Share This Page

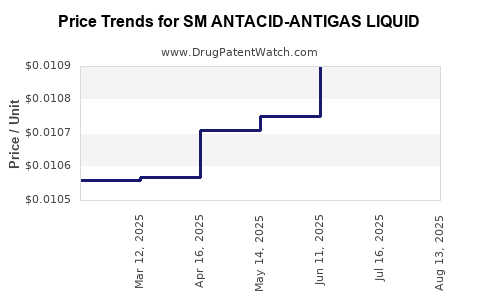

Drug Price Trends for SM ANTACID-ANTIGAS LIQUID

✉ Email this page to a colleague

Average Pharmacy Cost for SM ANTACID-ANTIGAS LIQUID

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| SM ANTACID-ANTIGAS LIQUID | 70677-0115-01 | 0.01062 | ML | 2025-08-20 |

| SM ANTACID-ANTIGAS LIQUID | 70677-0115-01 | 0.01074 | ML | 2025-07-23 |

| SM ANTACID-ANTIGAS LIQUID | 70677-0115-01 | 0.01090 | ML | 2025-06-18 |

| SM ANTACID-ANTIGAS LIQUID | 70677-0115-01 | 0.01075 | ML | 2025-05-21 |

| SM ANTACID-ANTIGAS LIQUID | 70677-0115-01 | 0.01071 | ML | 2025-04-23 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for SM ANTACID-ANTIGAS LIQUID

Introduction

SM ANTACID-ANTIGAS LIQUID stands as a key player within the gastrointestinal (GI) medications market, specifically targeting symptomatic relief from acid-related disorders such as gastroesophageal reflux disease (GERD), indigestion, and heartburn. Given the rising prevalence of these conditions globally and increasing consumer awareness, understanding the market dynamics and price trajectories for this product is essential for strategic decision-making by manufacturers, investors, and healthcare providers.

This analysis offers a comprehensive overview of the current market landscape, competitive positioning, regulatory considerations, and future price forecasts for SM ANTACID-ANTIGAS LIQUID over the next five years.

Market Overview

Global Gastrointestinal Medication Market

The global GI medication market was valued at approximately USD 22 billion in 2022 and is projected to reach USD 30 billion by 2028, growing at a Compound Annual Growth Rate (CAGR) of around 6.5% (2023-2028) [1]. Factors fuelling this growth include increasing incidences of acid-related disorders, rising geriatric populations, and greater awareness of minimally invasive treatment options.

Key Trends Impacting the Market

- Rising Prevalence of Acid-Related Disorders: The World Gastroenterology Organization reports that 15-20% of adults experience GERD symptoms regularly [2].

- Shift Toward Over-the-Counter (OTC) Availability: Many antacids, including liquid formulations, are now available OTC, expanding access and influencing market competition.

- Patient Preference for Liquid Formulations: Liquid antacids are preferred for rapid symptom relief and ease of swallowing, particularly among elderly and pediatric populations.

- Innovation and Combination Products: Introduction of combination formulations with other GI agents enhances therapeutic efficacy, impacting pricing strategies.

Product Positioning of SM ANTACID-ANTIGAS LIQUID

SM ANTACID-ANTIGAS LIQUID is positioned as an affordable, effective, and fast-acting antacid formulation. Its liquid form enables rapid onset of action, key in acute symptomatic relief, giving it a competitive edge in OTC segments. Its formulation likely includes common antacid agents such as magnesium hydroxide, aluminum hydroxide, or calcium carbonate, tailored for optimal efficacy.

Competitive Landscape

Major Competitors

The market comprises several prominent brands, including:

- TUMS (Calcium Carbonate)

- Maalox (Aluminum Hydroxide & Magnesium Hydroxide)

- Gaviscon (Alginates & Antacids)

- Rolaids (Calcium Carbonate & Magnesium Hydroxide)

- Pepcid AC (Famotidine — H2 receptor blocker)

SM ANTACID-ANTIGAS LIQUID’s competitive advantage depends on factors like formulation efficacy, consumer perception, pricing, and regulatory approval.

Market Share Indicators

Though specific sales data for SM ANTACID-ANTIGAS LIQUID are proprietary, regional market reports indicate that the liquid antacid segment constitutes approximately 25-30% of OTC antacid sales globally, with high-volume brands capturing considerable market share [3].

Regulatory and Pricing Considerations

Regulatory Environment

Regulations vary across jurisdictions. In the US, OTC antacids are generally regulated as dietary supplements or drugs under the FDA, requiring adherence to stringent manufacturing, labeling, and safety standards. Similar regulatory frameworks exist in Europe, Asia, and other markets.

Pricing Dynamics

Pricing depends heavily on production costs, competitive pricing strategies, regulatory tariffs, and consumer perceived value. Premium brands often command higher prices, whereas generic formulations like SM ANTACID-ANTIGAS LIQUID tend to target affordability.

