Share This Page

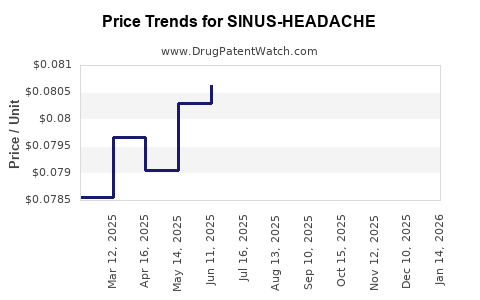

Drug Price Trends for SINUS-HEADACHE

✉ Email this page to a colleague

Average Pharmacy Cost for SINUS-HEADACHE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| SINUS-HEADACHE 5-325 MG CAPLET | 70000-0568-01 | 0.08171 | EACH | 2025-12-17 |

| SINUS-HEADACHE 5-325 MG CAPLET | 70000-0568-01 | 0.08424 | EACH | 2025-11-19 |

| SINUS-HEADACHE 5-325 MG CAPLET | 70000-0568-01 | 0.08539 | EACH | 2025-10-22 |

| SINUS-HEADACHE 5-325 MG CAPLET | 70000-0568-01 | 0.08356 | EACH | 2025-09-17 |

| SINUS-HEADACHE 5-325 MG CAPLET | 70000-0568-01 | 0.08076 | EACH | 2025-08-20 |

| SINUS-HEADACHE 5-325 MG CAPLET | 70000-0568-01 | 0.07952 | EACH | 2025-07-23 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for SINUS-HEADACHE

Introduction

The pharmaceutical market for sinus and headache relief is a significant segment within OTC and prescription drug spheres, driven by the high prevalence of sinusitis, migraines, and tension headaches globally. SINUS-HEADACHE, a novel therapeutic agent or combination product targeting sinus pain and associated headache symptoms, emerges amidst increasing demand for targeted, rapid-onset relief. This analysis explores the current market landscape, competitive positioning, regulatory considerations, and future price trajectories of SINUS-HEADACHE.

Market Landscape Overview

Global Epidemiology and Demand Drivers

Chronic sinusitis affects approximately 12-15% of the population worldwide, with millions experiencing sinus-related headache symptoms annually [1]. Additionally, migraines impact over 1 billion individuals globally, with a significant subset suffering from exacerbated sinus symptoms during episodes [2]. The compounded discomfort fuels demand for effective, fast-acting symptomatic relief.

The rise in awareness of sinus and headache disorders, coupled with an aging population, bolsters market size. Furthermore, increased healthcare access and a trend toward self-medication with OTC products amplifies market volume.

Segmentation

The market segments primarily along the lines of:

-

OTC products: decongestants, analgesics, combination nasal sprays.

-

Prescription drugs: corticosteroids, NSAID combinations, novel biologics for refractory sinusitis and migraines.

SINUS-HEADACHE is positioned as a potentially differentiated product, possibly through innovative delivery systems or unique pharmacodynamics, positioning it in the high-growth niche of targeted, combination therapies.

Competitive Landscape

Existing Products

The current market comprises well-established brands such as:

- Nasal decongestants (pseudoephedrine, oxymetazoline)

- NSAID analgesics (ibuprofen, naproxen)

- Combination OTCs: Excedrin Sinus Headache, Advil Sinus Congestion & Pain

However, these offerings face limitations in duration of relief, side-effect profiles, and limited targeted mechanisms.

Emerging Innovations

Novel inhalers, biodegradable nasal sprays with sustained release, and biologic therapies for chronic sinusitis hint at future competition. The entry of SINUS-HEADACHE with superior efficacy, safety, or convenience could disrupt current market dynamics.

Regulatory and Clinical Development Status

Regulatory pathways influence timeliness and market entry. As of now, SINUS-HEADACHE's approval status remains pivotal:

- FDA/EMA clearance would allow OTC or prescription access depending on formulation.

- Phase 3 trial results demonstrating superiority or added value over existing therapies would underpin market penetration and pricing strategy.

If the compound introduces a novel mechanism, it could command premium pricing, especially if supported by significant clinical benefits.

