Last updated: July 27, 2025

Introduction

Sirolimus, also known as Rapamycin, is a potent mTOR (mammalian target of rapamycin) inhibitor initially discovered as a natural product from Streptomyces hygroscopicus. Approved for solid organ transplant rejection prophylaxis and certain rare disease indications, its expanding therapeutic profile includes oncology, tuberous sclerosis complex (TSC), and cardiovascular applications. This analysis provides an in-depth review of the current market landscape, competitive environment, and future price projections, guiding strategic decision-making for stakeholders.

Market Overview

Current Indications and Usage

Sirolimus primarily functions as an immunosuppressive agent in transplant medicine, alongside everolimus and other mTOR inhibitors. Approved by the FDA in the late 1990s, its initial indication was renal transplant rejection prophylaxis. Over time, regulatory approvals extended its use to steroid-resistant pulmonary LAM (lymphangioleiomyomatosis) and some oncologic settings, such as advanced renal cell carcinoma, pending on clinical trial outcomes.

Market Size and Growth Dynamics

The global sirolimus market was valued at approximately USD 250 million in 2022. Its growth trajectory, compounded annually at around 5-7% (2023-2028), stems from:

- Expanding transplant patient populations in emerging markets.

- Growing adoption in oncology and rare disease treatments, fueled by increased research and approvals.

- Investment in combination therapies enhancing efficacy, thereby driving demand.

In particular, the niche yet expanding indications in tuberous sclerosis and neuro-oncology contribute significantly to growth, along with the approval and launch of generic versions in key markets.

Geographical Breakdown

- North America: Dominates market share (~50%) due to high transplant rates and robust healthcare infrastructure.

- Europe: Accounts for approximately 30%, with increasing adoption in transplant centers.

- Asia-Pacific: Exhibits fastest growth (CAGR 8-10%), driven by increasing healthcare expenditure, improved diagnostics, and increased transplant procedures.

Competitive Landscape

Key Players

- Apollo Pharma and Sandoz (generic manufacturers)

- Pfizer (original patent holder, now off-patent)

- Novartis (for some analogs and combination therapies)

- Emerging biotech companies focusing on novel formulations and dosing strategies

Patent and Regulatory Status

Major patents on sirolimus formulations expired between 2013-2018, facilitating the entry of generic competitors. However, branded formulations maintain market share through proprietary delivery systems and clinical reputation. Regulatory delays, pricing, and reimbursement policies influence market penetrance.

Innovative Developments

- Nanoformulations: Enhancing bioavailability and reducing side effects.

- Oral and IV formulations: Improving patient compliance.

- Combination regimens: Coupling with other immunosuppressants or chemotherapeutics to maximize efficacy.

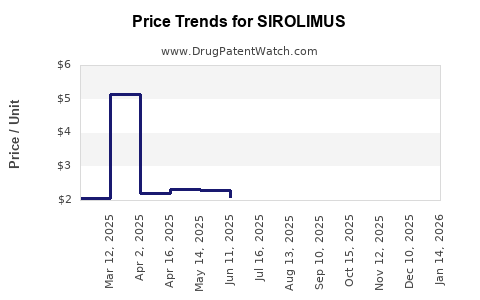

Price Dynamics and Projections

Current Pricing Landscape

The average wholesale price (AWP) of branded sirolimus (e.g., Rapamune) in the US is approximately USD 3,500–4,000 per month for typical maintenance doses. Generic options offer a significant price reduction, often in the USD 1,200–1,500 range monthly.

Factors Influencing Price Trends

- Patent expirations: Will continue to pressure prices downward.

- Market competition: Increased generic entry and biosimilars reduce costs.

- Manufacturing costs: Economies of scale and improved synthesis reduce production expenditures.

- Reimbursement policies: Payer negotiations and formulary restrictions influence net prices.

- New formulations and indications: May command premium pricing if they demonstrate superior bioavailability or efficacy.

Future Price Projections (2023–2028)

- Short-term (1–2 years): A decline of approximately 20% in branded prices due to generic competition, with prices stabilizing around USD 2,500 per month.

- Mid-term (3–5 years): Further reductions of 10–15% anticipated, driven by biosimilar entry and market saturation.

- Long-term (5+ years): Prices could plateau near USD 1,500–2,000 per month, particularly for generic formulations. Premium formulations addressing unmet needs could sustain higher prices in niche segments.

Market Penetration of Generics and Biosimilars

In key markets, generics are expected to capture >80% of the market share within the next five years, exerting downward pressure on prices. Nonetheless, branded versions will persist in certain markets, particularly where clinical familiarity and regulatory exclusivity prolong their relevance.

Strategic Considerations for Stakeholders

- Pharmaceutical Companies: Emphasize innovative delivery systems and expanded indications to sustain premium pricing.

- Investors: Focus on companies developing next-generation formulations or expanding geographic reach.

- Healthcare Providers: Balance cost considerations with clinical efficacy when choosing between branded and generic options.

- Payers: Leverage competitive pricing from generics and biosimilars to improve access and control costs.

Key Takeaways

- The sirolimus market is poised for gradual price declines driven by patent expirations and generic competition.

- Growth is sustained by expanding indications, especially in oncology and rare diseases.

- Strategic investments in formulation innovation and new indications could offset pricing pressures.

- Prioritizing access to generics will be key for cost containment, especially in emerging markets.

- Monitoring regulatory developments and patent statuses remains critical for market forecasting.

FAQs

1. How will patent expirations impact sirolimus pricing?

Patent expirations have already facilitated the entry of generics, leading to significant price reductions. Continued expiry of related formulations will further lower costs, increasing market competitiveness.

2. What are the primary factors driving demand for sirolimus?

Demand hinges on transplant-related immunosuppression, growing applications in cancer therapy, and treatment options for rare diseases like tuberous sclerosis. The expanding patient pool and clinical research are key drivers.

3. How do generic versions of sirolimus compare in efficacy and safety?

Generic sirolimus products approved via bioequivalence studies demonstrate comparable efficacy and safety profiles to branded formulations, per FDA and EMA standards.

4. Are there emerging therapies that could replace sirolimus?

While alternatives exist, such as everolimus and other mTOR inhibitors, sirolimus remains central due to its established efficacy. Novel agents targeting different pathways could influence future competition.

5. What is the outlook for high-cost formulations or combination therapies?

Premium formulations and combination regimens could command higher prices if they enhance efficacy or reduce side effects. These strategies can help maintain margins amid generic competition.

Sources

[1] MarketWatch. "Global Sirolimus Market Size, Share & Trends Analysis Report." 2022.

[2] EvaluatePharma. "2023 Global Oncology Drug Market Forecast."

[3] U.S. Food and Drug Administration: FDA Drug Approvals and Patent Data.

[4] IQVIA. "Global Biopharmaceutical Market Dynamics." 2022.

[5] ClinicalTrials.gov. "Current Clinical Trials Involving Sirolimus."

Conclusion

Sirolimus remains a pivotal immunosuppressant with expanding indications influencing its market dynamics. While patent expirations introduce downward price pressures, ongoing innovation and emerging markets offer opportunities for value-added strategies. Stakeholders must continuously monitor regulatory, competitive, and scientific developments to optimize investment and clinical outcomes in this evolving landscape.