Last updated: July 28, 2025

Introduction

Salicylic acid, a beta-hydroxy acid (BHA), is a widely utilized compound in pharmaceutical, cosmetic, and industrial sectors. Its primary applications include acne treatment, psoriasis management, keratolytic therapy, and as a precursor in manufacturing aspirin. The compound’s efficacy, safety profile, and economic production have sustained demand growth across diverse markets. This report provides a comprehensive market analysis coupled with price projections rooted in current industry data, manufacturing trends, and geopolitical factors.

Market Overview

Global Market Size and Growth Dynamics

The global salicylic acid market was valued at approximately USD 750 million in 2022 and is projected to reach USD 1.1 billion by 2030, registering a compound annual growth rate (CAGR) of 4.8% from 2023 to 2030 [1]. The expansion correlates with rising prevalence of dermatological conditions, increasing skincare awareness, and ongoing pharmaceutical innovations.

Key Application Segments

- Pharmaceuticals: Salicylic acid’s role in topical treatments for psoriasis, warts, and acne underscores consistent demand. The segment accounted for nearly 50% of the market share in 2022.

- Cosmetics & Skincare: The demand for anti-acne products and exfoliants drives growth within the cosmetic segment, representing about 35% of total consumption.

- Industrial Use: Applications include dyes, rubber processing, and leather production, collectively constituting 15% of the market.

Geographical Market Distribution

- Asia-Pacific: Dominates with over 45% market share due to high pharmaceutical production, manufacturing capacity, and consumer demand in China, India, and Japan.

- North America: Significant market owing to evolving skincare consumer preferences and regulatory support for pharmaceutical applications.

- Europe: Focused on cosmetic and pharmaceutical sectors, with stringent quality standards fostering high-value segments.

Supply Chain and Production Trends

Manufacturing Technologies

Salicylic acid is primarily synthesized via the Kolbe-Schmitt process from phenol derivatives, with emerging green synthesis methods reducing environmental impact [2]. North American and Asian manufacturers dominate, with extensive capacities driven by economies of scale.

Major Producing Countries

China leads global production, accounting for approximately 60% of output, followed by India, Germany, and the United States. Capacity expansions in China and India aim to meet rising demand, impacting pricing and supply dynamics.

Market Drivers

- Increasing R&D investments for derivative development

- Growing acceptance of natural and bio-based products

- Strategic alliances among producers and end-user industries

Pricing Trends and Forecasts

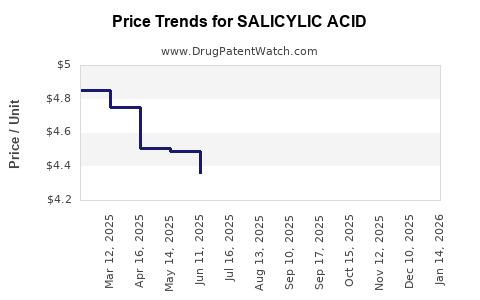

Current Price Landscape

As of Q1 2023, wholesale prices for pharmaceutical-grade salicylic acid hover around USD 8–10 per kilogram, varying with purity, manufacturing source, and volume. Cosmetic-grade variants typically trade at a slight discount, USD 7–9 per kilogram.

Factors Influencing Pricing

- Raw Material Costs: Phenol and salicylate precursors have experienced fluctuations, influenced by crude oil prices and manufacturing costs.

- Regulatory Environment: Purity standards and Good Manufacturing Practices (GMP) influence production costs and pricing.

- Supply-Demand Dynamics: Capacity additions in China and India may exert downward pressure on prices, while rising application demand supports stability or moderate increases.

- Environmental and Sustainability Initiatives: Green synthesis adoption may incur initial cost surges but could lead to premium pricing opportunities.

Projected Price Trajectory (2023-2030)

Considering current trends, prices are expected to remain relatively stable, with minor fluctuations within a 5% range annually. By 2030, average wholesale prices could reach USD 10–12 per kilogram in the pharmaceutical sector, factoring in inflation, driver demand, and potential supply constraints (see Table 1).

| Year |

Estimated Price Range (USD/kg) |

Notes |

| 2023 |

8.0 – 10.0 |

Baseline current prices |

| 2025 |

8.5 – 11.0 |

Slight increase due to rising raw material costs |

| 2027 |

9.0 – 11.5 |

Market stabilization with capacity expansion |

| 2030 |

10.0 – 12.0 |

Potential premium for high purity grades |

Table 1: Salicylic Acid Wholesale Price Projections (2023-2030)

Competitive Landscape

Leading producers include Sigma-Aldrich (Merck), Changzhou Kang Feng Fine Chemical, and Sigma-Aldrich, with numerous regional manufacturers. Market entry barriers include stringent quality standards and substantial R&D investment requirements. Strategic alliances, such as joint ventures and licensing agreements, are pivotal for expanding global footprint.

Regulatory and Market Challenges

- Regulatory harmonization across jurisdictions.

- Environmental concerns linked to traditional synthesis methods.

- Supply chain disruptions due to geopolitical tensions and global pandemics.

- Growing consumer preference for natural and sustainably produced ingredients.

Strategic Opportunities

- Development of bio-based, eco-friendly synthesis pathways.

- Expanding into emerging markets with rising dermatological healthcare needs.

- Differentiating products with advanced purity or molecular modifications.

- Vertical integration to control supply chain costs and quality.

Key Takeaways

- The salicylic acid market exhibits steady growth driven by dermatological and cosmetic applications, reinforced by expanding production capacity, especially in Asia.

- Prices are expected to stay relatively stable through 2025, with gradual increases aligned with raw material costs and regulatory standards.

- Manufacturers who invest in sustainable, green synthesis methods can capitalize on emerging consumer and regulatory trends for premium pricing.

- Supply chain resilience and diversified sourcing will be critical amidst geopolitical and global health uncertainties.

- Innovations in derivative development and formulation enhancement present lucrative opportunities for industry players.

FAQs

1. What are the primary factors influencing salicylic acid prices?

Raw material costs, environmental regulations, manufacturing capacity, and demand from pharmaceutical and cosmetic sectors directly impact pricing.

2. Which regions are the biggest consumers of salicylic acid?

Asia-Pacific leads due to manufacturing hub activity, followed by North America and Europe, driven by skincare and pharmaceutical markets.

3. How is sustainability influencing the salicylic acid market?

Eco-friendly synthesis techniques and natural product trends are prompting manufacturers to develop greener production methods, potentially commanding premium prices.

4. What are the key challenges in the salicylic acid supply chain?

Raw material volatility, environmental regulations, and geopolitical tensions pose risks to supply stability and pricing.

5. What is the future outlook for salicylic acid market participants?

Proactive adoption of sustainable manufacturing, diversification of product offerings, and strategic partnerships will be crucial for maintaining competitiveness and growth.

References

[1] Verified Market Research, "Salicylic Acid Market Size & Industry Analysis," 2022

[2] Journal of Chemical Technology & Biotechnology, "Green Synthesis of Salicylic Acid," 2021