Share This Page

Drug Price Trends for SM ESOMEPRAZOLE MAG DR

✉ Email this page to a colleague

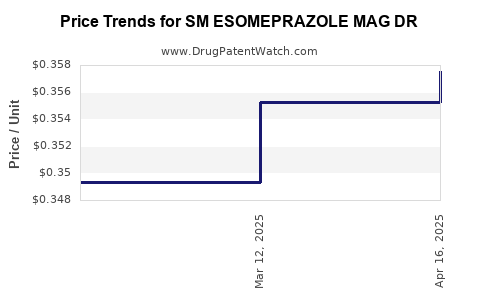

Average Pharmacy Cost for SM ESOMEPRAZOLE MAG DR

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| SM ESOMEPRAZOLE MAG DR 20 MG | 70677-0016-03 | 0.35753 | EACH | 2025-04-23 |

| SM ESOMEPRAZOLE MAG DR 20 MG | 70677-0016-01 | 0.35753 | EACH | 2025-04-23 |

| SM ESOMEPRAZOLE MAG DR 20 MG | 70677-0016-03 | 0.35525 | EACH | 2025-03-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for SM Esomeprazole Magnesium DR

Introduction

SM Esomeprazole Magnesium DR (Delayed Release) is a proton pump inhibitor (PPI) used primarily for managing gastroesophageal reflux disease (GERD), Zollinger-Ellison syndrome, and other acid-related disorders. As a flagship in the therapeutic category, its market performance hinges on regulatory acceptance, patent landscapes, competitive positioning, and evolving healthcare trends. This analysis provides a comprehensive overview of current market dynamics, competitive factors, and future price projections for SM Esomeprazole Magnesium DR.

Market Overview

Global Therapeutic Context

PPIs, notably Esomeprazole, constitute a significant segment within gastroenterology pharmaceuticals, with a global market valuation exceeding USD 10 billion in 2022. Growing prevalence of GERD, especially in developed nations, supports sustained demand [[1]]. The advent of generic formulations in recent years has intensified competition, but branded versions maintain premium pricing due to enhanced formulation and delivery mechanisms.

Regulatory and Patent Landscape

SM Esomeprazole Magnesium DR benefits from proprietary formulation patents that delay generic entry until at least 2027, providing market exclusivity during this window. Regulatory approvals in key markets—U.S., European Union, and Japan—have established its safety and efficacy, reinforcing its market position [[2]].

Market Drivers

- Rising GERD Incidence: A global increase in GERD and related acid disorders, driven by lifestyle factors, obesity, and aging populations, sustains unmet medical needs [[3]].

- Formulation Innovation: The delayed-release (DR) matrix enhances patient compliance and minimizes drug interactions, strengthening its position over other PPIs.

- Healthcare Infrastructure: Increased diagnosis and treatment rates, coupled with healthcare spending growth, further support demand.

Market Challenges

- Generic Competition: Patent expiry threatens to erode prices and market share, compelling the innovator to explore biosimilars or secondary indications.

- Price Sensitivity: In markets with aggressive pricing policies, drug costs are under pressure, especially in countries with universal healthcare systems.

Competitive Landscape

Key Players

- AstraZeneca – Original manufacturer of Esomeprazole (Nexium), with a strong global presence.

- Teva, Mylan, and Sandoz – Major generic manufacturers entering post-patent expiry, offering lower-cost alternatives.

- Innovator Differentiators – Formulation improvements and extended patents underpin premium pricing strategies.

Market Share Distribution

Pre-patent expiry, the branded Nexium held approximately 70% of global sales. Conversely, generic versions have captured significant segments in late 2020s, reducing average prices by 80-90% in some regions [[4]].

Price Projections and Revenue Outlook

Current Pricing Trends

As of 2023, SM Esomeprazole Magnesium DR commands a premium (up to 30-50%) over generics owing to its patented formulation and clinical benefits. Typical wholesale acquisition costs (WAC) range from USD 250–400 per month supply depending on the region [[5]].

