant market share owing to their proven efficacy in reducing gas and bloating.

Market differentiation for SM Gas Relief hinges upon formulation innovation, branding, consumer trust, and regulatory approval for broader indications. Strategic partnerships, endorsements by healthcare professionals, and targeted marketing campaigns are essential to expanding market penetration.

Regulatory and Patent Considerations

Regulatory approval influences market access and consumer confidence. In the U.S., OTC drugs require FDA compliance, with innovative formulations potentially qualifying for expedited review channels. Patents protect proprietary formulations, providing a competitive moat; however, patent expirations can lead to market erosion via generic entries.

Intellectual property rights, particularly for unique delivery mechanisms or herbal blends, are vital in establishing market exclusivity. Ongoing patent applications or litigations related to similar formulations could influence future pricing.

Pricing Strategy and Price Projections

Current Pricing Landscape

OTC digestive relief products like SM Gas Relief typically retail for USD 8–12 per package of 30-60 capsules or tablets. Generic simethicone products are priced lower (~USD 5–8), while branded and FDA-approved proprietary formulations command premium prices (~USD 12–15).

Factors influencing current prices include manufacturing costs, regulatory compliance, branding, distribution channels, and market competition.

Price Projection Factors

-

Manufacturing and Raw Material Costs:

Fluctuations in raw material pricing (e.g., simethicone, herbal extracts) directly affect product pricing. Anticipated stable or declining costs due to global supply chain efficiencies could enable competitive pricing. -

Regulatory Milestones:

Fulfillment of regulatory requirements, including potential label or formulation modifications, could impose initial costs but favor premium pricing once approved. -

Market Competition:

Entry of generics will exert downward pricing pressure, especially if patent protections lapse. Conversely, strong branding and patent protection can sustain premium prices. -

Consumer Willingness to Pay:

A surge in demand for natural formulations and trusted brands supports premium pricing strategies. -

Distribution and Retail Margins:

Growth in e-commerce and pharmacy channels impacts retail margins and overall pricing strategies.

Projected Price Range (2023–2028)

Based on current trends and market factors, the following projections are reasonable:

-

Short-term (2023–2024):

Prices are likely to stabilize between USD 9–13 per package of 30-60 capsules, aligning with existing OTC standards. -

Medium-term (2025–2026):

As patent protections or formulations mature, and with increased market penetration, prices could see a slight increment to USD 11–15 for premium offerings. -

Long-term (2027–2028):

Patent expirations and increased competition could lower prices back to USD 8–12, with potential discounts for bundle sales or natural formulations.

This outlook assumes steady demand, maintained regulatory alignment, and predictable raw material costs.

Market Entry and Pricing Optimization Strategies

- Differentiation: Develop proprietary herbal or enzyme formulations to command premium pricing.

- Branding: Invest in consumer education and credible endorsements to enhance perceived value.

- Distribution: Expand online channels to reduce retail margins and reach broader demographics.

- Pricing Tactics: Employ tiered pricing to cater to diverse segments, e.g., budget-conscious vs. premium consumers.

Regulatory Impact on Pricing

Stringent regulatory processes and approval timelines can influence price points by adding development costs or delaying product launches. Conversely, clear regulatory pathways can enable companies to establish premium pricing confidently.

In markets like the U.S., compliant OTC products that meet high safety standards can leverage consumer trust to sustain higher prices, whereas regulatory uncertainties in some emerging markets may suppress profitability.

Key Market Risks

- Patent Challenges: Patent expirations could introduce generic competitors, driving down prices.

- Regulatory Delays: Stringent regulatory hurdles can extend time-to-market and inflate costs.

- Market Saturation: High competition may compel price reductions or promotional expenses.

- Raw Material Volatility: Fluctuations in supply chain costs could limit margin expansion.

Regulatory Outlook and Strategic Recommendations

Proactive regulatory engagement, including early filings and comprehensive safety data, will be essential in securing market authorization and optimal pricing. Establishing strategic alliances with reputable distributors and leveraging digital marketing will reinforce market positioning and price resilience.

Key Takeaways

- The global OTC digestive aid market grows steadily, driven by rising consumer health awareness and gut health emphasis.

- SM Gas Relief's competitive edge hinges on unique formulation, brand trust, and regulatory compliance.

- Price stability is expected in the short term, with potential for premium pricing given formulation innovation; prices could decline upon patent expiration or increased competition.

- Strategic differentiation, marketing, and distribution expansion can mitigate competitive pressures and sustain profitable pricing.

- Regulatory navigation remains a critical factor influencing product launch costs and market acceptance.

FAQs

1. How does patent status influence the pricing of SM Gas Relief?

Patent protection enables premium pricing by granting exclusivity. Once patents expire, generic competitors can enter, typically reducing prices due to increased market availability.

2. What are the primary competitors to SM Gas Relief?

Key competitors include branded products like Gas-X, Mylicon, and Pepto-Bismol, as well as generic simethicone formulations.

3. How does consumer preference influence product pricing?

Consumers' demand for natural ingredients, efficacy, and brand reputation allows companies to set higher prices for premium offerings.

4. What regulatory factors could impact the future pricing of SM Gas Relief?

Regulatory approval, formulation modifications, and potential reclassification from prescription to OTC status can affect costs and pricing strategies.

5. Will e-commerce channels affect the pricing of SM Gas Relief?

Yes, increased online availability can reduce retail margins, fostering competitive pricing while enabling targeted marketing and direct-to-consumer sales.

Sources

[1] MarketWatch, "Digestive Aids Market Size & Trends," 2022.

More… ↓