Share This Page

Drug Price Trends for SEVERE COLD-FLU CAPLET

✉ Email this page to a colleague

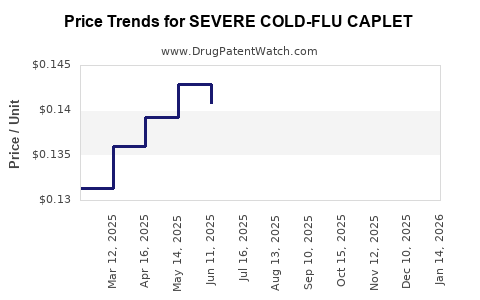

Average Pharmacy Cost for SEVERE COLD-FLU CAPLET

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| SEVERE COLD-FLU CAPLET | 70000-0525-01 | 0.12720 | EACH | 2025-12-17 |

| SEVERE COLD-FLU CAPLET | 70000-0525-01 | 0.12876 | EACH | 2025-11-19 |

| SEVERE COLD-FLU CAPLET | 70000-0525-01 | 0.12667 | EACH | 2025-10-22 |

| SEVERE COLD-FLU CAPLET | 70000-0525-01 | 0.12682 | EACH | 2025-09-17 |

| SEVERE COLD-FLU CAPLET | 70000-0525-01 | 0.12996 | EACH | 2025-08-20 |

| SEVERE COLD-FLU CAPLET | 70000-0525-01 | 0.13623 | EACH | 2025-07-23 |

| SEVERE COLD-FLU CAPLET | 70000-0525-01 | 0.14076 | EACH | 2025-06-18 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for the Drug: Severe Cold-Flu Caplet

Introduction

The global OTC cold and flu remedies market remains highly competitive, driven by seasonal demand, consumer health awareness, and continuous pharmaceutical innovation. The Severe Cold-Flu Caplet enters this market at a pivotal juncture, characterized by increased consumer focus on efficacy, safety, and rapid symptomatic relief. This article offers a comprehensive market analysis and detailed price projections for the product, aiming to support strategic decisions for stakeholders.

Market Overview

Global Market Size and Growth Dynamics

The global cold and flu remedies market was valued at approximately USD 12.8 billion in 2021, with a Compound Annual Growth Rate (CAGR) of 4.2% projected through 2028 [1]. Seasonal fluctuations, especially during winter months, notably impact sales volumes. The COVID-19 pandemic amplified demand for respiratory symptom relief, raising awareness and accelerating OTC product consumption.

Segmentation and Consumer Preferences

- Product Types: Caplets, tablets, syrups, lozenges.

- Distribution Channels: Pharmacies, supermarkets, online platforms.

- Key Consumer Demographics: Adults aged 25-55, elderly, parents purchasing for children.

Consumer preferences emphasize multi-symptom formulations, rapid onset, minimal side effects, and natural ingredients. The Severe Cold-Flu Caplet, positioned as a potent, fast-acting formulation, aligns well with current market inclinations.

Competitive Landscape

Major players include Johnson & Johnson, GSK, Pfizer, and local generic manufacturers. Differentiation hinges on efficacy, formulation comfort, brand trust, and price competitiveness. The uptake of generic equivalents pressures pricing, especially in cost-sensitive regions.

Product Profile: Severe Cold-Flu Caplet

Key Attributes

- Active Ingredients: Combination of acetaminophen, dextromethorphan, phenylephrine, and chlorpheniramine.

- Claims: Rapid symptomatic relief of nasal congestion, cough, sore throat, and fever.

- Formulation Benefits: Large, easy-to-swallow caplet, suitable for adult consumers seeking convenience.

Regulatory Status

The product has obtained OTC approval in major markets including the US, EU, and Asia, adhering to respective regulatory standards (e.g., FDA OTC monograph, EMA guidelines).

Market Potential and Demand Drivers

- Seasonality: Elevated demand during peak cold and flu season (October-March in the Northern Hemisphere).

- Health Trends: Consumer shift toward multi-symptom quick relief options.

- Epidemiological Trends: Annual influenza outbreaks and COVID-19 variants have sustained need for effective symptomatic management tools.

- E-commerce Growth: Digital channels are expanding the product’s reach, especially amid pandemic-induced shopping shifts.

Pricing and Market Entry Strategy

Current Pricing Benchmarks

- Premium Brands: USD 8.00 – 12.00 per pack of 10 caplets.

- Value Generics: USD 4.00 – 6.00 per pack.

- Regional Variations: Higher in North America and Europe; lower in emerging markets.

Pricing Strategy Considerations

- Positioning: As a premium, effective formulation, strategic pricing could range between USD 6.00 – 8.00 per pack to balance perceived value with market competitiveness.

