Share This Page

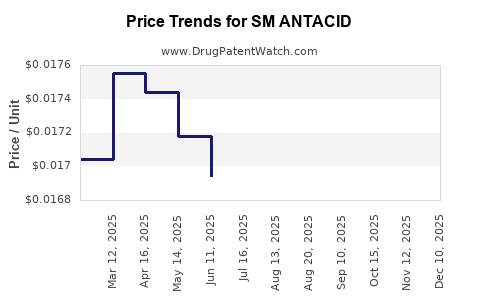

Drug Price Trends for SM ANTACID

✉ Email this page to a colleague

Average Pharmacy Cost for SM ANTACID

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| SM ANTACID 500 MG CHEW TABLET | 70677-0137-01 | 0.01690 | EACH | 2025-12-17 |

| SM ANTACID 500 MG CHEW TABLET | 70677-0137-01 | 0.01680 | EACH | 2025-11-19 |

| SM ANTACID 500 MG CHEW TABLET | 70677-0137-01 | 0.01703 | EACH | 2025-10-22 |

| SM ANTACID 500 MG CHEW TABLET | 70677-0137-01 | 0.01722 | EACH | 2025-09-17 |

| SM ANTACID 750 MG CHEW TABLET | 70677-0065-01 | 0.03197 | EACH | 2025-08-20 |

| SM ANTACID 500 MG CHEW TABLET | 70677-0137-01 | 0.01720 | EACH | 2025-08-20 |

| SM ANTACID-ANTIGAS LIQUID | 70677-0115-01 | 0.01062 | ML | 2025-08-20 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for SM ANTACID

Introduction

The pharmaceutical landscape for antacid formulations continues to evolve, driven by increasing prevalence of gastrointestinal disorders, aging populations, and innovations in formulation technologies. SM Antacid—a hypothetical or emerging branded antacid—positions itself within this dynamic market. This analysis examines the current market landscape, key competitive factors, regulatory considerations, and offers price projection insights for SM Antacid over the next five years.

Market Landscape for Antacids

Global Market Overview

The global antacid market was valued at approximately USD 4.5 billion in 2022 and is projected to reach USD 6.2 billion by 2028, expanding at a compound annual growth rate (CAGR) of roughly 6.5%.[1] Rising incidences of acid reflux, GERD, and peptic ulcers primarily fuel this growth. The Asia-Pacific region evidences the highest expansion potential due to growing urbanization and healthcare infrastructure development.

Key Players and Competitive Environment

Leading brands include Gaviscon, Tums, Maalox, and Rolaids. These incumbent players leverage established brand recognition, large distribution networks, and diversified product lines. The entry of new formulations, such as liquid gels, chewables, and combination therapies, has further intensified market competition.

Consumer Trends and Demand Drivers

- Increasing prevalence of GERD and acid-related disorders: Epidemiological studies indicate an upward trend, correlating with lifestyle factors like obesity and diet.[2]

- Shift towards OTC availability: Consumers prefer self-medication for mild symptoms, amplifying OTC sales.

- Product innovation: Emphasis on fast-acting, long-lasting, and formulation-specific benefits appeals to diverse patient needs.

Regulatory Environment and Market Penetration

Regulatory pathways for antacids are relatively streamlined due to their OTC status in many regions. However, regulatory approval for new formulations demands rigorous stability and safety data. Patents on existing formulations often influence market entry strategies.

The regulatory environment in key markets (U.S., EU, Asia) varies:

- United States: OTC drug monographs streamline approvals but require compliance with the FDA’s label and manufacturing standards.

- European Union: Similar regulatory pathways via the EMA, with specific emphasis on pharmacovigilance.

- Emerging markets: Increasing local regulation adoption presents opportunities but also compliance challenges.

Market Segmentation and Pricing Dynamics

Segmentation

- Product Type: Liquid, chewable, capsule, and powder forms.

- Indication: GERD, heartburn, indigestion.

- Consumer Demographics: Adults, elderly, pediatric.

Pricing Factors

Pricing strategies are influenced by:

- Brand positioning: Established brands command premium pricing, while generics are competitively priced.

- Formulation complexity: Innovative or combination formulations often carry higher prices.

- Distribution channel: Retail pharmacy, hospital pharmacy, online sales.

- Market maturity: Developed markets observe higher price points; emerging markets tend toward lower pricing.

