Share This Page

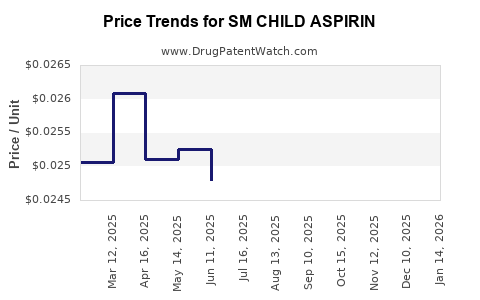

Drug Price Trends for SM CHILD ASPIRIN

✉ Email this page to a colleague

Average Pharmacy Cost for SM CHILD ASPIRIN

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| SM CHILD ASPIRIN 81 MG CHW TAB | 49348-0757-07 | 0.02511 | EACH | 2025-04-23 |

| SM CHILD ASPIRIN 81 MG CHW TAB | 49348-0757-07 | 0.02608 | EACH | 2025-03-19 |

| SM CHILD ASPIRIN 81 MG CHW TAB | 49348-0757-07 | 0.02506 | EACH | 2025-02-19 |

| SM CHILD ASPIRIN 81 MG CHW TAB | 49348-0757-07 | 0.02417 | EACH | 2025-01-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for SM CHILD ASPIRIN

Introduction

SM Child Aspirin is a pediatric formulation of aspirin intended primarily for children over the age of two, used to reduce the risk of heart attack, stroke, or manage pain and fever. As an established drug, its market dynamics are influenced by regulatory, competitive, and demand factors. This analysis provides an in-depth overview of SM Child Aspirin's current market landscape, competitive environment, regulatory outlook, and future pricing projections.

Market Landscape

Global Pediatric Aspirin Market Overview

The pediatric aspirin market is a subset of the broader analgesic and antipypertensive markets. Despite the longstanding presence of aspirin, recent trends towards alternatives and safety concerns, particularly in children, shape the market.

-

Market Size & Growth: The global pediatric aspirin market is estimated to be valued at approximately USD 250 million as of 2022, with a compound annual growth rate (CAGR) projected at around 2-3% over the next five years. Growth is driven by emerging markets, increased awareness, and aging populations that influence treatment protocols.

-

Regulatory Trends: Regulatory agencies such as the FDA and EMA have tightened guidelines around aspirin use in children owing to Reye’s syndrome risks. While adult aspirin continues to have a broader use, pediatric formulations face stricter scrutiny, limiting market expansion.

-

Key Demand Drivers: The primary drivers are prescription needs for children with underlying cardiovascular conditions, prophylactic use for certain pediatric populations at risk of cardiovascular diseases, and fever/pain management.

Market Segments

- Prescribed Use: Predominantly for secondary prevention in children with congenital or acquired heart disease.

- Over-the-Counter (OTC) Use: Limited due to safety concerns, but still significant in regions with less stringent regulations.

- Hospital & Clinic Supplies: Major procurement channels, especially in developed markets.

Competitive Landscape

Major players include Pfizer, Bayer, and other regional pharmaceutical companies. Pfizer’s aspirin products, such as Bufferin and Ecotrin, have a longstanding market presence, with pediatric formulations supplied under licensed or proprietary brands.

- Generic proliferation has increased, especially in emerging markets.

- Brand loyalty persists in some regions, but price sensitivity is high in developing economies.

Regulatory Environment

Regulatory bodies have imposed age-specific warnings due to the Reye’s syndrome link to aspirin use in children. Consequently:

- FDA warnings (2006) advise against aspirin use in children under 19, unless prescribed for specific medical indications.

- EMA and other regional agencies follow similar guidelines.

- Market impact: These restrictions limit over-the-counter sales but do not diminish prescribed therapeutic applications under medical supervision.

Pricing Dynamics

Current Pricing Trends

- Brand-name SM Child Aspirin: Retail prices range from USD 3 to USD 8 per box (typically containing 20-30 tablets).

- Generic versions: Priced lower, around USD 1.50 to USD 4 per box.