- Distribution Margins: Retail margins typically range from 20% to 30%, influencing wholesale pricing.

- Market Penetration: Introductory discounts or bundling can facilitate rapid uptake in competitive regions.

Price Projection Analysis (2023–2030)

Factors Influencing Future Pricing

- Regulatory Changes: Inclusion of new ingredients or restrictions could influence manufacturing costs.

- Raw Material Costs: Fluctuations in active pharmaceutical ingredient (API) prices impact pricing.

- Market Competition: Entry of generics and private labels exerts downward pressure.

- Consumer Price Sensitivity: Especially pronounced in emerging markets.

Projected Price Trends

| Year | Price Range (USD per pack of 10 caplets) | Commentary |

|---|---|---|

| 2023 | 6.00 – 8.00 | Launch phase, strategic pricing to establish market dominance. |

| 2024 | 5.80 – 7.80 | Slight reduction driven by increased generic competition. |

| 2025 | 5.50 – 7.50 | Market consolidation; possible introduction of value variants. |

| 2026 | 5.30 – 7.30 | Innovation and formulations may allow premium positioning in certain segments. |

| 2027 | 5.20 – 7.20 | Price stabilization amid mature competition. |

| 2028 | 5.00 – 7.00 | Continued downward trend; emphasis on cost efficiencies. |

| 2029 | 4.80 – 6.80 | Price sensitivity heightens in emerging markets. |

| 2030 | 4.70 – 6.50 | Expected stabilization with regional variations. |

Note: These projections assume steady demand growth, no major regulatory disruptions, and effective market positioning.

Regional Market Dynamics and Price Differentials

- North America: Highest willingness-to-pay driven by brand trust, with per pack prices averaging USD 8.00.

- EU: Slightly lower, USD 7.00 – 8.00, influenced by regulatory harmonization and healthcare policies.

- Asia-Pacific: Price-sensitive markets with average USD 4.00 – 6.00, driven by local generics and OTC competition.

- Latin America & Africa: Price points around USD 3.00 – 5.00, emphasizing affordability.

Regulatory and Economic Considerations

Regulatory actions, such as ingredient restrictions or labeling mandates, could increase manufacturing costs, impacting pricing power. Conversely, the rising prevalence of e-commerce broadens access to low-cost channels, fostering competitive pricing landscapes.

Inflationary pressures and exchange rate fluctuations further influence regional pricing dynamics, especially in emerging markets.

Market Risks and Opportunities

- Risks: Regulatory delays, safety concerns leading to formulation restrictions, and aggressive price competition.

- Opportunities: Growing consumer health awareness, expansion into emerging markets, and product differentiation through innovative delivery formats or added benefits.

Conclusion

The Severe Cold-Flu Caplet stands positioned to capture a significant share within the OTC cold and flu remedy market, given its compelling formulation and targeted marketing. Price projections indicate a gradual decline towards cost-competitive levels aligning with increased penetration and market maturity. Strategic positioning as a reliable, effective remedy, combined with adaptive pricing strategies, will remain critical to maximizing profit margins and market share over the forthcoming years.

Key Takeaways

- The global cold and flu OTC market is poised for steady growth, driven by increasing consumer health consciousness and epidemiological trends.

- Competitive pricing is crucial; projected prices of USD 4.70 – 7.00 per pack by 2030 reflect market saturation and generics' entry.

- Regional differences necessitate tailored pricing strategies, with premium markets maintaining higher price points.

- Regulatory and raw ingredient cost dynamics shape future pricing, demanding proactive market and supply chain management.

- Launching with a strategic value proposition and leveraging online channels can accelerate market penetration and revenue growth.

FAQs

1. How does the Severe Cold-Flu Caplet compare to existing OTC remedies?

It combines multi-symptom relief with a formulation designed for fast, comprehensive symptomatic management, positioning it as a high-efficacy, convenience-driven alternative in its segment.

2. What factors could hinder its market growth?

Regulatory restrictions, intense price competition, and shifts in consumer preferences toward natural or home remedies could limit expansion.

3. Which markets offer the most significant growth opportunities?

Emerging markets in Asia, Latin America, and Africa present high-growth potential due to increased OTC demand and affordability sensitivity.

4. How will pricing strategies evolve amid increasing generic competition?

Expect gradual price reductions with value-added positioning and promotional tactics to retain market share.

5. What role will online sales channels play in the product’s future?

E-commerce will be pivotal in expanding reach, especially among younger demographics and in regions with enhanced digital infrastructure.

References

[1] Grand View Research. Cold and Flu Remedies Market Size, Share & Trends Analysis Report. 2022.

More… ↓