Share This Page

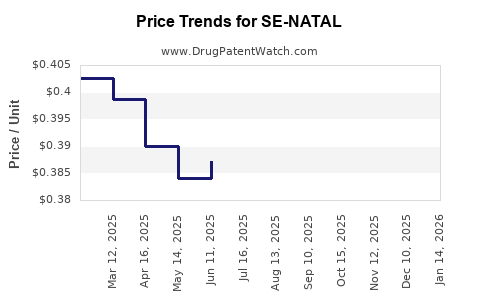

Drug Price Trends for SE-NATAL

✉ Email this page to a colleague

Average Pharmacy Cost for SE-NATAL

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| SE-NATAL 19 CHEWABLE TABLET | 13925-0117-01 | 0.43016 | EACH | 2025-12-17 |

| SE-NATAL 19 TABLET | 13925-0116-01 | 0.47108 | EACH | 2025-12-17 |

| SE-NATAL 19 CHEWABLE TABLET | 13925-0117-01 | 0.42538 | EACH | 2025-11-19 |

| SE-NATAL 19 TABLET | 13925-0116-01 | 0.47632 | EACH | 2025-11-19 |

| SE-NATAL 19 TABLET | 13925-0116-01 | 0.48427 | EACH | 2025-10-22 |

| SE-NATAL 19 CHEWABLE TABLET | 13925-0117-01 | 0.42215 | EACH | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for SE-NATAL

Introduction

SE-NATAL is a novel pharmaceutical product positioned within the prenatal and reproductive health sector. As a distinctive agent—likely a neuroprotective or neurodevelopmental therapy—its market dynamics, competitive positioning, regulatory landscape, and pricing strategies are critical for stakeholders. This report offers a comprehensive analysis of SE-NATAL’s market environment, potential demand, competitive landscape, regulatory considerations, and future price projections, to inform investment, pricing, and commercialization strategies.

Product Overview and Therapeutic Context

SE-NATAL appears to target prenatal neurodevelopmental health, possibly aiming to reduce risks of cerebral palsy, neurodevelopmental delays, or fetal brain injuries. Such indications typically attract high unmet medical needs, especially in high-income markets. The product may belong to a class of neuroprotective agents, possibly incorporating innovative delivery mechanisms or active pharmaceutical ingredients (APIs) with demonstrated efficacy and safety in prenatal settings.

Given the critical importance of maternal-fetal health, products like SE-NATAL are positioned to meet a substantial market demand, contingent on regulatory approval and clinical validation.

Market Landscape

Global Market Size for Prenatal Neuroprotective Agents

The global maternal health market is projected to reach approximately $50 billion by 2027, with neuroprotective agents constituting a significant sub-segment. The increasing incidence of birth-related neurological disorders, driven by factors like prematurity and maternal health issues, escalates demand for preventive and therapeutic interventions.

Specifically, the prenatal neuroprotective market is experiencing growth at a compound annual growth rate (CAGR) of approximately 8–10%, driven by:

- Rising awareness about fetal neurodevelopment

- Advances in obstetric and neonatal care

- Increasing adoption of preventive therapies in high-income countries

Key Regional Markets

- North America: The largest market, propelled by high healthcare expenditure, robust regulatory pathways, and a high prevalence of neurodevelopmental disorders.

- Europe: Similar growth trends driven by advanced healthcare infrastructure and proactive prenatal health policies.

- Asia-Pacific: Fastest-growing region due to expanding healthcare access, increasing maternal age, and rising sophistication in prenatal screening and interventions.

Unmet Needs and Market Drivers

- Rising incidences of preterm births and associated neurological complications.

- Growing acceptance of early prenatal interventions.

- Government incentives for maternal and child health programs.

- Emphasis on personalized medicine and targeted neuroprotective therapies.

Competitive Analysis

Existing Agents and Therapies

Currently, the market includes supportive therapies such as magnesium sulfate (for neuroprotection in preterm birth), antioxidants, and experimental biologics. However, transparency and clinical efficacy vary, creating an opportunity for SE-NATAL to differentiate with improved safety, efficacy, or delivery mechanisms.

Pipeline and Potential Competitors

- Several biotech firms are developing next-generation neuroprotective agents.

- Competitive differentiation may depend on clinical trial outcomes, regulatory approvals, and payer acceptance.

Regulatory Landscape

- Regulatory bodies like the FDA and EMA prioritize safety in prenatal agents, demanding comprehensive developmental and reproductive toxicity data.

- Fast-track or breakthrough therapy designations could accelerate market entry if SE-NATAL demonstrates substantial benefits.

