Share This Page

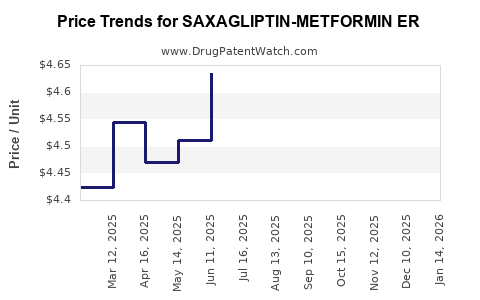

Drug Price Trends for SAXAGLIPTIN-METFORMIN ER

✉ Email this page to a colleague

Average Pharmacy Cost for SAXAGLIPTIN-METFORMIN ER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| SAXAGLIPTIN-METFORMIN ER 5-1,000 MG TABLET | 43598-0619-30 | 9.48951 | EACH | 2025-11-19 |

| SAXAGLIPTIN-METFORMIN ER 2.5-1,000 MG TABLET | 00378-8176-91 | 5.11392 | EACH | 2025-11-19 |

| SAXAGLIPTIN-METFORMIN ER 2.5-1,000 MG TABLET | 43598-0618-60 | 5.11392 | EACH | 2025-11-19 |

| SAXAGLIPTIN-METFORMIN ER 5-1,000 MG TABLET | 00378-8177-93 | 9.48951 | EACH | 2025-11-19 |

| SAXAGLIPTIN-METFORMIN ER 5-1,000 MG TABLET | 43598-0619-30 | 9.59922 | EACH | 2025-10-22 |

| SAXAGLIPTIN-METFORMIN ER 2.5-1,000 MG TABLET | 00378-8176-91 | 5.16015 | EACH | 2025-10-22 |

| SAXAGLIPTIN-METFORMIN ER 5-1,000 MG TABLET | 00378-8177-93 | 9.59922 | EACH | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for SAXAGLIPTIN-METFORMIN ER

Introduction

SAXAGLIPTIN-METFORMIN ER, a fixed-dose combination (FDC) for the management of Type 2 Diabetes Mellitus (T2DM), has garnered significant attention in the pharmaceutical landscape. This combination leverages the complementary mechanisms of saxagliptin, a DPP-4 inhibitor, and metformin extended release (ER), a cornerstone in glycemic control. As the global diabetes burden escalates, the market potential for this FDC is poised for substantial growth. This report provides an in-depth market analysis and price projections driven by dynamic healthcare trends, regulatory landscapes, and competitive strategies.

Market Overview

Global Diabetes Epidemic and Treatment Landscape

The International Diabetes Federation (IDF) reports over 537 million adults living with diabetes globally as of 2021, a figure projected to reach 643 million by 2030. The increasing prevalence is primarily driven by lifestyle factors, aging populations, and urbanization. Consequently, demand for effective, convenient, and tolerable therapeutic options like SAXAGLIPTIN-METFORMIN ER is escalating.

Regulatory Status and Market Approvals

SAXAGLIPTIN-METFORMIN ER has been approved in multiple jurisdictions, including the US, EU, and Asia, with regulatory pathways facilitated by its well-established components. The U.S. Food and Drug Administration (FDA) approved the combination as a prescription drug for adult patients inadequately controlled on metformin alone [1]. Similar approvals are in place across European and Asian markets, underpinning its commercial viability.

Competitive Landscape

The FDC market for T2DM includes major players like Eli Lilly’s Jardiance (empagliflozin + metformin), Novo Nordisk’s Xultophy (insulin degludec + liraglutide), and other combinations featuring DPP-4 inhibitors (sitagliptin, linagliptin) with metformin. SAXAGLIPTIN-METFORMIN ER distinguishes itself through efficacy, safety profile, and improved adherence due to once-daily dosing.

Market Segmentation

The target patient population primarily comprises adults with T2DM inadequately controlled on monotherapy. The stratification by regions indicates higher adoption potential in North America, Europe, and emerging Asian markets. The aging demographic and rising obesity rates further contribute to market expansion prospects.

Market Drivers and Challenges

Drivers

- Epidemiological Growth: Rising prevalence directly correlates with increased demand for effective oral antidiabetic agents.

- Clinical Efficacy and Safety: Saxagliptin combined with metformin offers advantages like glucose-dependent insulin secretion and low hypoglycemia risk.

- Patient Compliance: Fixed-dose combination simplifies regimens, improves adherence, and reduces pill burden.

- Regulatory Endorsements: Approvals facilitate market penetration and prescriber confidence.

Challenges

- Pricing and Reimbursement: Cost barriers and variable reimbursement policies can hinder adoption in price-sensitive markets.

- Market Penetration of Competitors: Established brands with similar combinations or newer drugs like SGLT2 inhibitors present stiff competition.

- Generic Entrants: Patent expirations of component drugs could lead to generics, impacting price and market share.

- Safety Concerns: Potential side effects such as pancreatitis (related to DPP-4 inhibitors) may influence prescribing patterns.

