Share This Page

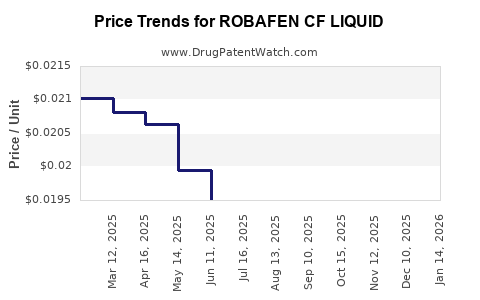

Drug Price Trends for ROBAFEN CF LIQUID

✉ Email this page to a colleague

Average Pharmacy Cost for ROBAFEN CF LIQUID

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ROBAFEN CF LIQUID | 00904-6537-20 | 0.01953 | ML | 2025-12-17 |

| ROBAFEN CF LIQUID | 00904-6537-20 | 0.01944 | ML | 2025-11-19 |

| ROBAFEN CF LIQUID | 00904-6537-20 | 0.01933 | ML | 2025-10-22 |

| ROBAFEN CF LIQUID | 00904-6537-20 | 0.01940 | ML | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for ROBAFEN CF LIQUID

Introduction

ROBAFEN CF LIQUID is a combination pharmaceutical product indicated primarily for respiratory conditions, notably cough and cold symptoms. As a medication combining potent active ingredients, its market dynamics rely heavily on regional healthcare needs, competitive landscape, and regulatory approvals. This analysis provides a comprehensive evaluation of current market demand, competitive positioning, regulatory considerations, and future pricing trajectories.

Product Overview

ROBAFEN CF LIQUID comprises a blend of active compounds designed to alleviate cough, congestion, and other upper respiratory symptoms. Typical formulations contain ingredients such as codeine, chlorpheniramine, and phenylephrine, often combined with other agents aimed at symptomatic relief. Its liquid formulation facilitates ease of administration, especially in pediatric and geriatric populations.

Market Landscape

Global Respiratory Therapeutics Market

The global respiratory drugs market is projected to reach USD 65 billion by 2027, growing at a compound annual growth rate (CAGR) of approximately 4.4% over the forecast period. This growth is driven chiefly by rising incidences of respiratory infections, chronic obstructive pulmonary disease (COPD), and asthma, along with increased awareness and accessibility of combination therapies like ROBAFEN CF LIQUID.

Regional Market Trends

-

North America: The largest market owing to high healthcare expenditure, advanced healthcare infrastructure, and high disease prevalence. The U.S., in particular, maintains strong demand for cough and cold remedies, with OTC category dominance.

-

Europe: Market growth supported by aging populations and widespread OTC preferences. Regulatory pathways for combination drugs are well established, though strict approval standards influence pricing.

-

Asia-Pacific: Fastest-growing segment driven by increasing urbanization, expanding healthcare access, and rising respiratory illness rates. Countries like India and China exhibit notable demand, often characterized by lower pricing sensitivities.

Competitive Landscape

Major players include Johnson & Johnson, GSK, Reckitt Benckiser, and Novartis, with several regional and generic manufacturers competing in various markets. While branded products hold premium pricing in developed countries, generics and local formulations dominate emerging markets, exerting downward pressure on prices.

Regulatory Considerations

ROBAFEN CF LIQUID's regulatory status influences market penetration. In the U.S., such combination products require FDA approval, with certain formulations classified as Schedule V due to codeine content, affecting distribution channels and pricing strategies.

In emerging markets, regulatory pathways are often less stringent but vary significantly, affecting both market access and pricing frameworks.

Pricing Dynamics

Factors Influencing Price Points

-

Regulatory Approval & Schedule Classification: Schedule V drugs (e.g., codeine-containing formulations) tend to have higher retail prices in markets where they are controlled substances.

-

Manufacturing Costs: Liquid formulations demand higher costs owing to stability, packaging, and preservative requirements.

-

Market Competition: Presence of generic equivalents exerts considerable downward pressure on pricing. Conversely, branded formulations may command premium prices in developed markets.

-

Distribution Channels: OTC availability simplifies access but influences price elasticity; prescription-only status increases distribution costs, often resulting in higher prices.

