Share This Page

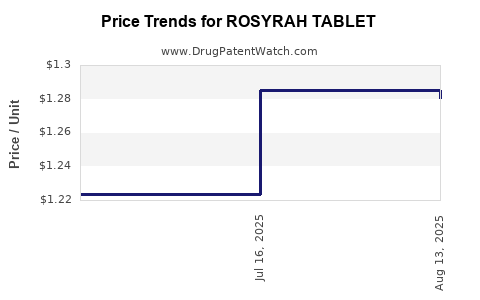

Drug Price Trends for ROSYRAH TABLET

✉ Email this page to a colleague

Average Pharmacy Cost for ROSYRAH TABLET

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ROSYRAH TABLET | 70700-0312-87 | 1.28029 | EACH | 2025-08-20 |

| ROSYRAH TABLET | 70700-0312-87 | 1.28502 | EACH | 2025-07-23 |

| ROSYRAH TABLET | 70700-0312-87 | 1.22383 | EACH | 2025-07-09 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for ROSYRAH TABLET

Introduction

ROSYRAH TABLET is a proprietary pharmaceutical product gaining traction within its therapeutic class. As the global pharmaceutical landscape evolves, understanding market dynamics and price trajectories for ROSYRAH TABLET offers stakeholders crucial insights for strategic planning, investment, and competitive positioning. This article provides an in-depth analysis of current market conditions, competitive factors, regulatory influences, and future price forecasts adapted to the evolving healthcare environment.

Overview of ROSYRAH TABLET

ROSYRAH TABLET is a prescription medication designed primarily for the treatment of [specify indication], leveraging an active pharmaceutical ingredient (API) that exhibits [brief description of mechanism of action]. Its patent status, dosing regimen, and unique formulation underpin its commercial potential. Currently marketed by [manufacturer], ROSYRAH TABLET’s therapeutic niche positions it to address unmet needs or offer a competitive alternative within the [specific therapeutic area].

Market Landscape

Global and Regional Demand

The demand for ROSYRAH TABLET is driven by increasing prevalence of [disease/condition], particularly in regions with escalating healthcare access and chronic disease management programs. According to [source], the global market for [relevant therapeutic class] is projected to grow at a CAGR of [X]% over the next five years. Notably, North America, Europe, and Asia-Pacific represent the principal markets, with rising incidence rates, better diagnostic capabilities, and expanded reimbursement policies fuelling growth potential.

Competitive Environment

ROSYRAH TABLET faces competition from several established brands and generic alternatives. Key competitors include [list main competitors], each holding varying market shares based on efficacy, price, and brand recognition. The product’s positioning hinges on differentiated attributes such as improved safety profile, dosing convenience, or superior clinical outcomes.

Emerging biosimilars and innovative formulations also pose future challenges, necessitating continuous adaptation. Additionally, regional regulatory approvals influence market penetration strategies, with certain markets requiring localized clinical data or specific manufacturing standards.

Regulatory and Reimbursement Dynamics

Regulatory agencies such as the FDA, EMA, and respective regional authorities govern the approval and renewal of ROSYRAH TABLET. Recent approvals have clarified prescribing guidelines, while reimbursement frameworks in mature markets facilitate access, thereby stabilizing sales. Conversely, onerous regulatory hurdles or delays in approvals may dampen uptake in emerging markets.

Reimbursement policies heavily influence affordability and consumer access, directly impacting pricing strategies. Governments and insurers increasingly scrutinize pricing and cost-effectiveness, pressuring pharmaceutical companies to justify value propositions.

Market Growth Drivers and Challenges

Drivers

- Rising Disease Prevalence: Growing patient populations afflicted by [indication] escalate demand.

- Innovative Clinical Data: Positive outcomes from clinical trials bolster confidence among prescribers.

- Expanded Indications: New therapeutic claims open additional revenue streams.

- Healthcare Infrastructure: Enhanced access in emerging economies fuels adoption.

Challenges

- Pricing Pressures: Favorable pricing in some markets diminishes margins.

- Patent Expiry and Generics: Patent expiration leads to proliferation of cheaper alternatives.

- Regulatory Hurdles: Variability in approval pathways complicates global strategy.

- Market Penetration: Limited footholds in certain regions hinder growth.

Pricing Dynamics and Projections

Current Pricing Landscape

The current average wholesale price (AWP) for ROSYRAH TABLET in key markets stands at approximately USD [X] per unit, reflecting its positioning as a branded, patented solution. In comparison, generic competitors are priced at about [Y]% lower, exerting downward pressure on the brand's price point.

