Share This Page

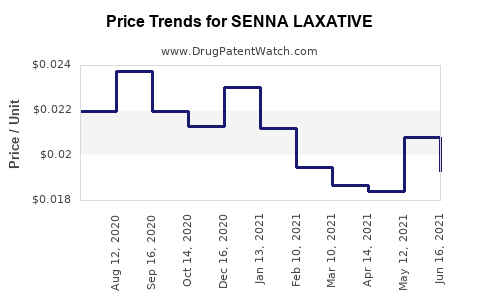

Drug Price Trends for SENNA LAXATIVE

✉ Email this page to a colleague

Average Pharmacy Cost for SENNA LAXATIVE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| SENNA LAXATIVE 8.6 MG TABLET | 70000-0447-03 | 0.02325 | EACH | 2025-01-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Senna Laxative

Introduction

Senna laxatives are widely used over-the-counter (OTC) medications primarily for short-term relief of constipation. Derived from the Senna plant’s leaves and pods, these botanical products act as stimulant laxatives, increasing intestinal motility. The global market for senna laxatives is shaped by consumer demand for safe, effective, and affordable constipation remedies, alongside regulatory influences, manufacturing dynamics, and competitive landscape shifts.

This analysis explores current market conditions, key drivers, competitive environment, regulatory factors, and offers informed price projections for senna laxatives over the next five years.

Market Overview

Global Market Size and Growth Trends

The global laxatives market was valued at approximately USD 7.8 billion in 2022 and is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.2% through 2028, driven by an aging population, increasing prevalence of gastrointestinal disorders, and rising health awareness.[1] Senna-based products constitute around 15-20% of the OTC laxatives segment, with steady demand in mature markets like North America and Europe, and rising adoption in emerging economies such as India and Brazil.

Market Segments

- Product Type: Senna-based stimulant laxatives, bulking agents, osmotic laxatives, stool softeners.

- Distribution Channels: OTC retail, pharmacies, online platforms, hospitals.

- User Demographics: Adults (primarily elderly), pediatric, and hospital settings.

Key Geographies

- North America: Largest market due to high healthcare awareness, OTC availability, and aging population.

- Europe: Moderate growth with regulatory moderations influencing product formulations.

- Asia-Pacific: Fastest growth driven by increasing urbanization, lifestyle changes, and medical infrastructure expansion.

- Latin America and Middle East: Emerging markets with growing consumer health consciousness.

Key Market Drivers

1. Rising Prevalence of Constipation and Gastrointestinal Disorders

Constipation affects an estimated 14% of the global population, with higher incidences in elderly and sedentary populations.[2] The increasing burden of gastrointestinal health issues sustains demand for OTC laxatives, including senna formulations.

2. Consumer Preference for Natural and Botanical Products

Growing preference for natural remedies bolsters the appeal of plant-derived laxatives like senna. Regulatory agencies in some regions, such as the European Medicines Agency (EMA), recognize herbal laxatives as safe when used appropriately, further supporting market growth.

3. OTC Accessibility and Convenience

Senna laxatives' OTC availability, coupled with minimal side effects when used within recommended dosages, fuels consumer adoption. The advent of online pharmacies accelerates accessibility, especially in pandemic contexts.

4. Expanding Healthcare Infrastructure in Emerging Markets

Improvements in healthcare delivery and rising disposable incomes facilitate increased adoption of OTC gastrointestinal remedies, including senna-based products.

Competitive Landscape

Leading manufacturers include colleagues like:

- Bayer AG: Offers Senokot and other herbal laxatives.

- C.P. G-b Pharmaceutical: Distributes generic senna formulations.

- Jingxi Pharmaceutical: Emerging regional player with herbal laxatives.

Private-label brands dominate the OTC segment at the retail level, emphasizing affordability. Patent protection is limited for natural products, intensifying price competition.

Regulatory Environment

Regulations for herbal and stimulant laxatives differ globally. In the EU, herbal laxatives are regulated under herbal medicinal product directives, requiring safety and efficacy data. In the US, the Food and Drug Administration (FDA) classifies senna as a dietary supplement or OTC drug, with labeling requirements. Regulatory restrictions on the maximum recommended doses aim to prevent misuse, influencing market stability and pricing.

Price Dynamics and Projections

Current Pricing Landscape

- Retail Price Range: The average retail price for a 100-dose bottle of senna laxative varies from USD 3.50 to USD 8.00, depending on brand, formulation, and distribution channel.

- Private Labels: Lower-priced options ($2.50–$4.00) often compete with branded products, especially in supermarkets and online outlets.

