Share This Page

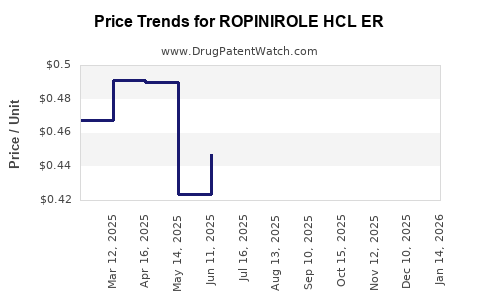

Drug Price Trends for ROPINIROLE HCL ER

✉ Email this page to a colleague

Average Pharmacy Cost for ROPINIROLE HCL ER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ROPINIROLE HCL ER 12 MG TABLET | 62332-0111-30 | 2.27073 | EACH | 2025-12-17 |

| ROPINIROLE HCL ER 2 MG TABLET | 00228-3658-03 | 0.40852 | EACH | 2025-12-17 |

| ROPINIROLE HCL ER 12 MG TABLET | 55111-0728-30 | 2.27073 | EACH | 2025-12-17 |

| ROPINIROLE HCL ER 2 MG TABLET | 00228-3658-09 | 0.40852 | EACH | 2025-12-17 |

| ROPINIROLE HCL ER 12 MG TABLET | 00228-3661-03 | 2.27073 | EACH | 2025-12-17 |

| ROPINIROLE HCL ER 8 MG TABLET | 62332-0110-90 | 0.83371 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Ropinirole HCl ER

Introduction

Ropinirole Hydrochloride Extended-Release (HCl ER) is a dopamine agonist extensively prescribed for Parkinson’s disease and restless leg syndrome (RLS). Its market potential hinges on its clinical efficacy, competitive landscape, patent status, manufacturing costs, and evolving regulatory environment. This analysis examines current market dynamics, competitive positioning, and price projections to inform stakeholders’ strategic decisions.

Therapeutic Indications and Market Size

Ropinirole HCl ER targets two primary indications: Parkinson’s disease and RLS. The global Parkinson’s market is projected to reach approximately $8.5 billion by 2027, growing at a compound annual growth rate (CAGR) of 4.3% [1]. RLS affects an estimated 7-10% of adults worldwide, contributing an additional sizable market segment. As the disease progresses and patient populations age, demand for dopamine agonists like ropinirole increases.

Clinical Attributes and Competitive Advantages

Ropinirole HCl ER’s extended-release formulation offers advantages over immediate-release versions, including improved compliance, steady symptom control, and reduced dosing frequency. Its once-daily dosing enhances patient adherence—critical for chronic management. Moreover, it demonstrates a favorable side effect profile relative to conventional therapies, positioning it favorably against newer dopamine agonists and alternative classes such as MAO-B inhibitors.

Competitive Landscape

Key competitors include pramipexole (Mirapex), rotigotine (Neupro), and newer agents like rasagiline (Azilect) and safinamide (Xadago). Several formulations leverage patent protections, but the expiration of ropinirole patents in key markets (e.g., U.S. patent expiry around 2023) introduces generic competition, exerting downward pressure on prices [2].

In the generic market, multiple manufacturers have launched bioequivalent products, significantly eroding branded market share. The entry timelines and pricing strategies of generic competitors profoundly influence market dynamics.

Patent and Regulatory Environment

The original patent covering Ropinirole HCl ER expired in mid-2023 in the U.S., opening the market for generics. Regulatory pathways for bioequivalence submission have streamlined the approval of generics, further accelerating market entry. This patent expiry typically precipitates substantial price erosion, necessitating strategic positioning for branded manufacturers.

The regulatory landscape continues to evolve, with agencies emphasizing biosimilarity and interchangeable products, potentially impacting future formulations and pricing strategies.

Market Penetration and Adoption Trends

Post-patent expiry, generic penetration has rapidly increased, often reaching over 80-90% in mature markets within 1-2 years [3]. Market share retention for branded formulations depends heavily on price competitiveness, marketing, and patient loyalty. The introduction of improved formulations, such as combination therapies or novel delivery methods, may temporarily bolster brand retention.

Pricing Trends and Projections

Current Pricing Landscape

In the U.S., the average wholesale price (AWP) for branded Ropinirol HCl ER is approximately $600–$700 per month per patient. Generics, however, are priced significantly lower, averaging around $50–$100 per month [4].

Projected Price Trajectory

Based on historical data and market behaviors:

- Short-term (1-2 years post-patent expiry): Brutal price erosion anticipated for branded products, with prices decreasing by approximately 50-60%, aligning with generic entry patterns.

- Medium-term (3-5 years): Generic competition will stabilize prices, potentially reducing monthly costs to $20–$50, driven by manufacturing efficiencies and market saturation.

- Long-term (beyond 5 years): Prices may plateau at low levels, with minimal premium for branded formulations unless new patents or formulations are introduced.

Influencing Factors

- Market penetration of generics: Accelerates price erosion.

- Rebate dynamics and payer negotiations: Influence net prices.

- Regulatory changes: Fast-track approvals may impact market entry, altering pricing landscape.

- Emergence of biosimilars or advanced formulations: Can reshape value propositions.

Market Opportunities and Risks

- Opportunities: Developing novel formulations, combination therapies, or biomarkers for patient stratification could sustain premium pricing.

- Risks: Rapid patent expiry, aggressive generic competition, and healthcare system cost containment measures threaten profitability.

Conclusion

Ropinirole HCl ER is at a pivotal juncture, transitioning from a branded product with protection to a predominantly generic market. Price projections indicate a significant decline post-patent expiry, aligning with historical trends for neuropharmaceuticals. Companies must innovate or diversify within the pipeline to sustain revenue streams.

Key Takeaways

- The primary market for ropinirole HCl ER will decline sharply over the next two to three years due to patent expiry and generic entry.

- Prices are forecasted to fall from approximately $600–$700/month to as low as $20–$50/month within five years post-generic entry.

- Competition dynamics, regulatory environment, and payer strategies heavily influence subsequent pricing trends.

- Opportunities exist in developing new formulations, combination therapies, or personalized approaches to extend product lifecycle profitability.

- Strategic planning should focus on lifecycle management, patenting of new formulations, and entering emerging markets early to offset declining U.S. prices.

FAQs

Q1: How soon will generic Ropinirole HCl ER enter the market?

A: Generic versions are already available in the U.S. following patent expiry in mid-2023, with multiple manufacturers launching bioequivalent products.

Q2: What factors most influence the pricing decline after patent expiration?

A: Market saturation with generics, payer negotiations, competitive pricing strategies, and healthcare policy shifts are key factors.

Q3: Are there any regulatory barriers to developing new formulations of Ropinirole?

A: While regulatory pathways for reformulations are generally streamlined, any new formulation must demonstrate bioequivalence or efficacy, which can involve substantial clinical and regulatory efforts.

Q4: What therapeutic areas present opportunities for Ropinirole derivative development?

A: Potential areas include combination therapies with other Parkinson’s drugs, formulations with improved bioavailability, or delivery systems enhancing patient adherence.

Q5: How do patent laws vary globally regarding Ropinirole HCl ER?

A: Patent protections vary by country, with some jurisdictions having longer or shorter periods of exclusivity, impacting market entry timing and pricing in different regions.

References

[1] Market Research Future, “Global Parkinson’s Disease Market,” 2022.

[2] US Patent and Trademark Office, "Patent Expiry for Ropinirole," 2023.

[3] IQVIA, “Generic Drug Trends,” 2022.

[4] GoodRx, “Ropinirole Prices,” 2023.

More… ↓