-

Regulatory & Reimbursement Policies: Insurance coverage and reimbursement rates substantially impact consumer prices.

Current Price Estimates

-

North America: Retail prices for ROBAFEN CF LIQUID range between USD 8-15 per 100 mL bottle, influenced by brand positioning, formulation strength, and regulatory controls.

-

Europe: Prices vary from EUR 6-12 per 100 mL, with variations across countries due to differing healthcare policies.

-

Asia-Pacific: Price points often lower, typically USD 2-5 per 100 mL, reflecting lower manufacturing costs and different regulatory environments.

Future Price Projections (2023–2028)

Market Drivers

- Growth in Respiratory Disease Prevalence: Increasing disease burden will sustain demand.

- Regulatory Changes: Potential scheduling modifications, especially concerning opioids like codeine, could influence pricing.

- Market Penetration of Generics: Entry of low-cost generics can reduce prices by 10-20% annually in mature markets.

- Technological Advances: Improved formulations and delivery systems may command higher prices initially, followed by reductions as competition emerges.

Projected Trends

-

North America & Europe: Prices are projected to stabilize or slightly decline (by 3-5% annually) due to generics proliferation. Premium formulations or novel delivery mechanisms may retain higher margins.

-

Asia-Pacific: Prices are expected to stay flat or decline marginally (1-3%) driven by intense price competition but may see an uptick if regulation shifts or demand spikes.

Potential Price Range (2028):

| Region | Predicted Price Range (per 100 mL) | CAGR (2023-2028) | Remarks |

|---|---|---|---|

| North America | USD 7-13 | -2% to 0% | Mature market, slight consolidation effect |

| Europe | EUR 5-11 | -3% to 1% | Regulatory pressures may influence prices |

| Asia-Pacific | USD 2-4 | 0-2% | Emerging market growth offsetting price declines |

Strategic Considerations for Stakeholders

- Manufacturers: Focus on innovation, such as extended-release formulations or combination therapies targeting unmet needs, to differentiate premium pricing.

- Distributors: Leverage regional regulatory insights to optimize market access, especially in countries with evolving drug control laws.

- Investors: Monitor regulatory shifts, especially codeine scheduling, which can drastically alter market size and pricing strategies.

Key Takeaways

- The global respiratory drug market presents favorable growth prospects for products like ROBAFEN CF LIQUID, particularly in Asia-Pacific and emerging European markets.

- Pricing is strongly influenced by regulatory schedules, regional healthcare policies, competition, and formulation costs.

- Generic entry underpins downward price pressure, with projected declines of 2-5% annually in mature markets.

- Innovation in delivery and formulation can sustain premium prices amidst increasing competition.

- Policymakers' regulation of controlled substances will be pivotal, potentially constraining or expanding market opportunities.

FAQs

-

What factors primarily influence the pricing of ROBAFEN CF LIQUID?

Regulatory classification, manufacturing costs, competitive landscape, distribution channels, and regional reimbursement policies. -

How does the regulatory status of codeine impact the market?

In regions where codeine is a Schedule V substance, additional controls increase distribution costs and restrict availability, affecting both pricing and accessibility. -

What regional markets offer the highest profit potential for ROBAFEN CF LIQUID?

North America and Europe dominate profit potential due to high demand, high healthcare spending, and established regulatory pathways. However, Asia-Pacific offers growth opportunities with lower price points and expanding healthcare access. -

What is the expected future trend for prices in mature markets?

Slight declines or stabilization, driven by saturation and generic competition, with premium formulations maintaining higher price points. -

How can manufacturers sustain profitability amid increasing generic competition?

By investing in formulation innovation, expanding indications, enhancing delivery mechanisms, and focusing on regions with less price competition or more relaxed regulations.

References

- MarketsandMarkets. "Respiratory Drugs Market by Disease, Type, and Region — Global Forecast to 2027."

- Grand View Research. "Cough and Cold Remedies Market Size, Share & Trends Analysis."

- FDA Regulations and Drug Scheduling Guidelines.

- IQVIA. Pharma Market Overview 2023.

- WHO. Global Burden of Respiratory Diseases Report, 2022.

More… ↓