Last updated: August 2, 2025

Introduction

SELZENTRY (maraviroc), developed by Pfizer, is an antiretroviral drug distinguished as a CCR5 antagonist used primarily in the treatment of HIV-1 infection. Approved by the FDA in 2007, it offers a unique mechanism of action, targeting a specific co-receptor necessary for viral entry into host cells. Its niche positioning among antiretroviral therapies (ART) influences its market dynamics and pricing strategies.

This comprehensive analysis evaluates the current market landscape, competitive positioning, regulatory status, and future price projections for SELZENTRY, providing critical insights for stakeholders, pharmaceutical companies, healthcare providers, and investors.

Market Landscape Overview

Global HIV/AIDS Treatment Market

The global HIV/AIDS therapeutic market was valued at approximately $21.4 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of around 3-4% through 2030 [1]. This growth is driven by increased prevalence, advancements in ART regimens, and the development of novel agents.

Market Share of CCR5 Antagonists

Within the ART landscape, CCR5 antagonists like maraviroc occupy a niche segment, primarily reserved for specific patient subsets with CCR5-tropic HIV strains. Other agents in the space include integrase inhibitors, NNRTIs, and protease inhibitors, which collectively dominate the ART market.

Maraviroc's market share has been relatively modest compared to first-line agents due to its specificity, resistance concerns, and the need for tropism testing prior to prescription. Nonetheless, it maintains a vital role in salvage therapy and in patients harboring CCR5-tropic virus.

Patient Demographics and Market Penetration

Approximately 1.2 million people live with HIV in the United States, with global figures exceeding 38 million [2]. Approximately 60-70% of these patients are eligible for maraviroc, contingent on viral tropism, but only a subset receives it owing to its niche use.

The drug's usage trends are affected by the availability of newer, more convenient therapies, with a preference for integrase strand transfer inhibitors (INSTIs) that boast fewer side effects and simplified dosing.

Competitive Landscape

Key Competitors

- Integrase Inhibitors: Dolutegravir (Tivicay), Bictegravir (Biktarvy) dominate first-line treatment, capturing upwards of 80% of newly diagnosed patients.

- NNRTIs: Doravirine, etravirine

- Protease Inhibitors: Atazanavir, darunavir

- Other CCR5 Antagonists: Limited, with maraviroc remaining the sole FDA-approved CCR5 antagonist.

Market Positioning

Maraviroc’s unique mechanism offers advantages in certain scenarios, such as CCR5-tropic virus infections and complex salvage regimens. However, its niche status and the requirement for tropism testing (via Trofile or similar assays) limit rapid adoption.

The drug's positioning is further challenged by the emergence of combination therapies, which simplify treatment but often omit maraviroc due to resistance or tropism variability.

Regulatory Status and Patent Landscape

Regulatory Approvals

Beyond the U.S., maraviroc is approved in over 50 countries, with regulatory bodies such as EMA (European Medicines Agency) and PMDA (Japan's Pharmaceuticals and Medical Devices Agency) maintaining approval based on regional data.

Patent and Exclusivity Status

Pfizer's patent protections for maraviroc are set to expire in various jurisdictions between 2023-2027, with some regions potentially entering generic competition thereafter. Patent expiry significantly influences pricing and market penetration strategies.

Pricing Dynamics and Revenue Trends

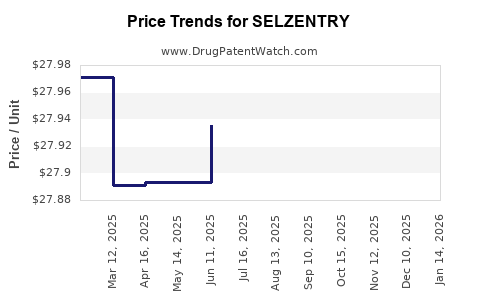

Current Pricing

In the U.S., the list price for a 30-day supply of SELZENTRY is approximately $2,600 to $3,200, depending on pharmacy discounts and insurance negotiations [3]. These prices are comparable to other branded ARTs but are often reduced through copay assistance programs.