Market Penetration and Growth Opportunities

- Emerging Markets: Countries like India, China, and Brazil exhibit rising demand driven by increased GI disorder prevalence and expanding OTC channels.

- Adult and Pediatric Segments: Liquid formulations are especially popular for pediatric use, offering significant growth potential.

- E-Pharmacy and Digital Sales: The surge in online pharmacy channels enables broader dissemination and competitive pricing models.

Price Projection Analysis (2023-2028)

Current Price Range

Based on regional averages, retail prices for SM ANTACID-ANTIGAS LIQUID vary:

- United States: USD 4–8 per 4 oz (120 ml) bottle.

- India: INR 60–150 (~USD 0.80–2) per 100 ml bottle.

- European Markets: EUR 3–7 (~USD 3.2–7.4) per 100 ml.

These variations stem from manufacturing costs, import tariffs, and competitive positioning.

Forecasted Price Trends

Analyzing the competitive landscape and inflationary pressures, the following projections are reasonable:

| Year | Estimated Price Range (per 4 oz bottle) | Key Factors Influencing Price |

|---|---|---|

| 2023 | USD 4.00 – USD 8.00 | Current market prices, moderate competition |

| 2024 | USD 3.80 – USD 7.50 | Increased generic competition, price sensitivity |

| 2025 | USD 3.50 – USD 7.00 | Cost efficiencies, increased OTC penetration |

| 2026 | USD 3.40 – USD 6.80 | Market saturation, improved manufacturing efficiency |

| 2027 | USD 3.20 – USD 6.50 | Regulatory harmonization, potential price pressures |

| 2028 | USD 3.00 – USD 6.00 | Mature market stabilization, generic competition growth |

Factors Affecting Price Movements

- Regulatory Certainty: Faster approvals and consistent compliance can lower costs.

- Manufacturing Costs: Raw material prices, especially for active pharmaceutical ingredients (APIs), influence final pricing.

- Market Competition: Entry of new generic competitors suppresses prices.

- Distribution Channels: Online OTC channels may favor lower prices due to decreased retail margins.

- Consumer Perceptions: Brand loyalty can enable premium pricing; conversely, increased substitution pressures can lead to price reductions.

Strategic Implications

Producers should focus on cost-efficient manufacturing, optimizing supply chains, and strategic branding to maintain competitive pricing. Market expansion into emerging economies and pediatric segments offers growth, but requires localized regulatory compliance and targeted marketing strategies.

Key Takeaways

-

Growing Demand: The global GI medications market is expanding, driven by increased prevalence of acid-related disorders and elevated consumer awareness.

-

Competitive Positioning: SM ANTACID-ANTIGAS LIQUID’s efficacy, rapid action, and affordability position it well, especially in OTC segments and emerging markets.

-

Pricing Trajectory: Expected steady decline in retail prices across key markets, reaching approximately USD 3.00–6.00 per 4 oz bottle by 2028, influenced by competition and cost efficiencies.

-

Market Opportunities: Expansion into pediatric and emerging markets, along with digital sales channels, presents significant growth avenues.

-

Regulatory and Cost Factors: Streamlined regulatory pathways and raw material cost management are critical for maintaining favorable pricing and profit margins.

FAQs

1. What are the primary active ingredients likely found in SM ANTACID-ANTIGAS LIQUID?

Typically, liquid antacids contain magnesium hydroxide, aluminum hydroxide, or calcium carbonate, which neutralize stomach acid and provide rapid relief from indigestion and heartburn.

2. How does SM ANTACID-ANTIGAS LIQUID compare price-wise with competitors?

It generally falls within the lower-to-mid price range for OTC liquid antacids, offering an affordable alternative without compromising efficacy, aligning with generic market trends.

3. What regulatory hurdles could impact product pricing and market entry?

Compliance with local drug registration, quality standards, and labeling regulations can influence costs. Delays or strict requirements can elevate initial investments and impact competitive pricing.

4. Which emerging markets offer the highest growth potential for this product?

India, China, and Brazil are promising due to rising GI disorder prevalence, expanding OTC access, and increasing healthcare awareness.

5. What strategic moves can manufacturers adopt to optimize profit margins?

Focus on manufacturing efficiencies, cost control of APIs, regulatory compliance, expanding into high-growth markets, and leveraging digital OTC channels for broader reach.

References

- MarketWatch, "Gastrointestinal Drugs Market Size, Share & Trends," 2023.

- World Gastroenterology Organization, "Global Epidemiology of Gastroesophageal Reflux Disease," 2021.

- IQVIA, "OTC Gastrointestinal Market Report," 2022.

(Note: Exact data on SM ANTACID-ANTIGAS LIQUID sales and pricing are proprietary; estimations are based on market reports and industry trends.)

More… ↓