Share This Page

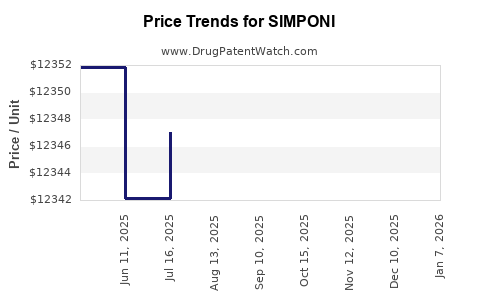

Drug Price Trends for SIMPONI

✉ Email this page to a colleague

Average Pharmacy Cost for SIMPONI

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| SIMPONI 50 MG/0.5 ML PEN INJEC | 57894-0070-02 | 12356.68364 | ML | 2025-12-17 |

| SIMPONI 50 MG/0.5 ML SYRINGE | 57894-0070-01 | 12359.28000 | ML | 2025-12-17 |

| SIMPONI 50 MG/0.5 ML SYRINGE | 57894-0070-01 | 12357.01429 | ML | 2025-11-19 |

| SIMPONI 50 MG/0.5 ML PEN INJEC | 57894-0070-02 | 12353.99048 | ML | 2025-11-19 |

| SIMPONI 50 MG/0.5 ML PEN INJEC | 57894-0070-02 | 12352.93300 | ML | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for SIMPONI (Golimumab)

Introduction

SIMPONI (Golimumab) is a biologic medication developed by Janssen Pharmaceuticals. It belongs to the anti-TNF (tumor necrosis factor-alpha) class of monoclonal antibodies, primarily indicated for autoimmune diseases such as rheumatoid arthritis (RA), psoriatic arthritis, ankylosing spondylitis, and ulcerative colitis. The drug's mechanism involves inhibiting TNF-alpha to reduce inflammation and halt disease progression. As a premium biologic, SIMPONI holds a significant position within the competitive landscape of cytokine inhibitors, influencing market dynamics and pricing strategies globally.

This market analysis delineates current trends, competitive positioning, and forecasted price trajectories for SIMPONI, considering factors like patent protection, market penetration, regulatory shifts, and emerging biosimilar developments.

Market Overview

Global Market for Biologics in Autoimmune Diseases

The global biologics market in autoimmune disorders is projected to grow at a compound annual growth rate (CAGR) of approximately 8% from 2022 to 2027 [1]. The increasing prevalence of autoimmune diseases, improved diagnostic capabilities, and expanding indications contribute substantially to this growth.

SIMPONI's Market Position

SIMPONI entered the market in 2013 and secured approvals for multiple indications, including RA, psoriatic arthritis, ankylosing spondylitis, and ulcerative colitis. Its unique dosing schedule—monthly subcutaneous injections—offers convenience, strengthening its competitive appeal [2].

In 2022, SIMPONI recorded global sales approximating $1.2 billion, with the U.S. comprising around 60-65% of revenue. The drug's market share is robust but faces stiff competition from other biologics like Humira (adalimumab), Enbrel (etanercept), and Stelara (ustekinumab) [3].

Competitive Landscape

The primary competitors include:

- Humira (adalimumab): Market leader in anti-TNF agents, with diverse indications.

- Enbrel (etanercept): Another established TNF inhibitor.

- Remicade (infliximab): Intravenous option with similar indications.

- Certolizumab pegol and Golimumab (SIMPONI): Other subcutaneous agents.

Furthermore, biosimilars for some of these drugs threaten market share as patent exclusivity diminishes, especially in Europe and the U.S. [4].

Patent and Regulatory Environment

Patent Landscape

SIMPONI’s primary patents expired or are nearing expiration in key markets, notably in Europe and the U.S., by 2027-2028. This opens avenues for biosimilar entrants, which are expected to drive price competition.

Regulatory Approvals and Restrictions

In recent years, regulatory agencies like FDA and EMA have streamlined pathways for biosimilars, facilitating market entry. The U.S. Food and Drug Administration (FDA) approved the first SIMPONI biosimilar, offering an alternative at potentially lower costs [5].

Price Analysis

Current Pricing Metrics

The average wholesale price (AWP) for SIMPONI in the U.S. stands at approximately $4,500 to $5,200 per 50 mg dose. Treatment regimens typically involve monthly doses, translating into annual costs of roughly $54,000 to $62,400 per patient, based on dosing.

In Europe, pricing varies by country, with discounts and negotiated payer prices reducing treatment costs by approximately 20-30%. In emerging markets, prices can be significantly lower, driven by local healthcare policies and lower purchasing power.

Pricing Trends (2018–2022)

- Stable pricing within the U.S. market due to brand monopoly rights.