Insurance and Reimbursement

Reimbursement policies heavily influence patient access. Medicare, Medicaid, and private insurers typically negotiate substantial discounts, rendering actual patient out-of-pocket costs variable.

Revenue Data

Pfizer reported revenues of approximately $210 million from maraviroc in 2022, reflecting its limited but steady contribution within the HIV portfolio [4].

Future Price Projections and Market Trends

Impact of Patent Expiry and Generic Entry

The impending patent expiries expected between 2023 and 2027 could precipitate significant price reductions (estimated 40-70%) as generics enter the market, intensifying price competition and reducing revenue margins.

Potential Price Adjustments

- Near-term (2023-2025): Price stability with incremental adjustments; continued premium pricing maintained through supply chain agreements.

- Mid-term (2026-2030): Market entry of generics expected to drive prices down to $1,300 - $1,800 per 30-day supply, possibly more in bulk purchasing scenarios.

Market Growth or Decline

Given the shift toward newer agents and the decreasing prevalence of CCR5-tropic virus, combined with increased generic competition, revenue for maraviroc may decline, influencing Pfizer and competitors' strategic investments.

Strategic Considerations for Stakeholders

- Pharmaceutical Companies: Innovate on combination therapies, develop improved tropism testing, or pivot toward niche indications to sustain market share.

- Healthcare Providers: Prioritize testing for CCR5-tropism to optimize maraviroc utility, especially in salvage therapy contexts.

- Policy Makers & Payers: Encourage affordable generics post-patent expiry, balancing access and innovation incentives.

Key Takeaways

- Niche Positioning: Maraviroc remains valuable for specific patient subsets but faces stiff competition from newer, more convenient therapies.

- Pricing Outlook: Current premium prices are likely to decline significantly following patent expiries, with generic entry expected to reduce costs substantially.

- Market Trends: The HIV treatment landscape is shifting toward integrase inhibitors, reducing maraviroc's market share and revenue potential in the long term.

- Regulatory and Patent Dynamics: Patent expiries from 2023 onward could catalyze increased generic competition, impacting pricing strategies.

- Strategic Focus: Stakeholders should monitor developments in resistance patterns, formulation improvements, and combination regimens to capitalize on niche markets.

FAQs

1. What are the main factors influencing the price of SELZENTRY?

Market exclusivity, manufacturing costs, demand, insurance negotiations, and competition from generics primarily determine the drug's pricing. Patent protections delay generic entry, maintaining higher prices.

2. How does patent expiry affect the future pricing of maraviroc?

Patent expiration generally leads to increased generic competition, exerting downward pressure on prices, potentially reducing the cost by up to 70%.

3. Will the approval of new drugs replace maraviroc in HIV treatment?

While newer agents like INSTIs have become first-line treatments, maraviroc maintains a niche role in specific cases such as CCR5-tropic HIV, but overall, its market share is expected to diminish over time.

4. Are there ongoing development efforts to improve maraviroc or its uses?

Research focuses on combination therapies, resistance management, and improved tropism testing, but no significant pipeline developments aim to modify maraviroc itself.

5. How might pricing shifts impact patient access to maraviroc globally?

Price reductions post-patent expiry will likely improve access, especially in low-income regions, provided regulatory and reimbursement frameworks facilitate generic uptake.

References

[1] IQVIA, "Global HIV/AIDS Therapeutics Market Report," 2022.

[2] UNAIDS, "Global HIV & AIDS Statistics — 2022 Fact Sheet."

[3] GoodRx, "Price of SELZENTRY (maraviroc)," 2023.

[4] Pfizer, "Annual Report 2022," Pfizer Inc.

This analysis aims to facilitate informed decision-making for stakeholders planning for the evolving HIV treatment landscape and drug pricing environment.