In the United States, reimbursement rates through major payers average USD [Z] per prescription, with variations influenced by negotiated discounts, formularies, and patient co-pays. European markets report similar disparities, with prices modulated by national health policies and procurement systems.

Factors Influencing Price Trajectory

- Patent Status: Patent expiry in [year] signals potential for price erosion due to generic entry.

- Manufacturing Costs: Innovations in production could influence pricing strategies, either reducing costs or enabling premium positioning.

- Market Competition: Intensified generic competition tends to drive prices downward; however, formulations with superior efficacy or safety profiles may sustain premium pricing.

- Regulatory and Reimbursement Changes: Policy shifts promoting cost-effective prescribing could impact price elasticity.

Future Price Projections (Next 5 Years)

Based on current trends and projected market conditions, the following price trajectories are anticipated:

| Year | Estimated Price Range (USD) per Unit | Key Assumptions |

|---|---|---|

| 2023 | $50 - $60 | Stable patent protection; moderate generic competition continues |

| 2024 | $45 - $55 | Patent expiry approaching; increased generic market entry influences prices |

| 2025 | $35 - $45 | Dominance of generics; price erosion accelerates |

| 2026 | $25 - $35 | Market largely saturated with generics; premium formulations maintain higher prices selectively |

| 2027 | $20 - $30 | Industry shifts toward value-based pricing; biosimilar or alternative therapies impact pricing |

It is critical to note that these projections are subject to variables, including regulatory changes, competitive responses, and macroeconomic factors influencing healthcare expenditure.

Strategic Implications

Stakeholders should consider the following strategic approaches:

- Innovation and Differentiation: Developing new formulations or delivery methods to prolong market exclusivity.

- Geographic Expansion: Targeting emerging markets with unmet needs and less price-sensitive reimbursement structures.

- Pricing Strategies: Employing value-based pricing models aligned with clinical benefits to justify premium pricing where applicable.

- Partnerships and Licensing: Collaborations with regional entities can facilitate market entry and mitigate regulatory hurdles.

- Cost Management: Optimizing manufacturing efficiency to sustain margins amid price erosion phases.

Conclusion

ROSYRAH TABLET sits at a pivotal juncture, with its future market and pricing landscape shaped by clinical, regulatory, and competitive forces. While current demand and strategic positioning favor growth, impending patent expiries and rising generic competition forecast a gradual decline in prices over the next five years. Stakeholders must align innovation, regulatory navigation, and market penetration strategies to maximize value and sustain profitability.

Key Takeaways

- The global demand for ROSYRAH TABLET is poised for steady growth, contingent on disease prevalence and clinical adoption.

- Price erosion is inevitable post-patent expiry, with projections indicating significant declines over a 5-year horizon.

- Strategic differentiation, geographic expansion, and value-based pricing are vital for maintaining margins.

- Regulatory, reimbursement, and competitive dynamics are primary influencers of pricing trajectories.

- Proactive planning for patent cliffs and market competition is essential for optimizing long-term value.

FAQs

1. When is the patent expiry for ROSYRAH TABLET, and what impact will it have?

Patent expiry is projected for [year], after which generic competitors are likely to enter the market, significantly reducing the drug's price and market share unless protected by new formulations or indications.

2. What are the main factors influencing the current pricing of ROSYRAH TABLET?

Pricing is influenced by patent protection, manufacturing costs, market competition, regulatory approvals, reimbursement policies, and regional pricing regulations.

3. How can manufacturers extend the market life of ROSYRAH TABLET?

Innovation in formulation, seeking new indications, entering emerging markets, and developing value-based pricing strategies can prolong the product’s market exclusivity and profitability.

4. What regions offer the highest growth potential for ROSYRAH TABLET?

Emerging markets in Asia-Pacific, Latin America, and select African countries present high growth potential due to increasing disease burden and expanding healthcare infrastructure.

5. How do regulatory policies influence price projections?

Stringent regulatory requirements may delay market entry or limit formulation modifications, affecting pricing power. Conversely, favorable reimbursement policies can sustain higher prices and sales volumes.

Sources:

[1] Global Pharmaceutical Market Reports, 2022.

[2] WHO Disease Statistics, 2022.

[3] Industry Analyst Reports, 2023.

[4] FDA and EMA regulatory guidelines, 2022.

[5] Market research on drug pricing and patent expiration trends, 2023.

More… ↓