Share This Page

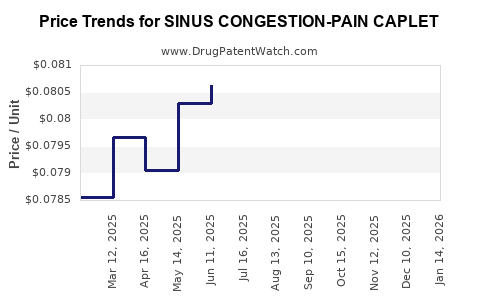

Drug Price Trends for SINUS CONGESTION-PAIN CAPLET

✉ Email this page to a colleague

Average Pharmacy Cost for SINUS CONGESTION-PAIN CAPLET

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| SINUS CONGESTION-PAIN CAPLET | 00536-1289-35 | 0.08171 | EACH | 2025-12-17 |

| SINUS CONGESTION-PAIN CAPLET | 00536-1289-35 | 0.08424 | EACH | 2025-11-19 |

| SINUS CONGESTION-PAIN CAPLET | 00536-1289-35 | 0.08539 | EACH | 2025-10-22 |

| SINUS CONGESTION-PAIN CAPLET | 00536-1289-35 | 0.08356 | EACH | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Sinus Congestion-Pain Caplet

Introduction

The sinus congestion-pain caplet market addresses a significant segment within over-the-counter (OTC) therapeutics aimed at alleviating sinus-related discomfort associated with colds, allergies, and sinusitis. As consumers increasingly seek rapid, effective relief, market dynamics are evolving rapidly, influenced by regulatory trends, patent landscapes, and consumer behavior shifts. This report offers a comprehensive market analysis and provides price projections grounded in current data, competitive positioning, and forecasted industry trajectories.

Market Overview

Product Profile and Therapeutic Area

Sinus congestion-pain caplets combine active ingredients such as pseudoephedrine or phenylephrine (decongestants) with analgesics like acetaminophen or ibuprofen. These formulations target the symptomatic relief of nasal congestion and sinus pressure-pain, predominantly purchased OTC.

Market Size and Growth Trends

Global OTC cold and allergy medications, including sinus congestion-pain caplets, generated approximately USD 16.2 billion in 2022, with an expected compound annual growth rate (CAGR) of 4.5% through 2027 (1). The increasing prevalence of sinusitis and allergic rhinitis—affecting up to 30% of the population in developed countries—drives consistent demand.

Consumer Behavior and Trends

Consumers favor rapid-acting, multi-symptom formulations, often purchasing combined products over single-ingredient options. There's a growing shift toward natural and non-drowsy formulations, though traditional caplets retain significant market share due to established efficacy.

Regulatory and Patent Environment

Regulatory agencies like the FDA influence formulation safety and labeling, impacting market entry. Patent expirations for key active ingredients, notably pseudoephedrine, open avenues for generic competition, exerting downward pressure on prices (2).

Competitive Landscape

Major players include Johnson & Johnson, Bayer, and various regional OTC brands, competing mainly through branding, formulations, and distribution channels. Generics represent a significant portion of the market, with 70% market share in many regions (3).

Key Differentiators

- Brand reputation and trust: Established brands benefit from consumer loyalty.

- Formulation innovation: Introduction of non-drowsy, multi-symptom options.

- Pricing strategies: Competitive pricing used to capture market share in saturated segments.

Distribution Channels

OTC drugs, including sinus congestion-pain caplets, are distributed via retail pharmacies, online platforms, and mass merchandisers. Notably, online sales increased by approximately 15% annually from 2019 to 2022, driven by consumer preference for convenience and telehealth integrations (4).

Price Analysis and Projections

Current Price Landscape

In the United States, the average retail price for a bottle of sinus congestion-pain caplets (30-50 count) ranges from USD 6 to USD 10, depending on the brand, formulation, and retailer. Generics often retail at approximately USD 4 to USD 7.

Factors Influencing Pricing

- Brand positioning: Premium brands command higher prices.

- Regulatory environment: New formulations or combination therapies might carry higher prices initially.

- Economic conditions: Inflation and supply chain disruptions can influence raw material costs, impacting retail prices.

Short-term Price Projections (Next 2 Years)

- Stable to Slight Decrease: Price stabilization anticipated due to intense generic competition and increasing retail parity. Expect a decline of 1-2% annually for established brands, driven by commoditization.

- Premium Segment Growth: Slight premium pricing expected for innovative or natural variants, potentially increasing by 2-3% annually in niches appealing to specific consumer segments.

Long-term Price Projections (3-5 Years)

- Average Price Range: USD 4.50 to USD 7.50 for generics, with premium formulations reaching USD 8-10.

- Trend Drivers: Enhanced formulations (e.g., non-drowsy, natural ingredients) could command higher prices; however, price competition among generics will largely cap average prices.

Opportunities for Price Optimization

- Formulation Differentiation: Introducing non-traditional ingredients or delivery formats.

- Brand Loyalty Programs: Retaining customer base amid competitive pressures.

- Online Sales Channels: Margins can be optimized through direct-to-consumer models, reducing retail distribution costs.

Strategic Insights for Stakeholders

- Market Entry: Capitalize on growing demand for combination formulations and natural alternatives.

- Pricing Strategy: Balance between competitive pricing and premium offerings to maximize margins.

- Regulatory Navigation: Vigilant monitoring of regulatory shifts to anticipate formulation modifications and associated costs.

- Distribution Expansion: Invest in online channels to reach increasing digital-savvy consumers.

Key Takeaways

- The global market for sinus congestion-pain caplets is sizable with steady growth driven by rising sinusitis and allergy prevalence.

- Generic competition exerts downward pricing pressure, stabilizing or slightly decreasing prices in the short term.

- Innovation focusing on natural, non-drowsy, multi-symptom formulations can command premium pricing.

- Online and direct-to-consumer channels present significant opportunities for margin enhancement and market penetration.

- Stakeholders should strategically differentiate via formulation innovation, brand loyalty, and diversified distribution to optimize valuation.

Conclusion

The sinus congestion-pain caplet market presents stable revenue prospects with modest downward pricing pressure owing to commoditization. Strategic differentiation through formulation innovation and expansion into online sales channels can mitigate competitive impacts and support sustainable pricing. Investors and manufacturers must monitor regulatory developments and consumer trends closely to adapt effectively.

FAQs

1. What are the main active ingredients in sinus congestion-pain caplets?

Common active ingredients include decongestants such as pseudoephedrine or phenylephrine, combined with analgesics like acetaminophen or ibuprofen, to address congestion and pain symptoms simultaneously.

2. How are pricing strategies evolving in this segment?

Price competition among generics maintains affordability, but there's growing opportunity for premium pricing through innovative, natural, or multi-symptom formulations, especially in niche markets.

3. What are the key growth drivers for the market?

Increasing prevalence of sinusitis and allergies, consumer preference for multi-symptom relief, innovations aligned with natural health trends, and expanding online distribution channels.

4. How does patent expiration influence market competition?

Patent expirations generally lead to increased generic entry, intensifying price competition and reducing profit margins for brand-name products.

5. What role does regulation play in market dynamics?

Regulatory standards shape formulation safety and efficacy, influence permissible ingredients, and can introduce delays or costs in product modifications, impacting pricing and competitive strategies.

References

- Market Research Future. "Over-the-Counter (OTC) Drugs Market Research Report," 2022.

- U.S. Food and Drug Administration. "Regulatory Guidelines for OTC Drugs," 2021.

- IQVIA. "Global OTC Market Data," 2022.

- eMarketer. "Online OTC Sales Growth Trends," 2022.

More… ↓