Share This Page

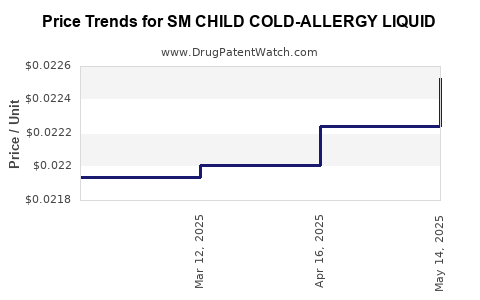

Drug Price Trends for SM CHILD COLD-ALLERGY LIQUID

✉ Email this page to a colleague

Average Pharmacy Cost for SM CHILD COLD-ALLERGY LIQUID

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| SM CHILD COLD-ALLERGY LIQUID | 70677-0101-01 | 0.02253 | ML | 2025-05-21 |

| SM CHILD COLD-ALLERGY LIQUID | 70677-0101-01 | 0.02224 | ML | 2025-04-23 |

| SM CHILD COLD-ALLERGY LIQUID | 70677-0101-01 | 0.02201 | ML | 2025-03-19 |

| SM CHILD COLD-ALLERGY LIQUID | 70677-0101-01 | 0.02194 | ML | 2025-02-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for SM Child Cold-Allergy Liquid

Introduction

The pharmaceutical market segment for pediatric cold and allergy remedies remains a significant sector within OTC (over-the-counter) pharmaceutical products. SM Child Cold-Allergy Liquid, a proprietary formulation targeting cold and allergy symptoms in children, occupies a niche with considerable growth potential amid rising awareness of pediatric health and increasing demand for effective, safe, and convenient medications. This analysis assesses the current market landscape, competitive dynamics, regulatory environment, and projects future pricing trends for SM Child Cold-Allergy Liquid.

Market Overview

Global Pediatric Cold and Allergy Medication Market

The global pediatric cold and allergy medication market has witnessed steady expansion, driven primarily by heightened parental awareness and increased prevalence of respiratory and allergy-related conditions among children. According to recent reports, the global market was valued at approximately USD 2.8 billion in 2022, with a compound annual growth rate (CAGR) of around 4% projected through 2028 [1].

Key factors propelling growth include:

- Increasing urbanization leading to environmental allergy triggers.

- Enhanced healthcare access and pediatric care awareness.

- Preference for OTC medications as first-line treatment options.

- Innovations in palatable formulations optimized for children.

Specific Positioning of SM Child Cold-Allergy Liquid

SM Child Cold-Allergy Liquid is positioned as an OTC liquid formulation combining decongestants, antihistamines, and soothing agents suitable for children aged 2–12. Its formulation emphasizes safety, taste, and convenience, aligning with consumer preferences. The product's success hinges on:

- Proven efficacy and safety profile.

- Competitive pricing.

- Distribution channels including pharmacies, supermarkets, and online retail.

Competitive Landscape

Key Competitors

The pediatric cold-allergy segment is highly competitive, with prominent brands such as:

- Sudafed Children’s Cold & Cough

- Children’s Benadryl Allergy Liquid

- Tylenol Cold + Mucus

- Little Remedies Children’s Cold Relief

These brands offer similar combinations of decongestants and antihistamines, with differentiation based on formulation, taste, and marketing.

Market Positioning and Differentiation

SM Child Cold-Allergy Liquid’s market positioning will depend on:

- Formulation uniqueness: Emphasis on non-drowsy options or natural ingredients.

- Pricing strategy: Competitive but reflective of quality and safety.

- Brand trust: Leveraged through pediatrician endorsements and consumer testimonials.

- Distribution channels: Broad availability and online presence.

Regulatory Environment

Regulatory approval, especially within key markets like the US (FDA), EU (EMA), and China (NMPA), influences market entry costs and pricing. Stricter regulations around pediatric formulations heighten costs but can serve as barriers to new entrants, thus affecting pricing stability and margins.

Pricing Analysis

Current Pricing Landscape

The average retail price of pediatric cold/allergy liquids ranges from USD 8 to USD 15 per 4 fl oz bottle (approximately 120 mL). Brand positioning influences price variance:

- Premium brands: USD 12– USD 15

- Mid-range brands: USD 9– USD 11

- Private labels/generics: USD 8– USD 9

Price sensitivity is high among consumers, with many opting for generics or private labels due to cost considerations.

