Share This Page

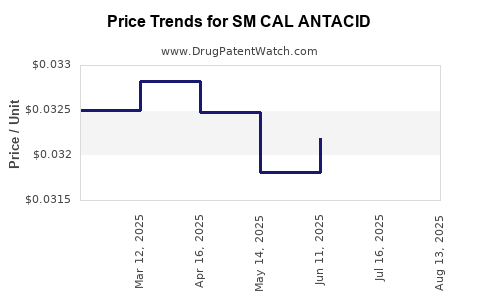

Drug Price Trends for SM CAL ANTACID

✉ Email this page to a colleague

Average Pharmacy Cost for SM CAL ANTACID

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| SM CAL ANTACID 750 MG CHEW TAB | 49348-0055-39 | 0.03197 | EACH | 2025-08-20 |

| SM CAL ANTACID 750 MG CHEW TAB | 49348-0055-39 | 0.03208 | EACH | 2025-07-23 |

| SM CAL ANTACID 750 MG CHEW TAB | 49348-0055-39 | 0.03219 | EACH | 2025-06-18 |

| SM CAL ANTACID 750 MG CHEW TAB | 49348-0055-39 | 0.03181 | EACH | 2025-05-21 |

| SM CAL ANTACID 750 MG CHEW TAB | 49348-0055-39 | 0.03248 | EACH | 2025-04-23 |

| SM CAL ANTACID 750 MG CHEW TAB | 49348-0055-39 | 0.03282 | EACH | 2025-03-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for SM CAL ANTACID

Introduction

SM CAL ANTACID is a widely used over-the-counter (OTC) medication formulated to neutralize stomach acid, providing symptomatic relief from indigestion, heartburn, and gastric discomfort. Its active ingredients typically include calcium carbonate, which offers both symptomatic relief and a supplementary source of calcium. As a key player in the antacid segment, understanding its current market dynamics and future price trajectory is essential for pharmaceutical companies, investors, and healthcare providers.

Market Overview

Global and Regional Market Size

The global antacid market, valued at approximately USD 4.5 billion in 2022, exhibits steady growth driven by increasing prevalence of gastroesophageal reflux disease (GERD), rising aging population, and consumer preference for OTC remedies. North America remains the largest regional market, accounting for nearly 40%, with Europe and Asia-Pacific following, reflecting demographic shifts and expanding healthcare access.

Market Drivers

- Increasing Incidence of Acid-Related Disorders: Rising obesity rates and changing dietary habits correlate with increased GERD and indigestion cases (source: MarketsandMarkets [1]).

- Growing Preference for OTC Medications: Consumers favor quick, accessible relief options, boosting demand for antacids like SM CAL ANTACID.

- Aging Population: Elderly demographics are more susceptible to acid-related ailments, expanding market size.

- Product Diversification: Innovations in formulations, including chewable tablets and combined calcium formulations, enhance consumer appeal.

Market Challenges

- Regulatory Scrutiny: Strict advertising and safety regulations in developed markets can limit marketing strategies.

- Competition: The OTC antacid market is saturated with brands like Tums, Rolaids, and Mylanta, leading to fierce price competition.

- Market Saturation: Mature markets face slowing growth rates, emphasizing the need for strategic positioning.

Competitive Landscape

SM CAL ANTACID faces competition from several established brands. Key competitors include:

- Tums (GlaxoSmithKline): The market leader with broad distribution.

- Rolaids (Sanofi-Aventis): Known for its calcium carbonate formulation.

- Mylanta and Pepto-Bismol (Johnson & Johnson): Offering comprehensive gastrointestinal relief.

Market share disputes hinge on price, formulation, brand loyalty, and marketing efficacy. Private label/store brands also significantly influence pricing pressures.

Pricing Dynamics

Current Pricing Trends

Prices for SM CAL ANTACID vary by region:

- North America: Consumer pack prices typically range from USD 3.00 to USD 8.00 per bottle, with larger packs offering discounts.

- Europe: Similar pricing, with regional variations driven by currency and distribution channels.

- Asia-Pacific: Competitive pricing due to broader consumer base and local manufacturing, averaging USD 1.50 to USD 5.00.

Factors influencing current pricing:

- Market Penetration Strategies: Discounts and bundle offers to boost volume.