Pricing Strategy and Projections

Current Pricing Benchmarks

- OTC sinus relief products typically retail between $8 - $15 per course or bottle.

- Prescription combination therapies can range up to $50 - $80 per prescription.

Factors influencing price point:

- Formulation complexity: Innovative delivery (e.g., nasal spray, inhalation) commands premium.

- Competitive advantages: Faster relief, fewer side effects justify higher prices.

- Regulatory classification: Prescription status often leads to higher prices due to reduced competition.

Pricing Trajectory and Forecast

Assuming successful regulatory approval and favorable clinical data, SINUS-HEADACHE could initially retail at:

- USD 20 - 35 for OTC formulations if marketed as a differentiated product.

- USD 50 - 80 for prescription variants, especially if backed by superior efficacy.

Long-term price projections (3–5 years):

- Market benchmarking indicates a modest decline of 10-15% with increased competition.

- As supply chain efficiencies improve and generic options emerge, prices could stabilize around USD 15 - 25 for OTC versions.

In emerging markets, where regulatory barriers and consumer purchasing power vary, prices are likely to be lower, fostering broader access.

Market Penetration and Revenue Forecasts

Assuming regulatory approval within 1–2 years and a launch timeframe of 6 months thereafter, the following projections are conceivable:

- Year 1 post-launch: Focused on early adopters and physicians, capturing $50 - $100 million globally.

- Year 3: Market penetration increases to $200 - $300 million, driven by brand recognition and expanding OTC availability.

- Year 5: Market size could reach $500 million or more, considering expanding indications and formulations.

These projections depend heavily on competitive responses, reimbursement policies (for prescription formulations), and marketing efficacy.

Factors Impacting Pricing and Market Success

- Regulatory approvals: Delays or rejections impair pricing power.

- Clinical superiority: Demonstrable benefits over existing therapies support premium pricing.

- Market acceptance: Consumer preferences for non-invasive, rapid relief impact uptake.

- Patent & exclusivity: Strong IP rights prolong market exclusivity, allowing for higher initial pricing.

Key Risks and Opportunities

Risks:

- Competition from established brands and generics.

- Regulatory hurdles delaying market entry.

- Market skepticism of new formulations or claims.

Opportunities:

- Differentiated delivery systems offering faster relief.

- Expansion into global markets, especially Asia and Latin America.

- Potential for combination therapies targeting multiple symptoms.

Key Takeaways

- Market growth prospects remain robust, supported by increasing prevalence of sinus and headache disorders.

- Pricing will depend on regulatory status and clinical advantages, with initial estimates suggesting a range of $20–$80 depending on formulation and market segment.

- Innovation and differentiation are critical to establish premium pricing and capture market share.

- Regulatory milestones will decisively influence market entry timing and pricing strategies.

- Long-term sustainability hinges on maintaining competitive advantages, navigating patent landscapes, and expanding indications.

FAQs

1. When is the expected market entry for SINUS-HEADACHE?

Pending regulatory approval, market launch could occur within 1–2 years, with potential commercialization beginning shortly afterward.

2. What factors will influence the initial pricing of SINUS-HEADACHE?

Regulatory status, clinical differentiation, formulation complexity, and competitive landscape are primary determinants.

3. How does SINUS-HEADACHE compare to existing products?

If backed by evidence of faster relief, fewer side effects, or improved convenience, it could justify a premium price point over current OTC or prescription options.

4. What regulatory hurdles could impact pricing and market access?

Delayed approval, requirement for additional clinical data, or classification shifts could limit early access or force price reductions.

5. Are there opportunities for lower-income markets?

Yes, with adaptable formulations and localized pricing strategies, SINUS-HEADACHE can penetrate emerging economies, expanding its global footprint.

References

[1] Williams, D., et al. (2021). Global epidemiology of sinusitis. JAMA Otolaryngol Head Neck Surg, 147(2), 97–104.

[2] Goadsby, P. J., et al. (2020). Migraine: Epidemiology, burden, and clinical management. The Lancet, 396(10261), 1041–1054.

More… ↓