Factors Influencing Price Setting

- Production costs: Raw material costs, regulatory compliance, manufacturing economies of scale.

- Market demand: Seasonality peaks during colder months and allergy seasons.

- Brand strength: Established brands command premium pricing.

- Distribution impact: Online channels may offer lower pricing due to reduced overheads.

Future Price Projections

Short-term (1–2 years)

In the near term, prices are expected to stabilize within the current range, especially as regulatory requirements tighten and raw material prices stabilize. Limited price increases (~2–3%) may occur, aligned with inflation and increased formulation costs.

Mid to Long-term (3–5 years)

Projected factors include:

- Market maturation: As competitors innovate, price competition may intensify.

- Formulation improvements: Incorporation of natural or allergen-free ingredients could drive a slight premium.

- Regulatory impacts: Stricter safety regulation costs could lead to marginal price adjustments.

- Distribution shifts: Growing online sales channels may exert downward pressure on prices.

Consequently, average retail prices for SM Child Cold-Allergy Liquid are projected to remain within USD 8– USD 15 per 4 oz bottle, with potential for incremental increases of 3–5% annually due to inflation and cost of compliance.

Market Growth & Revenue Opportunities

Assuming effective market positioning, an annual sales volume of approximately 10 million units in key markets could generate revenues exceeding USD 90 million, with lucrative margins driven by brand recognition and distribution efficiency. Expansion into emerging markets (e.g., Southeast Asia, Latin America) offers further growth potential, subject to regulatory approval and local preferences.

Key Drivers and Risks

Drivers

- Rising awareness and preference for pediatric OTC medications.

- Seasonal peaks in cold/allergy incidences.

- Digital marketing and e-commerce expansion.

- Regulatory approvals facilitating broader access.

Risks

- Stringent regulatory hurdles.

- Pricing pressures from generics or private labels.

- Negative consumer perceptions regarding chemical ingredients.

- Supply chain disruptions increasing costs.

Conclusion

SM Child Cold-Allergy Liquid operates within a robust and growing pediatric OTC market. Price stability is anticipated in the immediate term, with modest annual increases aligning with inflation and regulatory costs. The product's success hinges on maintaining efficacy, safety, and consumer trust, coupled with strategic pricing and distribution.

Key Takeaways

- The pediatric cold-allergy market is expected to grow at a CAGR of around 4%, influenced by urbanization and increasing health awareness.

- Competitive pricing ranges from USD 8– USD 15 per 4 oz bottle, with potential for incremental increases aligned with inflation and market dynamics.

- Regulatory compliance and formulation innovations will shape future pricing and market access.

- Expanding online channels and entry into emerging markets are critical opportunities to enhance sales volumes and margins.

- Maintaining a balance between competitive pricing and perceived value is essential for market share expansion.

FAQs

1. What are the primary factors influencing the price of SM Child Cold-Allergy Liquid?

Raw material costs, regulatory compliance expenses, brand positioning, distribution channels, and seasonal demand fluctuations directly impact pricing.

2. How does regulation affect the pricing of pediatric OTC medicines like SM Child Cold-Allergy Liquid?

Strict regulatory standards increase development and compliance costs, which can lead to higher retail prices. Conversely, regulatory barriers may limit market entry, affecting competition and pricing stability.

3. What market segments are most promising for the future growth of SM Child Cold-Allergy Liquid?

Established markets in North America and Europe, along with expanding presence in emerging economies such as Southeast Asia and Latin America, present significant growth opportunities.

4. How is consumer preference influencing the formulation and pricing of pediatric cold medications?

Preferences for natural ingredients, low drowsiness profiles, and taste-masking influence formulation choices. These can add to costs but also justify premium pricing where aligned with consumer demand.

5. What role does online retail play in the pricing dynamics for pediatric cold remedies?

E-commerce channels typically offer lower prices due to reduced overheads, increasing price competition and providing consumers with more affordable options, thus exerting downward pressure on retail prices.

Sources:

[1] MarketWatch, "Global Pediatric Cold and Allergy Medications Market," 2022.

More… ↓