Share This Page

Drug Price Trends for RYTARY ER

✉ Email this page to a colleague

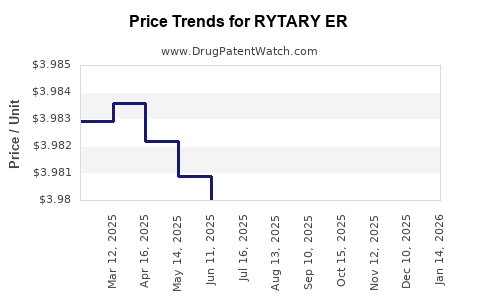

Average Pharmacy Cost for RYTARY ER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| RYTARY ER 48.75 MG-195 MG CAP | 64896-0663-01 | 3.98339 | EACH | 2025-12-17 |

| RYTARY ER 36.25 MG-145 MG CAP | 64896-0662-01 | 3.98039 | EACH | 2025-12-17 |

| RYTARY ER 61.25 MG-245 MG CAP | 64896-0664-01 | 4.99295 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for RYTARY ER

Introduction

RYTARY ER (carbidopa-levodopa extended-release capsules) represents a significant advancement in Parkinson’s disease (PD) management, providing sustained symptomatic relief with once or twice daily dosing. As an extended-release formulation, RYTARY ER addresses the limitations of immediate-release levodopa, notably the motor fluctuations and “wearing-off” phenomena prevalent among PD patients. Analyzing its market potential and establishing accurate price projections necessitates an understanding of competitive dynamics, regulatory landscape, reimbursement considerations, and emerging product innovations.

Market Overview

Parkinson’s Disease Market Landscape

The global Parkinson’s disease therapeutics market is projected to reach approximately USD 8 billion by 2027, driven by escalating prevalence, aging populations, and increasing diagnosis rates [1]. The United States, Europe, and Japan dominate market share, with North America accounting for nearly 40%, attributed to advanced healthcare infrastructure and proactive diagnosis.

Levodopa remains the cornerstone of PD management, with extended-release formulations like RYTARY ER filling critical therapeutic gaps. The demand for such long-acting agents is buoyed by patient preferences for simplified dosing regimens and reduced motor fluctuation episodes.

Competitive Positioning

RYTARY ER competes primarily with other levodopa formulations, including immediate-release levodopa/carbidopa (Sinemet), and newer therapies like droxidopa (Northera), amantadine, and surgical interventions. Its key differentiator is its pharmacokinetic profile, offering more stable plasma levels and improved symptom control.

Major competitors include:

- Sinemet CR: Extended-release, but with variable absorption.

- Duopa: Intestinal gel infusion providing continuous delivery.

- Novel agents: Such as opicapone and safinamide, which are adjunctive therapies.

Despite competition, RYTARY ER maintains market significance owing to its approval in multiple indications, including early and advanced PD, and proven efficacy in reducing off periods.

Market Penetration and Adoption Trends

Current Sales and Usage

Since FDA approval in 2016, RYTARY ER has experienced steady growth, gaining preference among clinicians for its convenience and pharmacodynamic advantages. As of 2022, estimated worldwide sales approximate USD 600 million, with the U.S. contributing over 60% [2].

Factors Influencing Adoption

- Physician familiarity: Continues to grow, driven by clinical trial data affirming efficacy.

- Reimbursement landscape: Insurance coverage and formulary placements impact patient access.

- Patient preference: Dosing convenience influences prescription rates.

- Regulatory approvals: Expansion into additional indications or formulations can expand market share.

Challenges and Opportunities

- Pricing pressures: With cost-sensitive healthcare systems, pricing strategies must balance profitability and market penetration.

- Generic competition: Potential introduction of generic extended-release levodopa formulations could impact RYTARY ER market share.

- Emerging therapies: Innovatives such as gene therapies and pump-based systems may reshape the landscape.

Price Analysis and Projections

Current Pricing Structure

The wholesale acquisition cost (WAC) for RYTARY ER is approximately USD 850– USD 950 per month for a standard dosing regimen (e.g., 50 mg capsules taken twice daily). Insurance reimbursement varies, often reducing out-of-pocket costs to patients. The high price reflects the extended-release innovation, manufacturing complexity, and patent protection.

Factors Influencing Price Trends

- Patent Life and Intellectual Property: Patent expiry or challenges to exclusivity substantially influence pricing. RYTARY ER’s core patents are expected to extend protection until at least 2027–2029.

