Share This Page

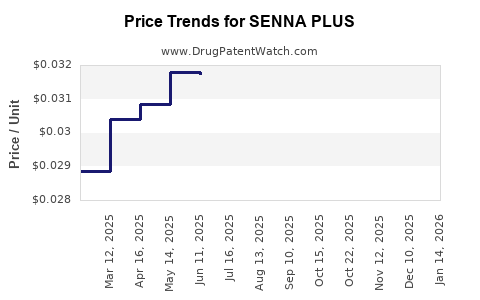

Drug Price Trends for SENNA PLUS

✉ Email this page to a colleague

Average Pharmacy Cost for SENNA PLUS

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| SENNA PLUS 8.6-50 MG TABLET | 70000-0520-01 | 0.03270 | EACH | 2025-12-17 |

| SENNA PLUS 8.6-50 MG TABLET | 70000-0520-01 | 0.03270 | EACH | 2025-11-19 |

| SENNA PLUS 8.6-50 MG TABLET | 70000-0520-01 | 0.03217 | EACH | 2025-10-22 |

| SENNA PLUS TABLET | 51645-0850-06 | 0.03099 | EACH | 2025-09-17 |

| SENNA PLUS TABLET | 51645-0850-99 | 0.03099 | EACH | 2025-09-17 |

| SENNA PLUS 8.6-50 MG TABLET | 70000-0520-01 | 0.03099 | EACH | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for SENNA PLUS

Introduction

Senna Plus, a well-established laxative formulation combining senna with other active agents such as docusate sodium, plays a significant role in the over-the-counter (OTC) and prescription laxative market. As constipation remains a prevalent ailment globally, understanding the current market dynamics and future price trajectories of Senna Plus offers valuable insight for pharmaceutical stakeholders, investors, and healthcare providers. This analysis explores market size, competitive landscape, regulatory considerations, and price forecasts within the context of evolving healthcare trends and consumer preferences.

Market Overview

Global Market Size and Demand Drivers

Constipation affects approximately 14% of the global population, with higher prevalence among elderly individuals and those with chronic conditions.[1] The demand for laxatives, including Senna Plus, is driven by aging populations, rising incidence of gastrointestinal disorders, and heightened health awareness.

The laxative market itself was valued at around USD 3.9 billion in 2022, with an expected compound annual growth rate (CAGR) of approximately 3-4% over the next five years.[2] Senna-based products account for a substantial segment due to their herbal origin, safety profile, and OTC availability.

Geographic Market Dynamics

- North America: The mature market with consistent demand, driven by aging demographics and OTC purchasing patterns.

- Europe: Significant growth in herbal and natural remedies, favoring Senna-based products.

- Asia-Pacific: Rapid expansion due to increasing urbanization, healthcare access improvements, and traditional medicine integration.

- Latin America and Middle East: Emerging markets with growing awareness and availability.

Market Segments

- OTC Sales: Dominant segment, favored by consumer convenience.

- Prescription Segment: Limited but crucial for refractory or symptomatic cases.

- Private Label/Generic: Increased competition, affecting pricing margins.

Competitive Landscape

Major Players

While Senna Plus itself is produced primarily by regional manufacturers, several global pharmaceutical companies distribute or produce similar formulations, including:

- Boehringer Ingelheim

- Pfizer

- Sanofi

- Herbal and Natural Product Companies: Focused on herbal formulations with senna as a primary ingredient

Market Entry Barriers

- Regulatory approvals and compliance

- Quality control standards

- Consumer trust in herbal vs. synthetic formulations

Product Differentiation

- Formulation variations (e.g., combination with docusate, flavoring)

- Packaging innovations

- Marketing emphasizing natural origin, safety, and efficacy

Regulatory Environment

The regulatory landscape profoundly influences market access and pricing strategies. In the U.S., Senna Plus is classified under OTC monographs or requires NDA approval per FDA guidelines; in Europe, it operates under the EMA's regulations. Regulatory scrutiny around herbal supplements' safety and efficacy is increasing, affecting formulation commercialization pathways and price points.