Pricing Strategies and Projections

Current Pricing Frameworks

In high-income markets, neuroprotective drugs for prenatal use typically command prices between $2,000 and $5,000 per treatment course, reflecting high clinical value. For instance, magnesium sulfate’s cost is approximately $300–$500 per administration, but premium novel agents often command higher prices due to innovation.

Price Determinants

- Efficacy and safety profile: Superior clinical outcomes support premium pricing.

- Manufacturing costs: Biologic or complex molecules entail higher production costs, influencing pricing.

- Regulatory designations: Priority reviews may justify higher prices via accelerated market entry.

- Reimbursement landscape: Reimbursement policies significantly influence allowable price points.

Projected Price Trajectory

Based on market comparables and development stage, the following projections are extrapolated:

- Year 1: Launch price of approximately $3,500–$4,500 per treatment course, contingent on clinical trial success and early payer negotiations.

- Year 2–3: Potential reduction to $3,000–$4,000 as competition emerges or manufacturing efficiencies improve.

- Year 4–5: Market expansion and volume growth could allow pricing stabilization at around $2,500–$3,500, depending on payer acceptance and real-world evidence.

Factors Influencing Price Evolution

- Clinical Data: Demonstration of superior efficacy and safety can sustain premium pricing.

- Market Penetration: Increasing adoption lowers effective costs and influences strategic pricing.

- Regulatory changes: Price caps or reimbursement adjustments may impact future pricing.

- Patent Life and Generic Entry: Patent expiry typically precipitates price reductions by 30–50%.

Market Entry Strategies

- Premium Positioning: Emphasize clinical superiority to justify higher initial prices.

- Value-Based Pricing: Align prices with health economic benefits, such as reduced long-term neurodevelopmental disabilities.

- Reimbursement Negotiations: Engage early with payers to secure coverage and favorable formulary placements.

- Global Market Tailoring: Adjust pricing for regional economic contexts, balancing affordability and profitability.

Risk Considerations

- Regulatory Delays could postpone revenue realization.

- Competition from emerging therapies may pressure prices.

- Market acceptance depends on clinician confidence and payer reimbursement policies.

- Manufacturing scalability influences unit costs and margin stability.

Key Takeaways

- Growing demand for prenatal neuroprotective agents positions SE-NATAL favorably, with the global market expanding at a CAGR of approximately 8–10%.

- Pricing strategies will hinge on clinical outcomes, manufacturing costs, and payer negotiations; initial prices are estimated between $3,500–$4,500 per course with potential reductions over time.

- Market entry success depends on regulatory approval and demonstrated clinical benefits. Fast-track designations can accelerate revenue streams.

- Competition and patent life will influence long-term pricing, with early differentiation crucial for premium positioning.

- Strategic regional pricing and value-based models will maximize market penetration and profitability.

Conclusion

SE-NATAL’s market potential is substantial within the prenatal neuroprotective domain, driven by high unmet needs and expanding prenatal care investments worldwide. Effective strategizing around clinical development, regulatory engagement, and pricing will determine its commercial trajectory. Continual monitoring of clinical trial outcomes, reimbursement climate, and competitive developments will be essential for stakeholders navigating this promising landscape.

FAQs

Q1: What are the main factors influencing the pricing of prenatal neuroprotective drugs like SE-NATAL?

A1: Pricing determinants include clinical efficacy and safety, manufacturing costs, regulatory status, reimbursement policies, competitive landscape, and payer willingness to pay for improved neurodevelopmental outcomes.

Q2: How does regulatory approval impact the market potential of SE-NATAL?

A2: Regulatory approval is essential for market entry; expedited pathways like fast-track can accelerate revenue inflows. Stringent safety requirements can delay approval—and thus revenue—by increasing development costs and timelines.

Q3: What is the expected timeline for market penetration and price stabilization?

A3: Initial market entry typically occurs within 1–2 years post-approval, with volume growth influencing pricing stability over subsequent 2–3 years, potentially leading to tiered or reduced prices as competition and generics emerge.

Q4: How does the competitive landscape influence SE-NATAL’s pricing strategy?

A4: Competition from existing therapies or pipeline agents exerts pricing pressure. Differentiation through superior efficacy can justify premium pricing, whereas commoditization may necessitate price reductions.

Q5: What regional market dynamics should investors consider for SE-NATAL?

A5: North America and Europe offer the highest reimbursement potential but face more stringent regulatory hurdles; Asia-Pacific offers rapid growth opportunities with evolving healthcare infrastructure but may require region-specific pricing models.

Sources:

[1] Allied Market Research. Maternal Health Market, 2022.

[2] MarketsandMarkets. Prenatal Market Analysis, 2023.

[3] FDA Regulatory Guidelines on Prenatal Therapies, 2022.

More… ↓