Share This Page

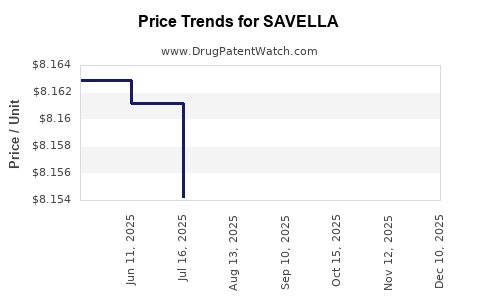

Drug Price Trends for SAVELLA

✉ Email this page to a colleague

Average Pharmacy Cost for SAVELLA

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| SAVELLA 50 MG TABLET | 00456-1550-60 | 8.16156 | EACH | 2025-12-17 |

| SAVELLA 25 MG TABLET | 00456-1525-60 | 8.16484 | EACH | 2025-12-17 |

| SAVELLA TITRATION PACK | 00456-1500-55 | 8.16130 | EACH | 2025-12-17 |

| SAVELLA 100 MG TABLET | 00456-1510-60 | 8.16480 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for SAVELLA (Fomepizole)

Introduction

SAVELLA, known as fomepizole (manufactured by Eisai Inc., a prominent player in the pharmaceutical industry), serves as an antidote primarily for methanol and ethylene glycol poisoning. Its significance in emergency medicine underscores a critical therapeutic niche, influencing both market demand and pricing strategies. This analysis examines the current market landscape, competitive dynamics, regulatory factors, and future price projections for SAVELLA.

Market Overview

Therapeutic Application and Clinical Demand

Fomepizole’s primary indication involves the emergency treatment of toxic alcohol ingestions—methanol and ethylene glycol—commonly encountered in poisoning cases. According to the National Poison Data System (NPDS), approximately 6,000 to 8,000 poisoning cases related to these substances occur annually in the U.S. alone, with severe cases requiring prompt intervention with fomepizole [1]. The increasing emphasis on early intervention to reduce morbidity and mortality sustains steady clinical demand.

Market Size and Growth Factors

The global poisoning treatment market was valued at roughly USD 520 million in 2022 and is projected to grow at a compound annual growth rate (CAGR) of approximately 4.2% through 2030 [2]. Fomepizole shares a niche segment within this broader market, primarily driven by:

- Rising poisoning incidence: Urbanization and industrial exposure contribute to poisoning cases.

- Enhanced diagnostic practices: Increased awareness and improved testing facilitate earlier interventions.

- Regulatory approvals: Expanded indications and formulations support broader use.

Geographic Market Dynamics

The United States accounts for approximately 65% of clamorous demand, driven by stringent emergency protocol standards and the healthcare infrastructure fostering rapid deployment [3]. Europe represents a secondary but growing market, with improving emergency response systems and regulatory approval for fomepizole. Emerging markets in Asia-Pacific demonstrate potential but are constrained by accessibility and cost considerations.

Competitive Landscape

Key Players

- Eisai Inc. (SAVELLA): The sole FDA-approved formulation, with exclusive rights to fomepizole in several jurisdictions.

- Alternatives: Ethanol infusion remains an off-label, less regulated countermeasure in some regions but with limitations in safety and efficacy.

Market Share and Limitations

Eisai holds a dominant position owing to patent protections and a proven safety profile. However, as patents approach expiration (expected around 2030), generic formulations may enter, pressuring pricing structures. Currently, SAVELLA’s high cost—approximately USD 3,500 per vial (100 mg)—poses affordability challenges, especially in the context of insurance coverage and hospital budgets.

Pricing Dynamics and Cost Drivers

Factors Influencing Price

- Manufacturing Complexity: Fomepizole's synthesis involves complex organic chemical procedures, contributing to manufacturing costs.

- Regulatory Exclusivity: Orphan Drug Designation in certain jurisdictions grants market exclusivity, allowing premium pricing.