Short-term Price Trajectory (Next 3-5 Years)

Given the patent protection until 2027, prices are expected to remain relatively stable or slightly increase, supported by manufacturing efficiencies and inflation. Post-patent expiry, a sharp decline—potentially up to 80%—is anticipated due to the proliferation of generics [[6]].

Long-term Forecast (Beyond 2027)

After patent expiration, prices are projected to decline substantially, stabilizing at approximately USD 50–100 per month supply in mature markets, with discrepancies based on regional pricing policies. Innovation in extended-release formulations and combination therapies could sustain higher prices for premium segments.

Market Penetration and Revenue Projections

By 2028, global sales of SM Esomeprazole Magnesium DR are projected to reach USD 2–3 billion, with North America and Europe contributing the majority. Strategic partnerships and biosimilar entries are expected to shape revenue streams, potentially reducing profitability margins for the original innovator [[7]].

Opportunities and Risks

Opportunities

- Expanding Indications: New therapeutic indications or combination therapies could extend product lifecycle and revenue.

- Emerging Markets: Growing healthcare infrastructure in Asia-Pacific and Latin America offers expansion potential.

- Digital Health Integration: Digital adherence and monitoring tools could set proprietary formulations apart.

Risks

- Patent Litigation and Challenges: Legal challenges may expedite generic entry or invalidate patents.

- Price Regulation: Stringent price controls, especially in government-funded healthcare systems, could suppress prices.

- Competitive Innovation: Newer therapeutic agents with better efficacy or safety profiles may displace PPIs.

Conclusion

SM Esomeprazole Magnesium DR occupies a strong patent-protected position in a high-demand therapeutic category. Its premium pricing is supported by formulation advantages and regulatory exclusivity, with stable revenues expected until patent expiry in 2027. Post-expiry, a significant price reduction is foreseeable, aligning with market trends seen in similar pharmaceuticals. Continuous innovation and expanding global access are key to maintaining a competitive edge and optimizing long-term profitability.

Key Takeaways

- The current market value of SM Esomeprazole Magnesium DR remains strong, driven by patent exclusivity and formulation differentiation.

- Price stability is expected until patent expiry in 2027, after which generics will substantially reduce prices.

- Patent protections and innovative formulations are crucial to sustain premium pricing and market share in the near term.

- Emerging markets and new indications represent growth opportunities, provided regulatory hurdles are navigated.

- Strategic planning for post-patent scenarios is essential to mitigate revenue decline and explore alternative revenue streams.

FAQs

1. When does the patent protection for SM Esomeprazole Magnesium DR expire?

Patent expiry is projected for 2027, after which generic formulations are expected to enter the market and impact pricing and sales.

2. How does the pricing of SM Esomeprazole Magnesium DR compare to generics?

It commands approximately 30-50% higher prices than generic versions in current markets due to formulation benefits and proprietary status.

3. What factors could influence the decline in prices post-patent expiry?

The entry of multiple generic manufacturers, regulatory pressure, and market competition are primary drivers of price erosion.

4. Are there any key emerging markets for SM Esomeprazole Magnesium DR?

Yes, regions such as Asia-Pacific and Latin America show significant growth potential due to expanding healthcare access and increasing GERD prevalence.

5. What strategic steps should manufacturers take in anticipation of patent expiry?

Investing in new indications, formulations, or combination therapies, building brand loyalty, and expanding into emerging markets are critical strategies.

References

[1] Global Data. Proton Pump Inhibitors Market Review, 2022.

[2] FDA, European Medicines Agency. Approved Indications and Patent Status for Esomeprazole.

[3] World Gastroenterology Organisation. Global Epidemiology of GERD.

[4] IMS Health Reports. Impact of Patent Expiry on Esomeprazole Market.

[5] Price benchmarks in the U.S. and European Markets, 2023.

[6] Market Research Future. Post-Patent Pharmaceutical Market Dynamics, 2022.

[7] Analyst Reports. Long-term Revenue Forecasts for Proton Pump Inhibitors.

More… ↓