Share This Page

Drug Price Trends for RYBELSUS

✉ Email this page to a colleague

Average Pharmacy Cost for RYBELSUS

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| RYBELSUS 14 MG TABLET | 00169-4314-30 | 32.20110 | EACH | 2025-12-17 |

| RYBELSUS 3 MG TABLET | 00169-4303-30 | 32.19441 | EACH | 2025-12-17 |

| RYBELSUS 7 MG TABLET | 00169-4307-30 | 32.20679 | EACH | 2025-12-17 |

| RYBELSUS 14 MG TABLET | 00169-4314-30 | 32.19922 | EACH | 2025-11-19 |

| RYBELSUS 3 MG TABLET | 00169-4303-30 | 32.19482 | EACH | 2025-11-19 |

| RYBELSUS 7 MG TABLET | 00169-4307-30 | 32.20469 | EACH | 2025-11-19 |

| RYBELSUS 7 MG TABLET | 00169-4307-30 | 32.20020 | EACH | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for RYBELSUS

Introduction

RYBELSUS (semaglutide) tablets represent a pivotal advancement in the management of type 2 diabetes mellitus. As an oral GLP-1 receptor agonist, RYBELSUS offers a convenience factor that has energized its market potential, positioning it as a competitive alternative to injectable GLP-1 therapies. This report provides a comprehensive market analysis and price projections, appraising current dynamics, competitive landscape, reimbursement factors, and future trends influencing RYBELSUS’s commercial trajectory.

Market Overview

Therapeutic Context

Type 2 diabetes (T2D) affects over 400 million globally, with significant morbidity and mortality burdens primarily due to macrovascular and microvascular complications. The market for T2D therapeutics is mature but still expanding, driven by the unmet need for agents that combine efficacy, safety, and patient adherence advantages.

Current Treatment Landscape

The advent of GLP-1 receptor agonists transformed T2D management by offering superior glycemic control, weight loss benefits, and cardiovascular risk reduction [1]. Traditionally administered via injections, their subcutaneous delivery posed barriers to adherence. The approval of oral semaglutide (RYBELSUS) in 2019 addressed these concerns, promising improved patient compliance and broader market access.

Market Penetration to Date

Since its launch, RYBELSUS has experienced rapid uptake in the U.S. and select international markets. According to IQVIA data, its sales in 2022 reached approximately $2.2 billion, representing a significant fraction of the oral antidiabetic market [2]. Its growth has been supported by clinical evidence demonstrating non-inferiority to injectable counterparts and positive cardiovascular outcomes.

Competitive Landscape

Key Competitors

- Dulaglutide (Trulicity): Injectable, once-weekly GLP-1.

- Semaglutide (Ozempic): Injectable, once-weekly.

- Liraglutide (Victoza): Injectable, daily.

- SGLT2 inhibitors: Empagliflozin, dapagliflozin, with cardiovascular benefits.

- Other oral agents: Metformin, SGLT2 inhibitors, DPP-4 inhibitors.

Differentiation Factors

RYBELSUS’s oral formulation offers a critical competitive advantage, particularly for patients reluctant to initiate injectables. Its efficacy in glycemic control and weight reduction aligns with injectable GLP-1s, while its convenience supports increased adherence.

Market Challenges

- Pricing: Higher than many oral drugs, partly due to manufacturing costs of peptide stability.

- Reimbursement and Access: Insurance coverage varies, affecting patient out-of-pocket costs.

- Competitive Development: Oral formulations of other biologics and combination therapies are in pipeline, threatening long-term market share.

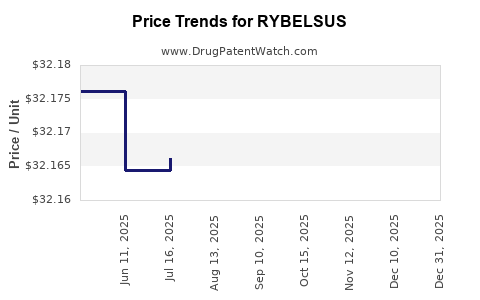

Pricing Dynamics

Current Pricing

RYBELSUS’s pricing in the U.S. stands at approximately $1,000 per month for the standard 14 mg dose, translating to an annual cost of roughly $12,000 [3]. This premium reflects the innovation, manufacturing complexity, and clinical benefits.