- Premium Formulations: Some brands introduce flavored or capsule-based formulations priced up to USD 10–12.

Factors Impacting Price Trends

- Raw Material Costs: Senna’s plant-based source can fluctuate in price due to agricultural variables.

- Regulatory Changes: Stricter safety standards may increase manufacturing costs, impacting retail prices.

- Market Competition: Increased competition from generics and private labels tends to exert downward pressure on prices.

- Consumer Preferences: Demand for natural, organic, and environmentally friendly products may command premium pricing.

Price Projection (2023–2028)

Based on current trends, the following projections are provided:

| Year | Average Retail Price (USD) per 100-dose bottle | Key Drivers/Comments |

|---|---|---|

| 2023 | $3.75 – $8.00 | Market stabilization; inflationary pressures; increased online sales |

| 2024 | $3.75 – $8.25 | Slight increase due to raw material costs; introduction of premium variants |

| 2025 | $3.75 – $8.50 | Regulatory tightening may slightly raise costs; continued generic competition |

| 2026 | $3.75 – $8.75 | Growing demand in emerging markets; inflation impacts persist |

| 2027 | $3.75 – $9.00 | Potential for premium product segment expansion |

| 2028 | $3.75 – $9.25 | Market maturation; sustained demand; potential regulation-driven cost increases |

Note: The upper limit reflects premium formulations or branded products, while the lower range pertains to private label and generic versions.

Future Market Opportunities and Challenges

Opportunities

- Product Innovation: Development of capsule forms, flavored variants, and combination products can command higher prices.

- Digital Commerce: Expansion of online sales provides access to price-sensitive consumers.

- Growing Demand in Developing Nations: Evolving healthcare infrastructures and urbanization accelerate adoption.

Challenges

- Regulatory Risks: Changing policies may restrict ingredient concentrations or advertising claims.

- Consumer Awareness of Overuse Risks: Excessive use of stimulant laxatives like senna raises safety concerns, potentially limiting sales.

- Pricing Compression: Intense competition may further suppress prices, particularly in commoditized markets.

Conclusion

Senna laxatives continue to hold a significant share in the global OTC gastrointestinal market owing to their botanical origin, proven efficacy, and consumer familiarity. Market growth is steady, catalyzed by aging demographics, rising chronic constipation cases, and preference for natural medicines. Price projections indicate a relatively stable retail segment with incremental increases expected due to raw material costs, regulatory compliance, and innovation efforts.

Business stakeholders should prioritize product differentiation, regulatory compliance, and digital marketing strategies to optimize market positioning. Recognizing regional variations and consumer preferences is crucial for tailoring offerings and pricing strategies to specific markets.

Key Takeaways

- Market is growing steadily, driven by demographic trends and consumer preference for natural remedies.

- Pricing remains competitive, with private labels offering low-cost options, but premium formulations support higher margins.

- Regulatory landscapes influence both innovation and pricing, necessitating ongoing compliance monitoring.

- Emerging markets offer substantial growth opportunities, with increasing demand for OTC herbal products.

- Innovation and digital channels are vital for maintaining competitive advantage and optimizing pricing.

FAQs

1. What factors influence the price of senna laxatives across different regions?

Regional regulatory standards, raw material costs, competitive landscape, consumer preferences, and distribution channels significantly affect prices. Developed markets tend to have higher prices due to stringent regulations and branding, while emerging markets often offer more affordable options.

2. How does regulation impact the future pricing of senna laxatives?

Regulations mandating safety assessments, labeling, and maximum dosages can increase manufacturing costs, potentially elevating retail prices. Conversely, regulatory clarity may facilitate market stability and consumer confidence, supporting sustained pricing levels.

3. Are there any premium formulations of senna laxatives expected to influence market prices?

Yes. Variants such as flavored capsules, combination products, or organic-certified senna formulations may command higher prices, creating niche segments within the broader market.

4. How will the growth of online pharmacies affect senna laxative pricing?

Online channels typically foster price competition, offering lower prices and promotional discounts. However, branding and product provenance become critical, allowing premium pricing for trusted or specialty formulations.

5. What are the risks associated with increasing the price of senna laxatives?

Elevating prices may reduce consumer access, especially among price-sensitive populations. Excessive pricing could also invite regulatory scrutiny or encourage substitution with alternative therapies.

References

[1] MarketWatch. (2022). Global laxatives market size and forecast.

[2] World Gastroenterology Organisation. (2021). Constipation prevalence and management.

More… ↓