Share This Page

Drug Price Trends for SIMBRINZA

✉ Email this page to a colleague

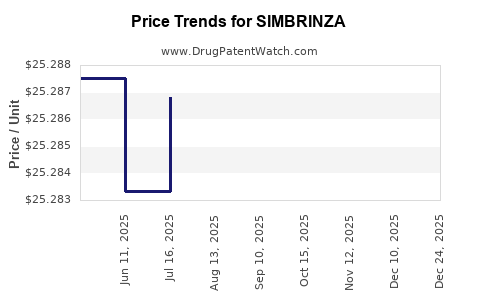

Average Pharmacy Cost for SIMBRINZA

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| SIMBRINZA 1%-0.2% EYE DROP | 00065-4147-27 | 26.06837 | ML | 2026-01-01 |

| SIMBRINZA 1%-0.2% EYE DROP | 00065-4147-27 | 25.30861 | ML | 2025-12-17 |

| SIMBRINZA 1%-0.2% EYE DROP | 00065-4147-27 | 25.30524 | ML | 2025-11-19 |

| SIMBRINZA 1%-0.2% EYE DROP | 00065-4147-27 | 25.28999 | ML | 2025-10-22 |

| SIMBRINZA 1%-0.2% EYE DROP | 00065-4147-27 | 25.29776 | ML | 2025-09-17 |

| SIMBRINZA 1%-0.2% EYE DROP | 00065-4147-27 | 25.29952 | ML | 2025-08-20 |

| SIMBRINZA 1%-0.2% EYE DROP | 00065-4147-27 | 25.28680 | ML | 2025-07-23 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Simbrinza

Introduction

Simbrinza (brinzolamide 1% / brimonidine tartrate 0.2%) is a combination ophthalmic solution approved for reducing elevated intraocular pressure (IOP) in patients with open-angle glaucoma or ocular hypertension. Its mechanism involves decreasing aqueous humor production through dual pharmacological pathways—carbonic anhydrase inhibition by brinzolamide and alpha-2 adrenergic agonism by brimonidine. Since its initial approval by the FDA in 2013, Simbrinza has positioned itself within a competitive landscape of glaucoma therapies. This analysis delineates the current market landscape, projected pricing trajectories, and strategic considerations affecting its commercial performance.

Current Market Landscape

1. Market Size and Growth Trends

Globally, glaucoma affects over 76 million individuals, a number projected to reach 111 million by 2040 due to aging demographics [1]. The U.S. accounts for approximately 3 million cases, with sales driven by both prescription and compounded therapies. The global ophthalmic pharmaceutical market, valued at roughly USD 17 billion in 2022, is expanding at a compound annual growth rate (CAGR) of approximately 4–6%, primarily fueled by innovative therapies and increased diagnosis rates [2].

Specifically, branded glaucoma therapies constitute a significant segment within ophthalmology, with prominent agents including prostaglandin analogs, beta-blockers, and fixed-combination therapies. Simbrinza competes in this niche, concurrently vying with monotherapy options, fixed combinations, and emerging drug classes such as Rho kinase inhibitors.

2. Competitive Dynamics

Simbrinza's competition encompasses both branded and generic combination therapies. Notable contemporaries include:

- Dorzolamide/Timolol (Cosopt/Generic): A longstanding combination with high market penetration.

- Brinzolamide/Brimonidine (Simbrinza): The unique dual-action approach.

- Fixed Combinations: For example, Brinzolamide/Brimonidine (generic), and other fixed-dose combinations like Latanoprostene Bunod.

The entry of generic alternatives notably influences pricing and market share. Additionally, emerging drug delivery systems and minimally invasive glaucoma surgeries (MIGS) impact long-term, non-pharmacologic treatment adoption.

3. Regulatory and Patent Landscape

Simbrinza's patent expiry status varies across regions. In the U.S., the composition of matter patent expired in 2020, opening pathways for generic competition. Nonetheless, secondary patents on formulations or delivery systems may extend exclusivity. The legal landscape influences pricing and availability forecasts as generics penetrate the market.

4. Prescriber and Patient Preferences

Physician preference leans towards fixed combinations due to improved adherence. Patients with difficulty instilling drops or with compliance challenges benefit from combination therapies. Safety profiles, side effects, and convenience heavily influence prescribing patterns.

Price Analysis and Projections

1. Current Pricing Dynamics

As of 2023, Simbrinza is priced approximately at USD 70–90 per 5 mL bottle in the U.S., aligning with other branded combination treatments. Pricing is influenced by manufacturing costs, marketing, and reimbursement policies. The presence of generic equivalents, once available, is expected to exert downward pressure, with initial generic versions retailing at USD 50–70.