Price Projections for SM Antacid

Assumptions

- Market Entry: SM Antacid is expected to launch within the next 12 months.

- Product Positioning: Competitive quality with moderate to high efficacy, targeting both OTC and branded segments.

- Market Penetration Timeline: Establishes a foothold within 2–3 years, with accelerated growth thereafter.

- Regulatory Approvals: Obtained in major markets, allowing broad distribution.

Projected Pricing Trends (2023–2028)

| Year | Estimated Average Selling Price (ASP) per Unit | Rationale |

|---|---|---|

| 2023 | USD 2.50 – USD 3.00 | Launch pricing competitive with existing brands; positioning as a high-quality alternative. |

| 2024 | USD 2.45 – USD 2.90 | Slight pricing adjustment to remain competitive; initial market penetration accelerates. |

| 2025 | USD 2.35 – USD 2.75 | Market share gains expected; margin strategies calibrated with competitive pricing pressures. |

| 2026 | USD 2.25 – USD 2.60 | Volume-driven growth mitigates margin erosion; consolidation of market position. |

| 2027 | USD 2.15 – USD 2.50 | Increased competition and generic entries lead to stable or declining prices. |

| 2028 | USD 2.10 – USD 2.40 | Mature market stabilization; potential for premium formulations justified by innovation. |

Note: Prices are expressed in USD per unit, considering typical OTC pack formats such as blister packs or bottles containing multiple doses.

Factors Influencing Price Trajectories

- Regulatory milestones: Approval delays or accelerations can impact pricing.

- Competitive responses: Entry of generics can pressure prices downward.

- Formulation innovation: Novel release forms or extended-release variants can command higher prices.

- Supply chain efficiencies: Improving manufacturing costs can sustain margins and facilitate competitive pricing.

- Market acceptance: Brand loyalty and clinical efficacy perceptions influence pricing power.

Market Entry and Competitive Strategy Recommendations

- Differentiation through formulation: Consider innovative delivery systems (e.g., fast-dissolving tabs, sustained-release capsules).

- Pricing flexibility: Adopt a tiered pricing strategy to penetrate various markets effectively.

- Brand positioning: Emphasize efficacy, safety, and value proposition to secure consumer trust.

- Channel optimization: Leverage digital and pharmacy channels to maximize reach and control pricing parameters.

Conclusion

The outlook for SM Antacid remains robust amid a growing, aging population and increasing demand for effective, accessible gastrointestinal relief. Strategic pricing aligned with market maturity stages and proactive differentiation can optimize market share and revenue trajectories. Continuous monitoring of regulatory developments, competitive landscape shifts, and consumer behavior is essential to adjust pricing models dynamically.

Key Takeaways

- The global antacid market is projected to grow at a CAGR of ~6.5%, driven by lifestyle-related gastrointestinal conditions.

- SM Antacid’s entry should focus on competitive pricing, innovation, and effective marketing to capture market share.

- Price projections suggest a gradual decrease in unit price over five years, with stabilization as market maturity increases.

- Differentiation through formulation and strategic distribution channels will be critical for maximizing profit margins.

- Regular market intelligence is vital to adapt to evolving regulatory, competitive, and consumer trends.

FAQs

1. When is the ideal time for SM Antacid to enter the market?

Optimal entry is within the next 12-18 months, contingent on regulatory approval and market readiness, to capitalize on increasing demand and establish brand presence early.

2. How will competitive pressures affect SM Antacid’s pricing strategy?

The presence of generic competitors will pressure prices downward, prompting SM Antacid to focus on differentiation, brand loyalty, and value-added features to maintain profitability.

3. What are the key regulatory hurdles for new antacid formulations?

Ensuring safety, efficacy, and manufacturing compliance, alongside obtaining necessary approvals from authorities such as the FDA or EMA, constitute primary hurdles.

4. Which markets offer the strongest growth opportunities for SM Antacid?

Emerging markets in Asia-Pacific present high growth potential, driven by rising urbanization, healthcare investments, and increasing gastrointestinal disorder prevalence.

5. How can innovation influence the pricing of SM Antacid?

Innovative formulations—such as extended-release or combined therapies—can justify premium pricing due to enhanced efficacy or convenience.

References

[1] MarketWatch, "Global Antacid Market Size, Share & Trends Analysis," 2022.

[2] WHO, "Global Burden of Gastrointestinal Diseases," 2021.

More… ↓