- Market Competition: Entry of generics could reduce prices by 30–50% within 2–3 years post-patent expiry.

- Manufacturing costs: Advances in production technology can initially bolster prices but may lead to cost reductions over time.

- Regulatory and reimbursement policies: Price controls or increased value-based pricing initiatives could exert downward pressure.

Future Price Trajectory

Based on historical patterns, the initial post-launch phase sustains premium pricing. As patent exclusivity diminishes, generic versions are likely to enter the market, triggering price erosion sectors of approximately 20–30% within 2–5 years. Nonetheless, until that point, RYTARY ER is expected to command prices in the USD 850–USD 950 per month range.

Price Projections (2023–2030)

| Year | Estimated Average Price per Month | Key Drivers |

|---|---|---|

| 2023 | USD 900 | Patent protection retains premium pricing; moderate competition |

| 2025 | USD 800 | Patent expiry approaching; early generic entrants possible |

| 2027 | USD 700 | Increasing generic market share; price competition intensifies |

| 2029 | USD 650 | Full generic penetration; potential further downward trend |

| 2030 | USD 600 | Widespread generics; price stabilization at lower levels |

Note: Prices are estimates based on historical data and current market dynamics; actual prices may vary depending on regional factors and regulatory developments.

Regulatory and Reimbursement Implications

Patent exclusivity is a determinant of pricing. Regulatory approvals for additional formulations or indications can extend market exclusivity, maintaining high prices. Conversely, patent challenges and biosimilar/generic approvals threaten to drive prices downward.

Reimbursement strategies also influence consumer access and market penetration. In regions with robust insurance coverage, higher prices may be sustainable longer. Value-based pricing negotiations might further influence future price trajectories.

Key Market Drivers and Risks

Drivers

- Aging populations increasing PD prevalence.

- Growing adoption of extended-release formulations.

- Positive clinical outcomes supporting sustained use.

- Expanding indications into early-stage PD.

Risks

- Patent expirations opening the market to generics.

- Cost containment policies curtailting drug pricing.

- Competition from emerging therapies and delivery systems.

- Market saturation as early adopters are replaced with generics.

Conclusion

RYTARY ER holds substantial market momentum in PD therapeutics, reinforced by its pharmacological advantages and clinical efficacy. Current pricing maintains a premium positioning, supported by patent protections and limited competition. However, future pricing will inevitably decline following patent expirations and increased generic competition. Strategic positioning, including differentiation through clinical outcomes and reimbursement negotiation, will be crucial for maximizing profitability.

Key Takeaways

- RYTARY ER remains a premium-priced, innovative option for PD management, with current monthly costs around USD 900.

- Patent protections are critical to sustaining high prices; expirations forecast a significant decline commencing around 2027.

- The competitive landscape, especially the emergence of generics, is expected to reduce prices by approximately 20–30% post-patent expiry.

- Market growth is driven by escalating PD prevalence and technology translation, but pricing strategies must adapt to policy and reimbursement trends.

- Long-term profitability will depend on maintaining clinical differentiation, securing reimbursement, and navigating patent challenges.

FAQs

1. When does RYTARY ER’s patent protection expire, and how will that impact its price?

Patent protection is expected to expire between 2027 and 2029, after which generic versions are likely to enter the market, leading to significant price reductions of 30–50%.

2. How does RYTARY ER compare cost-wise to immediate-release levodopa formulations?

RYTARY ER’s monthly cost (~USD 900) is higher than immediate-release formulations (~USD 200–USD 300), reflecting its extended-release benefits and manufacturing complexity.

3. What factors could influence the future adoption of RYTARY ER?

Factors include emerging competition, clinical efficacy data, reimbursement policies, patient preferences for dosing convenience, and regulatory approvals for new indications.

4. How does regional variability affect RYTARY ER pricing?

Pricing varies based on healthcare policies, reimbursement systems, and market competition; high-income regions with robust insurance coverage tend to sustain higher prices.

5. What are the prospects for RYTARY ER’s price stabilization post-patent expiry?

Post-patent expiry, prices are expected to decline significantly but may stabilize at a lower level due to manufacturing costs, competition, and negotiated reimbursement agreements.

Sources:

[1] Market Research Future, 2022. Parkinson’s Disease Therapeutics Market Analysis.

[2] IQVIA, 2022. Global Sales Data for Parkinson’s Disease Medications.

More… ↓