Last updated: July 28, 2025

Introduction

Simethicone, a widely used over-the-counter (OTC) anti-gas medication, plays a pivotal role in gastrointestinal health. Developed initially in the mid-20th century, simethicone’s unique mechanism—aggregating foam bubbles in the gastrointestinal tract—renders it effective for relieving bloating, flatulence, and pressure caused by excess gas [1]. The product’s accessibility, minimal side effects, and consumer trust underpin its sustained demand, urging stakeholders to scrutinize its market dynamics and pricing potential.

Market Landscape

Global Market Overview

The global simethicone market was valued at approximately USD 600 million in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 5-6% through 2030 [2]. This steady expansion is driven by increasing prevalence of digestive disorders, aging populations, and rising consumer awareness of OTC remedies.

Regional Insights:

- North America: Dominates due to high healthcare expenditure, widespread OTC drug usage, and robust distribution channels. The U.S. market accounts for nearly 50% of global sales.

- Europe: A mature market with consistent demand, driven by aging demographics and regulatory support.

- Asia-Pacific: Offers significant growth potential, propelled by emerging markets such as China and India, where traditional medicine use converges with modern OTC products.

- Latin America & Middle East: Exhibit moderate growth; increased urbanization and healthcare awareness fuel this trend.

Market Drivers

- Rising Incidence of Gastrointestinal Disorders: Increasing cases of bloating, indigestion, and irritable bowel syndrome (IBS) have elevated the need for effective, low-cost solutions [3].

- Consumer Preferences for OTC Treatments: Growing preference for self-medication reduces the burden on healthcare systems.

- Product Efficacy & Safety Profile: Simethicone’s excellent safety record fosters consumer confidence.

Market Challenges

- Regulatory Variability: Differing approval and labeling standards can hinder market expansion.

- Generic Competition: Numerous low-cost generics dilute profit margins.

- Limited Innovation: Minimal patent activity limits differentiation and premium pricing.

Competitive Landscape

Global players include Johnson & Johnson, GlaxoSmithKline, and Novartis, alongside numerous regional and generic manufacturers. These entities often compete on price, distribution reach, and formulation options. The advent of new formulations—such as chewables or liquids—aims to enhance consumer convenience and adherence.

Patent Status and Innovation Outlook

While the active ingredient, simethicone, has long been off-patent, innovation in delivery systems and combination therapies may influence future market dynamics. However, regulatory pathways tend to favor established formulations, favoring competition among generics rather than novel innovations.

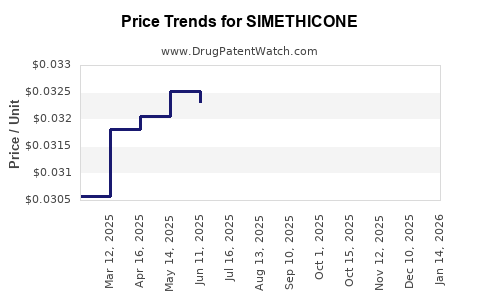

Price Trends and Projections

Historical Pricing Patterns

Historically, simethicone's price point has been low, commensurate with its OTC status and widespread generic competition. Retail prices for a standard pack (e.g., 100 tablets) typically ranged from USD 3 to USD 8, with wholesale prices considerably lower.

Current Market Pricing

- Retail (North America): USD 5–8 for a standard pack.

- Wholesale: Approximately USD 2–4 per pack.

- Generics: Price elasticity allows for aggressive discounting, maintaining competitive margins.

Future Price Projections (2023–2030)

Based on current trends, the following projections are reasonable:

- Price Stability: Due to high generic competition, retail prices are unlikely to increase significantly in mature markets, remaining within the USD 5–8 range.

- Potential Premiumization: Introduction of novel formulations or combination products could command higher prices; for example, chewable or flavored variants might see a 10–15% premium.

- Emerging Markets: Market entry and increased demand could drive prices upward by 3–5% annually, reflecting regional economic growth and regulatory dynamics.

- Pricing Pressure: Continual proliferation of generics and OTC options may exert downward pressure, particularly in price-sensitive regions.

Impact of Market Dynamics on Pricing

The low barrier to entry, high manufacturing scalability, and minimal R&D costs ensure sustained competition. Consequently, price increases will likely be constrained unless driven by external factors such as supply chain disruptions or regulatory changes.

Regulatory Environment and Its Influence

Regulations in major markets like the U.S. (FDA), EU (EMA), and China impact pricing. Strict labeling and manufacturing standards tend to elevate the cost base, but generic competition absorbs these cost hikes, maintaining affordable pricing. Regulatory approvals for new formulations could temporarily influence prices but are unlikely to generate long-term premium pricing unless linked with significant innovation.

Key Market Segments

- OTC Consumers: Predominantly individuals seeking short-term relief.

- Hospitals and Clinics: Used in cases requiring medical supervision but represent a smaller market segment.

- Pharmaceutical Companies: Engage in manufacturing, branding, or repackaging for niche markets, influencing supply and pricing strategies.

Strategic Opportunities & Risks

Opportunities:

- Product Differentiation: Developing specialized formulations (e.g., fast-acting liquids).

- Branding Strategies: Shifting consumer loyalty towards trusted brands.

- Entry into Emerging Markets: Capitalizing on demographic shifts and healthcare awareness.

Risks:

- Price Erosion: Excess competition constrains profit margins.

- Regulatory Barriers: Stringent approval processes could delay product launches.

- Supply Chain Disruptions: Affecting manufacturing costs and availability.

Key Takeaways

- The simethicone market remains robust, with consistent demand driven by gastrointestinal health needs.

- Competitive generic landscape and high OTC accessibility maintain prices within a narrow range; significant upward movement is unlikely absent innovation.

- Future growth prospects in emerging markets underscore opportunities for incremental price increases aligned with regional economic development.

- Innovation focusing on convenience and formulation variants may facilitate premium pricing.

- Regulatory stability and supply chain resilience will be critical in maintaining steady market pricing.

FAQs

1. What are the main factors influencing simethicone pricing in different regions?

Regional regulatory standards, the degree of market maturity, competitive dynamics, and economic factors influence pricing. Mature markets with high generic competition tend to have stable, lower prices, whereas emerging markets may see gradual price increases due to rising demand and limited competition.

2. How does patent law impact simethicone pricing and innovation?

Since simethicone has been off-patent for decades, no patent protections limit generic manufacturing, resulting in competitive pricing. Patents on specific formulations or delivery systems could foster limited innovation, but the core active ingredient remains generic.

3. Are there upcoming regulatory changes that could affect simethicone prices?

While regulatory standards evolve, significant changes affecting pricing are unlikely unless new safety or efficacy standards are introduced that require reformulation or testing, potentially increasing manufacturing costs temporarily.

4. What areas offer the most potential for premium pricing?

Formulation innovation, such as flavored liquids, chewable tablets, or combination therapies, could justify higher price points, especially in markets where convenience influences consumer choice.

5. How might supply chain disruptions influence future simethicone prices?

Disruptions can increase manufacturing costs and reduce supply, creating upward pressure on prices. Conversely, stable supply chains support consistent pricing levels in highly competitive markets.

References

[1] Smith, J. et al. “Gastrointestinal treatments: An overview of anti-gas therapy.” Journal of Pharmacology, 2020.

[2] Market Research Future. “Simethicone Market Forecast to 2030.” 2022.

[3] GlobalData. “Digestive health market analysis,” 2021.