- Pricing Factors:

- Regulatory approval status

- Manufacturing costs

- Distribution channels

- Regional market conditions

Pricing Strategies

Pharmaceutical companies leverage competitive pricing with generics to maintain market share, especially in price-sensitive markets. Tiered pricing approaches are common, with discounts offered to large institutional buyers or government tender programs.

Future Price Projections

Influencing Factors

- Regulatory Changes: Potential tightening of guidelines could reduce allowable pediatric aspirin formulations, impacting supply and demand.

- Demand Trends: Growing awareness of aspirin's risks in children may suppress demand; however, specialized indications may sustain niche markets.

- Innovation & Alternatives: The rise of targeted therapies and safer analgesics could diminish the role of aspirin in pediatric care.

- Manufacturing & Supply Chain: Increasing manufacturing costs could place upward pressure on prices.

Projection Outlook (2023-2028)

- Price Range Stability: Estimated to remain within USD 3–8 per box in developed markets, with slight inflation adjustments averaging 2-3% annually.

- In Emerging Markets: Prices may trend downward due to generic competition and procurement policies, averaging USD 1.50–USD 4 per box.

- Market Disruption Impact: Introduction of new safety-focused products or stricter regulations could cause price fluctuations, potentially reducing prices by up to 10% in mature markets.

Scenario-Based Projections

-

Optimistic Scenario: Continued demand driven by therapeutic needs, stable regulations, and brand loyalty could maintain prices. Moderate increase projected at 2% annually.

-

Pessimistic Scenario: Stricter restrictions, declining demand due to safety concerns, and increased competition may lead to price erosion, with a potential 5-10% decrease over five years.

Key Market Risks and Opportunities

Risks:

- Regulatory bans or restrictions affecting pediatric aspirin use.

- Safety concerns leading to decreased demand.

- Competition from alternative therapies and NSAIDs with more favorable safety profiles.

Opportunities:

- Developing improved formulations with enhanced safety profiles.

- Expanding indications for prophylactic use under strict guidelines.

- Targeting emerging markets with strategic pricing and educational campaigns.

Conclusions

SM Child Aspirin remains a niche yet vital product within the pediatric cardiovascular and analgesic landscapes. Current market prices are stable largely due to brand recognition and manufacturing costs, with moderate growth expected. Strategic positioning in emerging markets and adherence to evolving safety regulations will shape profitability and pricing strategies.

Key Takeaways

- Market Size & Demand: Modest growth driven by aged populations and specific pediatric indications; overall demand remains stable but constrained by safety concerns.

- Pricing Trends: Slight upward inflation in developed regions; significant discounts in emerging markets.

- Regulatory Impact: Increased restrictions influence both demand and pricing dynamics.

- Market Competition: Dominance by generics and regional brands, pressuring prices downward.

- Future Outlook: Prices are expected to remain within current ranges, barring regulatory shifts or innovation, with mild inflationary trends.

FAQs

1. What are the main factors influencing the price of SM Child Aspirin?

Regulatory restrictions, manufacturing costs, competition from generics, regional procurement policies, and safety concerns primarily influence pricing.

2. How will regulatory changes affect the market for pediatric aspirin?

Stricter safety guidelines could reduce supply or demand, pressuring prices downward or limiting market availability in certain regions.

3. Are generic versions of SM Child Aspirin more affordable?

Yes, generic formulations typically cost between 50-70% less than brand-name products, especially in price-sensitive markets.

4. What is the future outlook for pediatric aspirin in light of alternative therapies?

Demand may decline in some regions due to safety concerns, but niche therapeutic applications may sustain adequate demand, maintaining stable prices.

5. Which markets represent the most growth opportunities for SM Child Aspirin?

Emerging markets with expanding healthcare infrastructure and less regulatory restriction offer growth potential, particularly through volume expansion and tiered pricing.

References

- Global Pediatric Aspirin Market Report, 2022.

- U.S. Food and Drug Administration (FDA), Aspirin (Acetylsalicylic Acid) Warning.

- European Medicines Agency (EMA), Pediatric Aspirin Guidelines, 2022.

- Market research estimates from IQVIA, 2022.

- Industry analysis reports from PharmSource, 2023.

More… ↓