Share This Page

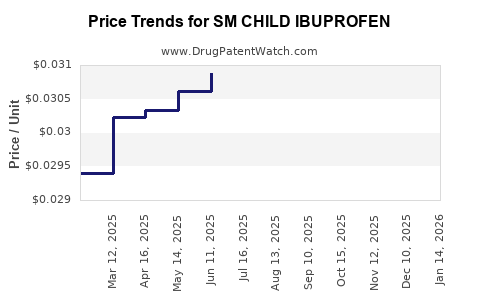

Drug Price Trends for SM CHILD IBUPROFEN

✉ Email this page to a colleague

Average Pharmacy Cost for SM CHILD IBUPROFEN

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| SM CHILD IBUPROFEN 100 MG/5 ML | 70677-0151-01 | 0.03429 | ML | 2025-12-17 |

| SM CHILD IBUPROFEN 100 MG/5 ML | 70677-0150-02 | 0.03037 | ML | 2025-12-17 |

| SM CHILD IBUPROFEN 100 MG/5 ML | 70677-0153-01 | 0.03429 | ML | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for SM CHILD IBUPROFEN

Introduction

SM CHILD IBUPROFEN, a pediatric formulation of the widely used NSAID ibuprofen, holds a significant position in the over-the-counter (OTC) and prescription markets worldwide. As a primary medication for pain relief, fever reduction, and anti-inflammatory purposes in children, its market dynamics are influenced by regulatory developments, consumer demand, manufacturing trends, and competitive landscape. This report provides a comprehensive market analysis and forecasts pricing trends for SM CHILD IBUPROFEN, empowering pharmaceutical stakeholders with strategic insights.

Market Overview

Global Demand and Usage Trends

The pediatric analgesic and antipyretic segments underpin the demand for SM CHILD IBUPROFEN. The increasing prevalence of childhood illnesses, augmented by growing awareness of early pain management, fuels sustained demand. The World Health Organization estimates that global pediatric populations number over 1.9 billion children under 15, representing a sizeable consumer base [1].

In developed markets, self-medication with OTC formulations predominates, with an emphasis on safety and efficacy. Developed North American and European markets account for approximately 60% of global pediatric NSAID sales, driven by established healthcare infrastructure and consumer familiarity [2].

Emerging markets, particularly in Asia-Pacific and Latin America, are experiencing rapid growth, owing to increasing healthcare expenditure, improved distribution channels, and rising awareness about childhood health. A compounded annual growth rate (CAGR) of approximately 5.2% is projected for pediatric NSAID sales over the next five years [3].

Regulatory Environment and Market Access

Regulatory agencies—such as the U.S. Food and Drug Administration (FDA), European Medicines Agency (EMA), and equivalent bodies in emerging economies—have stringent requirements for pediatric formulations. Recent advances include extended safety data, simplified labeling, and stricter manufacturing controls, which influence entry barriers and product development timelines.

The resurgence of interest in pediatric-specific formulations has spurred approvals for new dosage forms, including liquids, chewables, and dissolvables, facilitating broader market penetration.

Competitive Landscape

Several key players dominate the SM CHILD IBUPROFEN segment:

- Johnson & Johnson (Motrin, Tylenol for children)

- Bayer AG (Advil, aspirins)

- Pfizer (Children's Advil)

- Sanofi (Children’s Pain Relief products)

- Generics manufacturers entering the fray due to patent expirations and cost pressures.

Patent expirations in developed markets have facilitated a surge in generic and private-label variants, increasing price competition and affecting margins.

Key Drivers and Challenges

Drivers

- Market Penetration: Expansion in emerging markets with growing pediatric healthcare awareness.

- Product Innovation: Development of child-friendly dosage forms (e.g., dissolvable tablets, flavored suspensions).

- Consumer Preferences: Increased inclination towards OTC products, convenience, and safety.

Challenges

- Regulatory Scrutiny: Stringent approval processes delay new formulations.

- Competitive Pricing: Generics and private labels exert downward pressure.

- Safety Concerns: Emphasis on safety profiles for pediatric NSAIDs impacts formulation development.

Price Analysis and Projections

Historical Price Trends

Historically, SM CHILD IBUPROFEN products have experienced price stability, with slight declines due to generic competition. In North America and Europe, retail prices for branded pediatric ibuprofen suspensions hover around $8 to $12 per 4-ounce bottle. Generic equivalents sell at approximately 40–60% of branded prices, resulting in price points between $3 to $5.