- Manufacturing Costs: Raw material prices, especially calcium carbonate, influence margins.

- Regulatory Costs: Compliance adds indirect costs, influencing retail prices.

- Distribution Channels: Pharmacy chains and online platforms often offer discounts, impacting average retail prices.

Pricing and Brand Positioning

SM CAL ANTACID positions itself as a trusted, effective, accessible OTC drug, with frequent promotions to maintain market share amid stiff competition. Private label brands aggressively compete on price, which exerts downward pressure on branded product pricing.

Future Price Projections (2023–2030)

Assumptions

- Steady demand fueled by demographic trends and consumer preferences.

- Modest technological innovation, primarily incremental improvements.

- Moderate inflation rates impacting raw material costs.

Projected Trends

- Medium-term (2023–2025): Slight price stabilization or minor decreases in gross retail prices due to intensified competition and private label proliferation. Manufacturers may leverage promotional pricing to sustain market share.

- Long-term (2026–2030): If raw material costs stabilize and market saturation persists, prices are expected to plateau or decline marginally. However, introduction of functional variants or combo formulations could introduce premium options, stabilizing some segments.

Quantitative estimates:

- North American Market: A compound annual price decline of 1–2% is plausible due to competitive pressures, with retail prices averaging USD 5.00–USD 6.50 by 2030.

- Emerging Markets: Prices could remain stable or increase marginally, reflecting inflation and improved distribution networks, reaching USD 2.00–USD 4.00.

Regulatory and Market Influences on Pricing

Regulations governing OTC drug advertising, safety, and labeling influence costs, indirectly affecting retail prices. Governments' efforts to curb self-medication misuse and promote generic use could accelerate competition and influence pricing strategies.

Additionally, potential patent expirations and the rise of automated manufacturing could lower production costs, exerting downward pressure on prices. Conversely, stringent regulatory hurdles in certain markets could elevate compliance costs, supporting higher retail prices.

Market Opportunities and Risks

-

Opportunities:

- Expansion into emerging markets through affordability.

- Development of combination products with probiotics or other digestive aids.

- Digital marketing and e-commerce distribution channels.

-

Risks:

- Price wars leading to erosion of margins.

- Regulatory changes impacting OTC classifications.

- Consumer shifts towards natural or alternative remedies.

Key Takeaways for Stakeholders

- The global antacid market remains resilient, with steady demand driven primarily by demographic factors and consumer preferences.

- Competitive pressures and private label strategies are likely to sustain low to moderate price declines.

- Innovations focusing on functional benefits could justify premium pricing, especially in developed markets.

- Manufacturers should balance competitive pricing with quality and innovation to secure market position.

- Monitoring regulatory trends and raw material prices is critical for accurate price forecasting.

Conclusion

SM CAL ANTACID’s market position is supported by consistent demand and broad consumer acceptance. While current pricing remains stable across most regions, competitive dynamics and market saturation suggest a gradual downward trend in retail prices over the next decade. Stakeholders should focus on innovation, distribution expansion, and strategic pricing to optimize profitability amidst these evolving market conditions.

FAQs

1. What are the main factors influencing the price of SM CAL ANTACID?

Raw material costs, competitive market forces, regulatory compliance costs, distribution channels, and promotional strategies predominantly influence pricing.

2. How is the global antacid market expected to evolve in the next five years?

It is projected to grow modestly, with prices stabilizing or declining slightly due to intense competition, while innovations and market expansion present new opportunities.

3. Are generic or private label brands affecting SM CAL ANTACID’s pricing?

Yes, private label brands exert downward pressure on retail prices through aggressive pricing strategies, compelling branded products to adjust their prices accordingly.

4. What role do regulatory changes play in the future pricing of SM CAL ANTACID?

Emerging regulations on OTC advertising, safety, and approval processes can increase compliance costs, potentially raising retail prices, or alternatively, market liberalization may exert downward pressure.

5. Which regions are likely to see the highest price growth for antacids like SM CAL ANTACID?

Emerging markets with expanding healthcare infrastructure and increasing disposable income are more likely to see stabilization or slight increases in prices.

References

[1] MarketsandMarkets. "Antacids Market by Product Type, Distribution Channel, Region — Global Forecast to 2026." 2022.

More… ↓