- Introduction of biosimilar options in 2022-2023 has initiated downward pressure on prices, with discounts ranging from 15-30% for biosimilars.

- Competitive bidding and formulary decisions increasingly favor biosimilars, leading to further price erosion.

Forecasted Price Trajectory (2023–2028)

Estimates project a linear decline of approximately 15-20% in SIMPONI’s list price over the next five years, predominantly influenced by:

- Biosimilar competition: Expected to capture 30-50% of the market share in established indications.

- Market penetration of biosimilars: Initially in Europe, with gradual adoption in North America.

- Payer negotiations and formularies: Resulting in negotiated discounts over the list price, potentially reaching 20-25% reductions.

- Regulatory policies: Potential mandates or incentives for biosimilar utilization.

A conservative projection suggests the U.S. treatment cost may decline to $3,500–$4,000 per 50 mg dose by 2028.

Factors Impacting Market and Price Dynamics

Patent Expiry and Biosimilar Entry

The impending patent expirations catalyze significant price competition. Biosimilar manufacturers such as Samsung Bioepis, Coherus, and Amgen have developed and submitted biosimilar versions of golimumab. Early market entry and aggressive pricing strategies are anticipated to further reduce biologic costs.

Market Adoption and Payer Policies

Payer strategies heavily influence pricing. Strict formulary restrictions and step therapy protocols favor biosimulator adoption, driving down list prices and reimbursed amounts.

Healthcare Regulatory Policies

Increased regulatory support for biosimilars and potential legislative frameworks promoting competition are poised to shape pricing landscapes.

Clinical and Safety Profile

SIMPONI’s favorable safety and efficacy profile, along with convenient monthly dosing, supports sustained demand despite pricing pressures.

Regional Market Outlook

| Region | Expected Price Trend (2023–2028) | Market Penetration | Key Factors |

|---|---|---|---|

| North America (US) | 15-20% decline | High | Biosimilar entry, payer negotiations |

| Europe | 20-25% decline | Moderate to high | Multiple biosimilars, healthcare policies |

| Asia-Pacific | Stable to slight decline | Growing | Price controls, increasing autoimmune prevalence |

| Emerging Markets | Stable or slight decline | Low to moderate | Price sensitivity, local manufacturing |

Conclusion

SIMPONI retains a strong market position within the biologic landscape for autoimmune conditions. However, patent expiries and biosimilar competition will catalyze a downward trend in pricing over the next five years. Price reductions are mainly driven by biosimilar market entry, payer negotiations, and regulatory policies promoting cost-effective therapies.

Healthcare stakeholders should prepare for evolving market dynamics, focusing on strategic formulary management and competitive purchasing strategies. For Janssen, continued innovation and potential pipeline expansion will be crucial to sustain growth amidst impending biosimilar competition.

Key Takeaways

- The global biologics market continues exponential growth, with SIMPONI occupying a significant niche.

- Upcoming patent expirations by 2027-2028 will facilitate biosimilar market entry, pressuring prices downward.

- Current U.S. treatment costs are approximately $54,000–$62,400 annually, with projections suggesting a 15-20% reduction by 2028.

- Regulatory support and aggressive biosimilar launches in Europe and the U.S. will accelerate price declines.

- Payer strategies and formulary restrictions will be pivotal in determining access and reimbursement levels for SIMPONI.

FAQs

-

When will SIMPONI patents expire, and how will this affect pricing?

Patent protections for SIMPONI are expected to expire around 2027-2028, opening the market for biosimilar competitors and intensifying pricing pressures. -

How do biosimilars impact SIMPONI’s market share?

Biosimilars are projected to capture a significant portion of the market, especially post-patent expiry, leading to decreased prices and increased competition. -

What are the main factors influencing SIMPONI's future pricing?

Patent expiries, biosimilar market launches, payer negotiations, regulatory policies, and clinical demand dynamics are primary drivers. -

Are there any approved biosimilars for SIMPONI?

As of 2023, biosimilars for golimumab have been developed and gained approval in some regions, with market entry strategies shaping current price trends. -

What strategies should healthcare providers consider amid declining biologic prices?

Providers should prioritize formulary inclusions of biosimilars, negotiate rebates, and implement step therapy protocols to optimize costs while ensuring efficacy.

References

- MarketsandMarkets. Biologics Market by Application and Region, 2022–2027.

- Janssen Pharmaceuticals. SIMPONI Prescribing Information.

- IQVIA. Pharmaceutical Market Data, 2022.

- European Medicines Agency. Biosimilar Guidelines and Approvals.

- FDA. Approvals of Biosimilars in Autoimmune Indications, 2022.

More… ↓