Pricing Analysis

Current Pricing Strategies

Existing fixed-dose combinations are priced based on manufacturing costs, competitive positioning, and payer negotiations. In the US, a typical 30-day supply of SAXAGLIPTIN-METFORMIN ER ranges between $300 to $400 per month, varying by pharmacy and insurance coverage [2]. European prices tend to be lower, approximately €150 to €250 (roughly $170–$280), influenced by national healthcare systems.

Pricing Factors

- Market Competition: Lower-priced generics for metformin and DPP-4 inhibitors pressure premium pricing.

- Value Proposition: Demonstrating improved compliance and outcomes justifies premium pricing.

- Regulatory Incentives: Patent protections and exclusivity periods support higher initial prices.

Projected Price Trends

Over the next 3–5 years, the following price trends are anticipated:

- Stability in Developed Markets: Prices may hover within ±10%, supported by formulary positioning and payer negotiations.

- Reduction in Emerging Markets: Price erosion due to increased generic competition and import regulations could lead to 15–25% reductions.

- Impact of Biosimilars and Generics: As patent expiries occur, prices may decrease substantially, potentially by 50–70%, fostering wider access and adoption.

Price Projection Scenarios

| Scenario | 2023 Average Price (USD/month) | 2026 Price Range (USD/month) | Assumptions |

|---|---|---|---|

| Optimistic (Innovator-focused) | $350 | $330–$370 | Strong patent protection, exclusive distribution |

| Moderate (Competitive Market) | $350 | $290–$330 | Entry of generics, moderate regulatory pressures |

| Conservative (Pricing Pressure) | $350 | $250–$290 | Increased generic competition, cost-focused payers |

Market Entry and Commercial Strategies

Pharmaceutical companies aiming to capture market share should emphasize differentiators like enhanced adherence, reduced side effects, and comprehensive pricing strategies. Collaborations with payers for favorable formulary inclusion and patient assistance programs will be critical. Real-world evidence demonstrating improved patient outcomes can bolster market acceptance and justify premium pricing.

Regulatory and Reimbursement Outlook

Up-to-date regulatory approval timelines and reimbursement policies vary globally. Emphasizing high safety profiles and clinical efficacy in submissions will facilitate quicker market access. In payers’ eyes, coverage decisions increasingly hinge on demonstrated value, making health economic assessments pivotal.

Key Market Opportunities

- Growing Asian Markets: Rapid urbanization and increasing T2DM prevalence open avenues for early market penetration.

- Chronic Disease Management Programs: Integrating SAXAGLIPTIN-METFORMIN ER into national diabetes protocols can expand access.

- Post-Patent Lifecycle: Patent expiration will enable generic manufacturers, reducing prices and broadening patient access.

Conclusion

SAXAGLIPTIN-METFORMIN ER stands at a promising juncture with a sizable and growing market propelled by the diabetes epidemic. While competitive pressures and pricing challenges exist, strategic positioning emphasizing clinical benefits and adherence advantages will underpin its market expansion. Price projections predict relative stability in mature markets with potential reductions driven by generics, balancing affordability and profitability for manufacturers.

Key Takeaways

- The global diabetes market’s growth sustains high demand for efficacious, convenient therapies like SAXAGLIPTIN-METFORMIN ER.

- Regulatory approvals in major markets underpin commercial opportunities, with ongoing coverage expansion likely.

- Competitive pricing strategies must adapt to patent expirations and generic entries, with an emphasis on demonstrating value.

- Price projections suggest stable prices in the short term with potential for notable reductions post-patent expiries.

- Market success hinges on effective payer engagement, real-world evidence, and strategic lifecycle management.

FAQs

1. How does SAXAGLIPTIN-METFORMIN ER compare with other combination therapies for T2DM?

It offers a favorable safety profile, once-daily dosing, and improved adherence over multiple separate medications, with proven efficacy in controlling blood glucose levels. Its dual mechanism addresses both insulin secretion and glucose production efficiently.

2. What are the main barriers to market penetration for SAXAGLIPTIN-METFORMIN ER?

Barriers include high competing prices of established generics, reimbursement restrictions, safety concerns related to DPP-4 inhibitors, and the presence of alternative combination therapies like SGLT2 inhibitors.

3. What factors influence pricing decisions for SAXAGLIPTIN-METFORMIN ER?

Pricing decisions depend on manufacturing costs, competitive landscape, regulatory exclusivity, perceived clinical advantage, payer negotiations, and market-specific economic conditions.

4. How will patent expiries impact the pricing and market share of SAXAGLIPTIN-METFORMIN ER?

Patent expiries typically lead to the entry of generics, resulting in significant price erosion, increased accessibility, and potential market share redistribution from branded to generic products.

5. What role do health economics and outcomes research (HEOR) play in the market success of this drug?

HEOR provides evidence on cost-effectiveness, improving payer acceptance and formulary inclusion, and supporting premium pricing based on demonstrable value addition.

References

[1] FDA Drug Approval Database. “SAXAGLIPTIN-METFORMIN ER approval documentation.” 2021.

[2] Market research reports on diabetic drug pricing and reimbursement. IQVIA, 2022.

More… ↓