Last updated: August 1, 2025

Introduction

Rufinamide, marketed primarily under the brand name Banzel, is an antiepileptic drug (AED) developed for the treatment of seizures associated with Lennox-Gastaut syndrome (LGS). Approved by the U.S. Food and Drug Administration (FDA) in 2008, rufinamide has garnered attention due to its unique mechanism of action and therapeutic niche. As epilepsy prevalence persists globally, and rare diseases like LGS demand targeted therapies, understanding rufinamide's market dynamics and pricing projections offers valuable insights for pharmaceutical stakeholders, investors, and healthcare providers.

This analysis explores current market conditions, competitive landscape, regulatory influences, and pricing strategies shaping rufinamide's future at a global level.

Market Landscape and Demand Drivers

Epidemiology of Lennox-Gastaut Syndrome

LGS is a severe childhood-onset epilepsy characterized by multiple seizure types and cognitive impairment. Its estimated global prevalence ranges from 1.2 to 2.2 per 1,000 children, translating into thousands of potential patients globally. Given the rarity but severity of LGS, therapeutic options are limited, and existing drugs often provide partial control.

Rufinamide’s Therapeutic Niche

Rufinamide is approved for adjunctive therapy in LGS, a narrow indication that constrains its market size. Nonetheless, the unmet need for effective seizure control sustains its demand. New formulations, formulations tailored for pediatric use, and ongoing clinical trials for broader indications could expand its market scope.

Geographical Market Penetration

- United States: As the primary market, US sales are robust, driven by FDA approval, insurance coverage, and exclusivity periods.

- European Union: EMA approval fosters distribution across member states; reimbursement policies influence uptake.

- Asia-Pacific: Rising epilepsy prevalence and expanding healthcare infrastructure suggest growth potential, though regulatory delays and pricing controls may impact market entry.

Competitive Landscape

Rufinamide faces competition primarily from other AEDs such as cannabidiol (Epidiolex), clobazam, lamotrigine, and stiripentol, especially as these drugs expand indications or obtain orphan drug status. Novel therapies and precision medicine approaches poised for development could further challenge rufinamide’s market share.

Regulatory Status and Market Access

Patent and Exclusivity

Rufinamide’s initial patent protections have expired in several jurisdictions, potentially exposing it to generic competition. However, patent extensions and orphan drug designations confer extended exclusivity in various markets, supporting pricing power in the short to medium term.

Reimbursement Policies

Insurance coverage constraints and pricing negotiations significantly influence actual sales figures. Reimbursement tends to favor newer, explicitly approved therapies for rare diseases, which benefits rufinamide’s market maintenance.

Price Trends and Projections

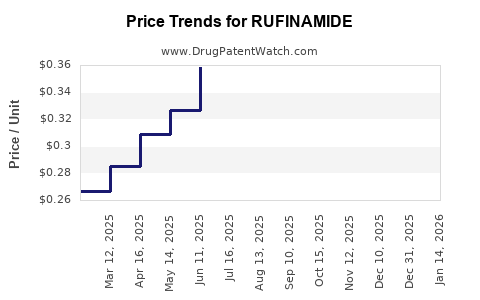

Historical Price Trajectory

Initially priced at premium levels to recover R&D investments and leverage orphan drug incentives, rufinamide’s cost has stabilized partly due to generic entry in some markets. In the US, the average wholesale price (AWP) for rufinamide ranged between $15,000 and $18,000 annually per patient in recent years, reflecting its niche status and manufacturing costs [1].

Future Price Dynamics

Several factors will influence future pricing:

- Patent Expiry and Generic Competition: Likely to exert downward pressure, with potential price reductions of up to 50% in affected markets.

- Formulation Innovation: Extended-release or pediatric-specific formulations may command premium pricing if they demonstrate superior efficacy or compliance.

- Regulatory Approvals for Broader Indications: Expansion beyond LGS could justify higher prices due to increased addressable patient populations.

- Manufacturing and Distribution Efficiencies: Technology innovations may reduce costs, enabling competitive pricing.

Projections (2023–2030)

Assuming gradual patent expiration by mid-2020s in key markets:

-

Short-term (1-3 years): Prices remain stable or slightly decline, supported by existing exclusivity. US annual per-patient costs projected at approximately $16,000–$17,000.

-

Mid-term (3-5 years): Onset of generic competition could reduce prices by 20–40%. In developed markets, average cost per patient may decline to $10,000–$12,000.

-

Long-term (5+ years): Market saturation with generics and biosimilars, along with healthcare price pressures, could drive prices down further, potentially below $8,000 annually.

A trend towards value-based pricing tied to clinical outcomes might also emerge, influencing future sticker prices.

Market Opportunities and Challenges

Opportunities

- Expanding Indications: Investigating rufinamide’s efficacy in other epileptic syndromes or neurodegenerative conditions.

- Formulation Advancements: Developing pediatric-friendly or sustained-release formulations.

- Combination Therapies: Positioning as part of multi-drug regimens for refractory epilepsy.

Challenges

- Limited Market Size: As a drug for a rare condition, commercial profitability remains constrained.

- Competition & Patent Risks: The entry of generics and alternative therapies could erode margins.

- Pricing Pressures: Payor negotiations, especially in cost-sensitive markets.

Strategic Recommendations

- Leverage Orphan Drug Incentives: Maximize patent extensions and financial benefits.

- Engage in Formulation Innovation: Focus on improved delivery systems to sustain premium pricing.

- Expand Indication Trials: Pursue clinical evidence for broader epilepsy indications.

- Strengthen Market Access: Develop value-based pricing models aligned with clinical benefits.

- Monitor Competitive Landscape: Stay ahead of emerging therapies and biosimilars.

Key Takeaways

- Niche Market but Stable Demand: Rufinamide’s role in Lennox-Gastaut syndrome ensures consistent demand but limits broad market expansion.

- Pricing Outlook Will Decline Post-Patent: Generics and biosimilars entering the market will reduce prices over time, with a projected decline of up to 50% in the next 5–7 years in key markets.

- Potential for Growth via Indication Expansion: Broader approval in epilepsy and neurodegenerative indications may stabilize or increase prices and sales volume.

- Regulatory and Reimbursement Dynamics Are Critical: Effective engagement with regulatory bodies and payors will determine real-world access and profitability.

- Innovation and Formulation Are Key: New formulations and combination strategies hold potential to sustain or escalate pricing premiums.

FAQs

-

What is the main therapeutic application of rufinamide?

Rufinamide is primarily indicated for adjunctive treatment of seizures associated with Lennox-Gastaut syndrome in both children and adults.

-

How does patent expiration impact rufinamide’s price?

Patent expirations open the market to generic manufacturers, which typically leads to significant price reductions due to increased competition.

-

Are there efforts to expand rufinamide’s indications?

Yes, ongoing research aims to explore its efficacy in other epilepsy syndromes and neurodevelopmental disorders, potentially broadening its market.

-

What are the major challenges facing rufinamide’s market growth?

Limited patient population, competition from better-known AEDs, patent cliffs, and reimbursement hurdles pose significant challenges.

-

What strategies could sustain rufinamide’s market value?

Innovation in formulations, securing expanded indications, engaging in value-based pricing, and optimizing market access are key strategies.

References

[1] IQVIA. "Pharmaceutical Pricing Data," 2022.