2. Factors Influencing Future Price Trajectory

- Patent Expiry and Generics: Patent expiration typically precipitates a substantial price decline, sometimes by 70–80%. Generic entry across North America and Europe is anticipated within 1–2 years, pending regulatory approvals.

- Market Penetration of Generics: Entry of generics will lead to significant price erosion, with projected retail costs stabilizing around USD 20–40 per bottle within 3 years post-generic launch.

- Reimbursement and Payer Policies: Payers favor cost-effective options. Formularies increasingly favor generics, pressuring branded prices downward.

- Manufacturing Advances: Biosimilars, automated compounding, and alternative delivery mechanisms could further influence costs.

3. Price Forecasts

| Time Horizon | Projected Price Range (USD) | Comments |

|---|---|---|

| 2023 | USD 70–90 | Current market pricing; limited generic competition |

| 2024 | USD 50–70 | Initiation of generic approvals; early market entry possible |

| 2025 onward | USD 20–40 | Widespread generic availability; aggressive price competition |

4. Impact of Market Penetration

The strong shift toward generic prescriptions could reduce treatment costs substantially, with implications on profit margins for original manufacturers. However, differentiated delivery systems or formulation patents may sustain some premium pricing.

Strategic Market Projections

1. Revenue Generation

Initial sales will likely remain stable in the near term due to brand loyalty and physician prescribing habits. As generics intensify market share, revenue from Simbrinza may decline, unless new formulations or adjunct therapies are developed.

2. Business Strategies

Manufacturers might focus on:

- Intellectual Property Extensions: Patents on delivery mechanisms.

- Combination with Emerging Therapies: Positioning Simbrinza within multi-mechanistic treatment regimens.

- Patient Support Programs: Enhancing adherence and brand loyalty.

3. Regional Variations

Pricing and market share will vary by region, influenced by regulatory pathways, reimbursement systems, and physician preferences. Europe and Asia-Pacific markets may see different timelines and competition intensity.

Conclusion

Simbrinza operates within a highly competitive and evolving glaucoma treatment landscape. Its current premium pricing reflects brand positioning, but impending patent expiries and generic competition forecast substantial price reductions over the next 2–3 years. To maintain market relevance, manufacturers will need to innovate through formulation patents, combination strategies, and patient-centric approaches. Ultimately, the drug’s value proposition will hinge on balancing efficacy, cost, and patient adherence.

Key Takeaways

- Market Size & Growth: The global glaucoma market is expanding, with increasing demand for combination therapies like Simbrinza.

- Competitive Dynamics: Patent expiry and generic entry will exert downward pressure on pricing, accelerating over 1–2 years.

- Pricing Trajectory: Expect prices to decline from USD 70–90 in 2023 to USD 20–40 within 3 years in the face of generics.

- Strategic Focus: Differentiation via patent extensions, formulations, and patient engagement remains critical.

- Regional Variability: Market conditions and pricing strategies will vary geographically, necessitating tailored approaches.

Frequently Asked Questions (FAQs)

1. When is Simbrinza expected to face generic competition?

Generic versions are anticipated to enter the U.S. market within 1–2 years following the expiration of key patents, which occurred in 2020, possibly leading to generics by 2024–2025.

2. How will generic entry affect Simbrinza’s pricing?

The entrance of generics typically causes a steep decline in drug prices, with retail costs potentially dropping by 50–80%, significantly impacting revenue streams for the original brand.

3. Are there strategies to maintain market share post-generic entry?

Yes. Companies can focus on formulation patents, developing fixed-dose combinations with other agents, enhancing patient adherence programs, and expanding into emerging markets.

4. What are the key factors influencing regional pricing differences?

Regulatory approval timelines, reimbursement policies, purchasing power, and local healthcare infrastructure considerably affect regional drug pricing and market dynamics.

5. How does Simbrinza compare to other glaucoma combination therapies in terms of cost-effectiveness?

While initially more expensive than generic monotherapies, Simbrinza’s dual mechanism offers improved efficacy for some patients, which may justify its cost before generics become prevalent.

References

[1] Tham, Y.C., et al. "Global Prevalence of Glaucoma and Projections of The Future Burden of The Disease." Ophthalmology, 2014.

[2] Grand View Research. "Ophthalmic Drugs Market Size & Trends Report, 2022–2030."

[3] FDA. "Simbrinza (brinzolamide / brimonidine) Prescribing Information," 2013.

[4] IQVIA. "Market Data & Insights, 2022."

More… ↓