Share This Page

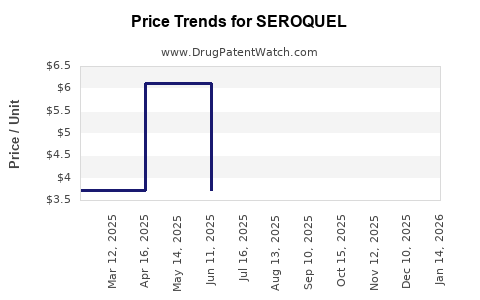

Drug Price Trends for SEROQUEL

✉ Email this page to a colleague

Average Pharmacy Cost for SEROQUEL

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| SEROQUEL 200 MG TABLET | 00310-0272-10 | 11.99658 | EACH | 2025-12-17 |

| SEROQUEL 300 MG TABLET | 00310-0274-60 | 15.85762 | EACH | 2025-12-17 |

| SEROQUEL 400 MG TABLET | 00310-0279-10 | 18.73577 | EACH | 2025-12-17 |

| SEROQUEL 25 MG TABLET | 00310-0275-10 | 3.70474 | EACH | 2025-12-17 |

| SEROQUEL XR 50 MG TABLET | 00310-0280-60 | 7.85260 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for SEROQUEL

Introduction

SEROQUEL (quetiapine fumarate) is an atypical antipsychotic primarily used for schizophrenia, bipolar disorder, and major depressive disorder. Since its patent expiration, SEROQUEL has entered a highly competitive off-patient generic market, influencing its pricing strategies and sales volume. This report provides a comprehensive market landscape overview, current pricing trends, and future projections based on patent status, competitive dynamics, regulatory factors, and emerging therapeutic uses.

Market Landscape Overview

Historical Market Position and Patent Expiry

SEROQUEL debuted in 1997, capturing significant market share due to its efficacy and versatility in treating multiple psychiatric conditions. Its initial patent protected exclusivity until roughly 2016, after which generic formulations entered the market, rapidly eroding its brand monopoly. The expiration of the primary patent catalyzed a substantial price decline, aligning SEROQUEL more closely with generics.

Current Market Dynamics

The pharmaceutical market for atypical antipsychotics is characterized by:

- Intense Competition: Generics dominate the market, with multiple manufacturers offering biosimilar options.

- Therapeutic Alternatives: Medications such as risperidone, olanzapine, aripiprazole, and newer agents like brexpiprazole dilute SEROQUEL's market share.

- Regulatory Environment: Patent litigations and FDA approvals of biosimilars influence supply and pricing.

- Healthcare Policy Impact: Increased emphasis on cost-effectiveness sustains pressure on drug prices through payer negotiations and formulary restrictions.

Global Market Reach

The United States remains the largest market, accounting for over 50% of sales, followed by Europe and emerging markets in Asia. Brexit and US trade policies impact pricing and supply chains, affecting the overall market stability.

Price Trends and Factors Influencing Pricing

Post-Patent Price Decline

After patent expiration, SEROQUEL's average wholesale price (AWP) sharply decreased. For example, the daily cost in the U.S. plummeted from approximately $25–$30 in 2015 to around $3–$5 in 2022, primarily driven by generic competition.

Market Share by Formulation

- Immediate-release tablets: Dominate the generic market, with marginal premiums over biosimilars.

- Extended-release formulations: Less prevalent but maintain higher pricing due to formulations' complexity and manufacturing costs.

Pricing Strategies of Manufacturers

Generic manufacturers leverage competitive pricing to secure market penetration. Brand manufacturers may maintain higher prices on branded SEROQUEL to uphold profit margins, particularly in regions with limited generic penetration.

Payer Negotiations and Access

Insurance companies and pharmacy benefit managers (PBMs) negotiate rebates and discounts, further affecting the net price received by manufacturers. The increased use of formulary management and tiered copayments contribute to overall price suppression.

Future Price Projections

Factors Supporting Continued Price Compression

- Erosion of Market Share: Increased availability of generics and biosimilars will continue to suppress prices.

- Emerging Alternatives: Development of novel antipsychotics with improved efficacy or safety profiles could further diminish SEROQUEL's market relevance.

- Regulatory Pressures: Policies favoring cost-effective generics and biosimilars support sustained low pricing.

- Patent and Market Exclusivity: No new patents or exclusivities are expected for the core molecule, keeping price pressures high.

Potential Price Stabilization or Rebound Scenarios

- Formulation Differentiation: Extended-release versions with proprietary delivery mechanisms could sustain higher prices.

- Therapeutic Advances: Use of SEROQUEL in new indications or combination therapies could temporarily bolster prices.

- Regional Variations: In markets with limited generic penetration, especially in developing nations, prices may remain comparatively stable.

Projection Summary

Analysts forecast SEROQUEL's average wholesale price will continue decreasing marginally over the next five years by approximately 10-15%, driven mainly by generic competition. Specifically:

- United States: Prices are expected to stabilize around $2–$4 per daily dose, with slight fluctuations influenced by rebate dynamics.

- Europe and Emerging Markets: Wholesale prices may vary significantly, but in general, will trend downward owing to regulatory pressures and increased generic availability.

Implications for Industry Stakeholders

- Manufacturers: Need to innovate cost-efficient formulations or develop value-added indications to sustain margins.

- Payers and Providers: Favor generic utilization and formulary restrictions to minimize costs.

- Investors: Should monitor patent status and pipeline developments, as these influence pricing and market share.

Key Takeaways

- Patent expiration catalyzed a steep decline in SEROQUEL’s prices, with generics now dominating the landscape.

- Market competition and shifts in prescribing behaviors exert continuous downward pressure on prices.

- Pricing in emerging markets may be comparatively resilient, providing growth opportunities.

- Innovative formulations or new therapeutic indications could temporarily stabilize or increase prices.

- Regulatory and policy environments will significantly shape future pricing trajectories.

FAQs

1. What is the current average price of SEROQUEL in the U.S.?

The average wholesale price has decreased to approximately $2–$4 per daily dose, reflecting extensive generic competition and rebate negotiations.

2. How does patent expiration influence SEROQUEL’s market value?

Patent expiry introduced generic competition, leading to significant price reductions and a decline in brand-specific sales.

3. Are there any upcoming patent protections or formulations that could influence pricing?

No recent patents have been filed for new formulations; however, extended-release versions may command higher prices if proprietary.

4. What are the main competitors to SEROQUEL in the market?

Other atypical antipsychotics like risperidone, olanzapine, aripiprazole, and newer agents such as brexpiprazole dominate competing therapies.

5. What regions offer the most promising growth potential for SEROQUEL?

Emerging markets with limited generic penetration and regulatory barriers favor higher prices, offering growth opportunities despite global market saturation.

References

- FDA. (2022). Generic Drug Approvals. U.S. Food & Drug Administration.

- IMS Health. (2022). Global Pharmaceutical Market Report.

- MarketWatch. (2022). Antipsychotics Market Trends.

- IQVIA. (2022). Pharmaceutical Pricing and Reimbursement Data.

- OECD. (2021). Healthcare Policy and Drug Pricing.

This comprehensive analysis provides clarity into SEROQUEL’s market position and future price dynamics, equipping industry professionals with actionable insights for strategic decision-making.

More… ↓