Reimbursement Landscape

Insurance coverage independently influences actual patient costs. While Medicare and private insurers generally provide coverage, prior authorization and formulary restrictions can limit access or increase out-of-pocket expenses.

Price Modifiers and Discounting

Pharmaceutical companies employ rebate strategies, coupon programs, and patient assistance initiatives to enhance access. Biosimilar competition is currently minimal due to complex manufacturing, keeping prices relatively stable in the short term.

Market Forecast and Price Projection

Market Growth Drivers

- Expanding global T2D prevalence expected to reach 700 million by 2045.

- Shifting treatment paradigms favoring agents with cardiovascular benefits.

- Patient preference for oral therapies bolstered by the COVID-19 pandemic, highlighting need for non-injectable options.

- Reimbursement expansion as more payers recognize the long-term cost-effectiveness of GLP-1s.

Forecasting Methodology

Using a compound annual growth rate (CAGR) approach based on historical sales data and projected market expansion, RYBELSUS’s sales are expected to grow at a CAGR of approximately 12-15% over the next five years.

Projected Price Trajectory

Given current market dynamics, the per-unit price of RYBELSUS is anticipated to stabilize over the next 2-3 years, barring significant competition or policy shifts. Industry experts project:

-

2023-2024: Stable at approximately $1,000/month, with potential slight discounts as market penetration deepens.

-

2025-2027: Slight downward pricing pressure, especially if biosimilar manufacturing advances or if generic options emerge, potentially lowering costs by 10-15%.

-

Long-term scenarios (2028+): Prices could decline further to $800-900/month if biosimilar manufacturing becomes feasible or reimbursement strategies evolve.

Market Expansion Impact

As RYBELSUS penetrates emerging markets in Asia, Latin America, and Africa, pricing will adapt according to local healthcare infrastructure and economic factors. Typically, prices in these regions may come down significantly, ranging from 30-50% below U.S. levels.

Regulatory and Policy Impact

Government healthcare initiatives favor cost containment, which may incentivize price negotiations or formulary placement strategies. Bundled payment models and value-based pricing could influence future price adjustments, especially if long-term outcome data supports cost-effectiveness.

Conclusion

RYBELSUS continues to carve out a significant share of the T2D market due to its oral delivery platform and robust efficacy profile. While current prices remain high, market forces, competition, and policy pressures are poised to moderate future pricing. The product’s growth trajectory remains strong, driven by expanding global prevalence, improved access, and increasing prescriber acceptance.

Key Takeaways

- Market leadership position: RYBELSUS holds a strong position in the oral diabetes segment, with projected sustained growth.

- Pricing outlook: While current prices are premium, expectations of gradual reduction are supported by market competition and biosimilar developments.

- Competitive advantages: Oral administration, cardiovascular benefits, and ease of use bolster market penetration.

- Reimbursement considerations: Insurance coverage significantly influences patient access and overall revenue.

- Strategic factors: Manufacturers should monitor biosimilar progress, policy shifts, and acceptability trends to adapt pricing and marketing strategies.

FAQs

1. How does RYBELSUS’s price compare to injectable GLP-1 receptor agonists?

RYBELSUS’s monthly cost (~$1,000) is comparable to or slightly lower than injectable GLP-1s like Trulicity and Ozempic, which can range from $800 to $1,200 monthly, depending on dosages and insurance negotiations.

2. What factors could drive a decrease in RYBELSUS’s price?

Introduction of biosimilars, increased market competition, evolving reimbursement policies, and technological manufacturing advancements could help lower prices.

3. How significant is insurance coverage for RYBELSUS’s market uptake?

Coverage policies critically impact patient access and adherence, directly influencing sales volumes and overall market share.

4. Are there geographic differences in RYBELSUS’s pricing?

Yes, pricing varies globally, often lower in emerging markets due to regional healthcare economics and pricing regulations, impacting overall revenue streams.

5. What is the outlook for RYBELSUS in the context of diabetes management trends?

Its oral formulation offers a strategic edge amid a shift towards patient-friendly therapies. Continued evidence of cardiovascular and glycemic benefits will support sustained growth.

References

- Davies, M. et al. (2021). GLP-1 receptor agonists in type 2 diabetes: Efficacy and safety profile. Diabetes Care.

- IQVIA. (2022). Pharmaceutical Market Reports.

- GoodRx. (2023). RYBELSUS pricing and discounts.

More… ↓