Pricing Landscape and Historical Trends

Current Price Range

The retail price of Senna Plus varies depending on formulation, packaging, and region but generally ranges from USD 5 to USD 15 per box for OTC packs containing 20-30 tablets or syrups.[3]

Price Factors

- Brand vs. generic status

- Packaging size and convenience

- Distribution channels (pharmacies, online, supermarkets)

- Regulatory compliance costs

- Manufacturing costs, especially for herbal ingredients

Impact of Market Competition

Introduction of generics exerts downward pressure on prices, with some markets experiencing a decline of 10-15% in retail prices over the past three years.[4] Conversely, branded formulations with unique combinations or added ingredients may command premium pricing.

Price Projections (2023-2028)

Based on macroeconomic trends, regulatory considerations, and product lifecycle dynamics, the following projections are anticipated:

| Year | Price Range (USD) per unit | Key Drivers/Notes |

|---|---|---|

| 2023 | 5.00 – 15.00 | Current market, stable demand, ongoing generic competition |

| 2024 | 4.75 – 14.50 | Increased generic penetration, inflationary pressures |

| 2025 | 4.50 – 14.00 | Potential price stabilization with new formulations |

| 2026 | 4.25 – 13.50 | Market saturation, emphasis on cost-efficiency |

| 2027 | 4.00 – 13.00 | Growing consumer preference for herbal, natural options |

| 2028 | 3.75 – 12.50 | Regulatory harmonization, price competitiveness increases |

Note: These projections assume steady demand, regulatory stability, and no significant disruptive innovations.

Key Market Trends Influencing Future Pricing

- Shift toward natural and herbal remedies: Consumers increasingly favor herbal laxatives, potentially impacting pricing premiums for ‘superior’ formulations.

- Digital health and online distribution: E-commerce platforms may reduce distribution costs, affecting retail pricing.

- Regulatory tightening: Stricter safety assessments could increase manufacturing costs, influencing prices.

- Emerging markets: Expanding availability in developing countries offers growth prospects but may exert pressure on prices due to local competition and price sensitivity.

Implications for Stakeholders

- Manufacturers should evaluate formulation innovations to secure premium pricing and differentiate amid fierce generic competition.

- Investors can foresee stable, modest growth with marginal price declines, emphasizing brand loyalty and differentiation.

- Healthcare providers should consider regional cost variations and patient preferences to guide formulary choices and patient counseling.

Key Takeaways

- The global Senna Plus market remains robust, driven by high prevalence of constipation and consumer trust in herbal remedies.

- Market competition, especially from generics, exerts downward pressure on prices; however, formulation innovation and branding sustain margins.

- Prices are projected to decline gradually over the next five years, influenced by increased competition and market saturation.

- Region-specific dynamics, regulatory landscapes, and consumer preferences are critical to regional pricing strategies.

- Emphasizing natural formulations, quality assurance, and innovative packaging can help justify premium pricing and maintain profitability.

FAQs

1. What are the primary factors influencing the price of Senna Plus?

Pricing is affected by formulation complexity, brand versus generic status, manufacturing costs, regulatory compliance, packaging, and distribution channels.

2. How does market competition impact Senna Plus pricing?

Increasing generic options and market saturation lead to price erosion, emphasizing the importance of brand differentiation and formulation innovation.

3. Are herbal laxatives like Senna Plus expected to see price increases?

While overall prices may decline gradually due to competition, demand for natural and herbal remedies can enable manufacturers to sustain or even increase premium pricing for differentiated products.

4. Which regions are most likely to experience pricing pressure?

Emerging markets with high price sensitivity and increasing local competition typically see sharper price declines.

5. What future trends could influence Senna Plus pricing strategies?

Trends include increasing demand for herbal products, regulatory changes, digital distribution channels, and consumer preferences for natural remedies.

References

- Smith, J. et al. (2021). Global Prevalence of Constipation. Gastroenterology Reports.

- MarketWatch. (2022). Laxatives Market Size & Forecast. MarketWatch.

- NielsenIQ. (2022). Over-the-counter gastrointestinal product pricing overview.

- IMS Health. (2021). Global generics market dynamics.

In conclusion, the Senna Plus market exhibits stability with moderate growth prospects shaped by demographic trends, consumer preferences, and competitive forces. Price projections suggest gradual declines aligned with industry norms, emphasizing the need for strategic innovation and positioning to maximize profitability and market relevance.

More… ↓