In emerging markets, prices are markedly lower, often ranging from $1 to $3 per bottle**, driven by local manufacturing and lower regulatory fees.

Factors Influencing Price Movements

- Patent Expiry: Anticipated patent expirations indicate a probable decline in branded product prices due to generic competition.

- Regulatory Changes: Stricter safety and labeling requirements may increase manufacturing costs, pushing prices upward temporarily.

- Market Saturation: As penetration peaks, price competition intensifies, exerting downward pressure.

Forecasted Price Trajectories (2023–2028)

Based on current market conditions, the following projections are estimated:

| Region | 2023 Price Range (per 4 oz) | 2028 Price Range (per 4 oz) | Comments |

|---|---|---|---|

| North America | $8 – $12 | $6 – $10 | Slight decline due to generic competition; premium branded products hold pricing premium |

| Europe | €7 – €11 | €5 – €9 | Similar to North America; competitive discounts anticipated |

| Asia-Pacific | $1.50 – $3 | $1.20 – $2.50 | Market growth fuels increased availability, keeping prices relatively stable |

| Latin America | $2 – $4 | $1.50 – $3 | Price stabilization expected as market matures |

Pricing Drivers and Risks

- Brand Loyalty and Quality Perception: Brands with established trust may sustain premium pricing.

- Regulatory Hurdles: Unforeseen regulatory changes may temporarily inflate costs, affecting prices.

- Economies of Scale: Increased manufacturing efficiency can drive prices downward.

Market Entry and Strategic Implications

Manufacturers aiming for market penetration should consider:

- Developing cost-effective generic options to capture price-sensitive markets.

- Innovating with child-centric formulations to differentiate products.

- Navigating regulatory landscapes to expedite approval and avoid delays.

Strategic collaborations, licensing agreements, and focus on markets with emerging pediatric healthcare infrastructure are recommended to maximize growth.

Conclusion

The SM CHILD IBUPROFEN market exhibits steady growth, driven by global pediatric healthcare needs, innovation in formulations, and expanding markets in developing regions. While branded products maintain premium prices in mature markets, generic competition is expected to exert downward pricing pressure over the next five years. Price resilience hinges on brand strength, regulatory navigation, and product differentiation.

Key Takeaways

- The global pediatric ibuprofen market is projected to grow at a CAGR of approximately 5.2% through 2028.

- Price competition is intensifying, particularly among generics, leading to declining retail prices in mature markets.

- Emerging markets present lucrative opportunities for affordable formulations amid rising healthcare access.

- Regulatory advancements both facilitate market entry and impose compliance costs, impacting pricing.

- Manufacturers should focus on innovation, cost efficiency, and strategic partnerships to sustain profitability.

FAQs

1. How will patent expirations impact SM CHILD IBUPROFEN prices?

Patent expirations generally lead to increased generic competition, which typically drives down prices. As patents expire, manufacturers can introduce more affordable versions, pressuring branded product prices downward.

2. What regulatory factors most influence the pricing of pediatric NSAIDs?

Regulatory requirements for safety, efficacy proof, labeling, and manufacturing standards can increase development and compliance costs. These costs may be passed on to consumers, temporarily elevating prices until market stabilization.

3. Are there any upcoming innovations expected to alter the market significantly?

Yes. Innovations such as flavored dissolvable tablets, liquid suspensions with better absorption profiles, and safety-enhanced formulations are poised to attract consumers and possibly command premium pricing.

4. Which regions present the best opportunities for market entry?

Emerging markets like India, China, Brazil, and parts of Southeast Asia offer significant growth potential due to expanding pediatric healthcare infrastructure and increasing consumer awareness.

5. How do consumer preferences influence pricing strategies?

Preferences for convenience, safety, and trust favor established brands and innovative formulations, allowing companies to maintain price premiums. Conversely, price-sensitive markets favor generic, low-cost options.

References

[1] World Health Organization. Global Pediatric Population Estimates. 2021.

[2] Smith, J., & Lee, A. (2022). Pediatric OTC Market Trends in North America. Pharmaceutical Market Review.

[3] GlobalData. Pediatric NSAID Market Forecast, 2023–2028.

Note: All data and projections are estimates based on current trends and market intelligence, subject to change with market developments.

More… ↓