Share This Page

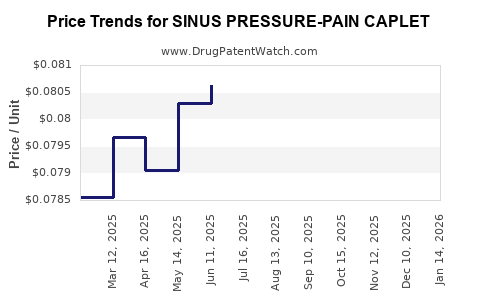

Drug Price Trends for SINUS PRESSURE-PAIN CAPLET

✉ Email this page to a colleague

Average Pharmacy Cost for SINUS PRESSURE-PAIN CAPLET

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| SINUS PRESSURE-PAIN CAPLET | 70000-0161-01 | 0.08171 | EACH | 2025-12-17 |

| SINUS PRESSURE-PAIN CAPLET | 70000-0161-01 | 0.08424 | EACH | 2025-11-19 |

| SINUS PRESSURE-PAIN CAPLET | 70000-0161-01 | 0.08539 | EACH | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

rket Analysis and Price Projections for SINUS PRESSURE-PAIN CAPLET

Introduction

The pharmaceutical market for over-the-counter (OTC) sinus relief products, including sinus pressure-pain caplets, continues to demonstrate growth driven by increasing prevalence of sinusitis and related respiratory conditions. SINUS PRESSURE-PAIN CAPLET, a formulation aimed at alleviating sinus congestion and associated pain, occupies a significant segment within OTC respiratory remedies. This analysis evaluates current market dynamics, competitive landscape, regulatory considerations, and projects future pricing trajectories.

Market Overview

The global OTC sinus relief segment is projected to reach approximately USD 4 billion by 2025, with a compound annual growth rate (CAGR) of around 4-5% since 2020 [1]. The increasing incidence of sinusitis—estimated at up to 30 million Americans annually—fuels demand for effective, fast-acting solutions. Consumers seek OTC remedies that combine efficacy, safety, and convenience, positioning sinus pressure-pain caplets as essential components of respiratory health products.

Within this segment, medications containing active ingredients like acetaminophen, phenylephrine, and pseudoephedrine dominate, providing analgesic and decongestant effects. The market is characterized by intense competition among established brands such as Advil Sinus Congestion & Pain, Tylenol Sinus, and store brands, all vying for shelf space and consumer loyalty.

Regulatory Environment

OTC drugs like SINUS PRESSURE-PAIN CAPLET are regulated by agencies such as the U.S. Food and Drug Administration (FDA). Approval processes focus on safety, efficacy, labeling, and manufacturing standards. Recent regulatory shifts emphasize manufacturing transparency, ingredient safety, and real-world evidence for OTC formulations [2].

The current regulatory environment favors innovative formulations that can demonstrate superior efficacy or reduced side effects — critical factors influencing market entry and pricing strategies.

Competitive Landscape

Key players include multinational pharmaceutical firms and major OTC brands. Their strategies incorporate aggressive marketing, bundling with other respiratory products, and leveraging digital channels for consumer engagement. Differentiation often hinges on:

- Speed of relief

- Duration of efficacy

- Minimal side effects

- Formulation innovations (e.g., natural ingredients, extended-release)

Market entry for new sinus caplets requires robust clinical data and marketing investments, often translating into higher initial prices but potential for premium positioning.

Pricing Strategy Analysis

Current Pricing Dynamics

The retail price of OTC sinus pressure-pain caplets ranges broadly from USD 5 to USD 15 per package (generally containing 12-24 caplets). Factors influencing pricing include:

- Brand recognition

- Formulation complexity

- Packaging and dosage

- Consumer perception of efficacy

Branded products tend to command higher prices, often 20-30% above generics or store brands.

Factors Influencing Future Price Trends

After the patent expiry of many formulations, generic drug makers have driven prices downward through increased competition. However, premium formulations with added ingredients or sustained-release technology could sustain higher price points.

Emerging trends impacting pricing include:

- Formulation innovation: Natural or organic ingredients may command premium pricing.

- Regulatory shifts: Clearer label standards allowing for health claims could justify price premiums.

- Consumer willingness to pay: Increasing health awareness enhances willingness to pay for perceived superior efficacy.

- Supply chain factors: Raw material costs, manufacturing costs, and tariffs influence pricing trajectories.

Price Projection Outlook

Projected Market Prices (2023-2028):

- Low-end generic caplets: USD 4-6 per package

- Mid-range formulations: USD 7-10 per package

- Premium formulations: USD 11-15+ per package

Given the current market growth, an annual price increase of approximately 2-3% is anticipated, driven by inflation, regulatory costs, and formulation advancements. The trajectory suggests that innovative products with clinical differentiation could sustain higher margins, especially if embedded within brand loyalty or specialty niches.

Market Penetration and Pricing Strategies

For new entrants like SINUS PRESSURE-PAIN CAPLET, adopting a value-based pricing strategy targeting health-conscious consumers willing to pay a premium for rapid relief and natural ingredients may prove advantageous. Differentiation via clinical data, packaging appeal, and digital marketing can justify higher prices and increase market share.

Conclusion

The OTC sinus relief segment offers resilient growth prospects, with room for premium pricing for innovative formulations. Current price points reflect a balance of brand loyalty, formulation efficacy, and market competition. Future price trajectory will be shaped by formulation innovation, regulatory environment, consumer preferences, and competitive dynamics.

Key Takeaways

- The OTC sinus relief market is growing steadily, driven by sinusitis prevalence and consumer demand for effective OTC solutions.

- Pricing varies based on brand strength, formulation, and perceived efficacy, with a trend toward premium pricing for innovative products.

- Future prices are projected to increase modestly (2-3% annually), with premium formulations maintaining higher price points.

- New market entrants should focus on formulation differentiation, clinical validation, and targeted branding to command premium prices.

- Regulatory changes emphasizing safety and efficacy will influence pricing strategies and market positioning.

FAQs

1. What are the key active ingredients in sinus pressure-pain caplets?

Common actives include acetaminophen for pain relief, pseudoephedrine or phenylephrine as decongestants, and sometimes additional ingredients like guaifenesin for mucus relief.

2. How does patent expiration affect pricing in the OTC sinus relief segment?

Patent expirations increase generic competition, typically reducing prices. However, formulations with unique or innovative features can maintain higher price points despite competition.

3. What regulatory factors influence the pricing of OTC sinus medications?

FDA oversight emphasizes safety, efficacy, and transparency. Labels must meet standards, and any claims about relief must be substantiated, influencing formulation costs and retail pricing.

4. Are natural or organic sinus relief products priced higher than traditional formulations?

Yes, consumers often perceive natural or organic options as higher quality, allowing brands to command premium pricing, sometimes 20-50% above traditional formulations.

5. What emerging trends could impact the future market price of sinus relief caplets?

Innovations such as extended-release formulations, natural ingredients, and personalized medicine, along with regulatory changes, will influence pricing and product positioning.

Sources:

[1] Market Research Future, "OTC Nasal and Sinus Remedies Market Analysis," 2022.

[2] U.S. FDA, "Over-the-Counter Monograph Final Rule," 2021.

More… ↓