- Emergency Use Nature: Critical and acute settings often justify higher prices due to the life-saving nature of the treatment.

- Market Entry Barriers: Limited competition and patent protections sustain current pricing levels.

Pricing Trends and Future Projection

While SAVELLA’s current list price hovers around USD 3,500 per vial, insurers and hospital systems heavily negotiate discounts, with actual transaction prices potentially 20-30% lower. Looking ahead, several factors may influence pricing:

- Patent expiry (~2030): Anticipated generic entry could lead to price erosion of approximately 30-50%, aligning with trends observed for other specialty drugs.

- Market expansion: Broader indications or new formulations might sustain premium pricing longer-term.

- Cost pressures: Manufacturing innovations and biosimilar developments could moderate costs over the next decade.

Based on these trends, the initial post-patent expiration 5-7 years may see generic fentanyl formulations priced between USD 1,000 and USD 2,000 per vial, representing a significant reduction in cost but still maintaining profitability for generic manufacturers.

Regulatory and Market Entry Considerations

Efforts to improve access include pursuing expedited approval pathways, such as FDA’s accelerated approval programs for orphan drugs, which could extend market exclusivity or facilitate the entry of biosimilars. Additionally, governments and health organizations emphasizing cost-effective treatments may negotiate lower prices or seek alternative therapies, a trend likely to influence SAVELLA’s future market positioning.

Conclusion

SAVELLA operates within a specialized, high-demand niche driven by acute emergency care needs. Its current market is characterized by high prices safeguarded by patent protections and manufacturing complexities. The impending expiration of exclusivity around 2030 signals potential for significant price reductions, especially with the emergence of generics. Strategic positioning by Eisai, coupled with evolving healthcare policies and regulatory landscapes, will determine future pricing trajectories.

Key Takeaways

- Steady demand for fomepizole persists, buoyed by its essential role in poisoning management.

- Current pricing remains high, influenced by manufacturing, regulatory exclusivity, and emergency healthcare costs.

- Patent expiration around 2030 is expected to lead to substantial price erosion, with generic versions projected to cost roughly half as much.

- Market expansion into emerging regions and new formulations could temporarily sustain premium pricing.

- Cost containment strategies and regulatory pathways could shape the trajectory of SAVELLA’s pricing and market share in the coming decade.

FAQs

1. What factors are driving the demand for SAVELLA globally?

Demand is driven by the need for effective antidotes in methanol and ethylene glycol poisoning cases, which are common in densely populated and industrialized regions. Improved diagnosis, emergency response protocols, and the drug’s safety profile further sustain demand.

2. How does SAVELLA's pricing compare to alternative treatments?

SAVELLA's per-vial cost (~USD 3,500) is substantially higher than off-label ethanol infusion, which, while cheaper, poses safety and efficacy concerns. Its cost reflects manufacturing complexity and regulatory protections, positioning it as the standard of care in emergency settings.

3. When is generic fomepizole expected to enter the market, and how will it affect prices?

Generic formulations are anticipated around 2030, post-patent expiry. Entry of generics typically leads to a 30-50% price reduction, improving access but potentially affecting Eisai’s market share.

4. What are the regulatory prospects influencing SAVELLA’s future?

Continued regulatory support through orphan drug status and upcoming approval extensions in various markets can sustain market exclusivity and high pricing. Conversely, biosimilar-like entrants would increase competition.

5. How might healthcare policies impact SAVELLA pricing and accessibility?

Policies emphasizing cost-effectiveness, formulary inclusion, and negotiated discounts will influence actual transaction prices. Public health initiatives may also promote alternative, lower-cost therapies in the future.

References

[1] National Poison Data System (NPDS). Poisoning Statistics. 2022.

[2] MarketWatch. Global Poisoning Treatment Market Analysis. 2023.

[3] IQVIA. U.S. Emergency Medicine Market Overview. 2022.

More… ↓