Share This Page

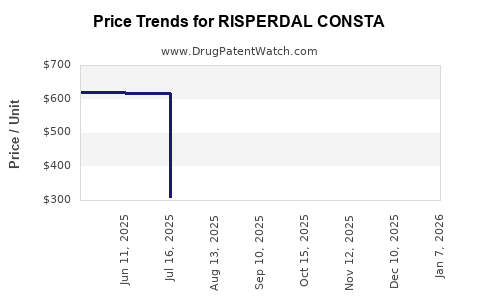

Drug Price Trends for RISPERDAL CONSTA

✉ Email this page to a colleague

Average Pharmacy Cost for RISPERDAL CONSTA

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| RISPERDAL CONSTA 37.5 MG VIAL | 50458-0307-11 | 928.76000 | EACH | 2025-12-17 |

| RISPERDAL CONSTA 25 MG VIAL | 50458-0306-11 | 621.16786 | EACH | 2025-12-17 |

| RISPERDAL CONSTA 50 MG VIAL | 50458-0308-11 | 1240.39370 | EACH | 2025-12-17 |

| RISPERDAL CONSTA 12.5 MG VIAL | 50458-0309-11 | 308.78750 | EACH | 2025-12-17 |

| RISPERDAL CONSTA 50 MG VIAL | 50458-0308-11 | 1239.79387 | EACH | 2025-11-19 |

| RISPERDAL CONSTA 37.5 MG VIAL | 50458-0307-11 | 929.16781 | EACH | 2025-11-19 |

| RISPERDAL CONSTA 12.5 MG VIAL | 50458-0309-11 | 308.50857 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for RISPERDAL CONSTA

Introduction

Risperdal Consta (risperidone long-acting injectable) is a pivotal antipsychotic medication marketed primarily for managing schizophrenia and bipolar disorder. Since its approval, it has garnered a significant share in the long-acting injectable antipsychotics segment. This analysis explores current market dynamics, competitive positioning, pricing trends, and future price projections to inform strategic decisions for stakeholders.

Market Overview

Therapeutic Landscape

Risperdal Consta is part of the atypical antipsychotics segment, which has seen steady demand due to its effectiveness in reducing relapse rates in schizophrenia and bipolar disorder. The global market for long-acting injectable (LAI) antipsychotics is projected to grow at a compound annual growth rate (CAGR) of approximately 6% over the next five years, driven by increasing prevalence rates, improved medication adherence, and evolving clinical guidelines emphasizing LAIs’ benefits ([2]).

Market Penetration and Positioning

Risperdal Consta, developed by Janssen Pharmaceuticals (a Johnson & Johnson subsidiary), commands a leading position due to its established efficacy, longstanding market presence, and robust clinical data. However, the competitive landscape is intensifying with newer agents like Invega Sustenna, Abilify Maintena, and Aristada, offering alternative dosing, formulations, or improved side effect profiles.

Global Market Scope

While the U.S. remains the largest market historically, emerging markets in Asia-Pacific, Latin America, and Middle East display promising growth potential owing to expanding mental health awareness and improved healthcare infrastructure ([1]). Penetration in these regions depends heavily on pricing strategies, regulatory approvals, and healthcare system integration.

Pricing Dynamics and Trends

Current Pricing Landscape

- U.S. Market: The average wholesale acquisition cost (AWAC) for Risperdal Consta is approximately $750–$900 per 28-day dose, though actual reimbursement and patient out-of-pocket costs vary widely ([3]).

- International Markets: Prices are generally lower, often 40–60% of U.S. levels, influenced by local reimbursement policies and competition.

Price Influences

- Regulatory and Reimbursement Policies: Policies promoting generic substitution and biosimilars have exert downward pressure on prices.

- Market Competition: Introduction of biosimilars and new entrants fragment the pricing landscape.

- Formulation Advancements: Innovations such as once-every-two-month formulations, if pricing reflects added convenience, could sustain premium pricing.

- Patient Demographics: Growing emphasis on adherence and quality of life may allow for maintained or marginally increased pricing in certain markets.

Projected Price Trends (2023–2028)

Factors Supporting Price Stabilization or Increase

- Limited Biosimilar Competition: Currently, no approved biosimilars for risperidone LAI significantly impact Risperdal Consta's pricing. Lack of biosimilar encroachment grants Janssen leverage to maintain premium pricing.

- Market Expansion in Emerging Economies: As healthcare systems adopt LAIs, initial pricing may be higher to recover R&D investments, especially in markets with fewer existing competitors.

- Product Line Extensions: Introduction of new formulations (e.g., 2-month injections) could command higher prices due to convenience.

Anticipated Price Decline Factors

- Patent Expiry and Biosimilars: Patent expiration estimated around 2025–2026 in key markets like the U.S. may trigger price reductions.

- Cost-Containment Policies: Governments and insurers employing formulary management and value-based pricing can further push prices downward.

Forecast Summary

| Year | Estimated U.S. Price Range (per 28-day dose) | Remarks |

|---|---|---|

| 2023 | $750 – $900 | Stable with minor declines possible due to inflation |

| 2024 | $700 – $850 | Slight downward pressure from market adjustments |

| 2025 | $650 – $800 | Potential impact from biosimilar entry |

| 2026 | $620 – $780 | Increased biosimilar competition; price compression |

| 2027–28 | $600 – $760 | Market stabilization, possible price declines |

Note: International prices are projected to follow similar trends, adjusted for local economic factors and reimbursement policies.

Competitive and Regulatory Factors Impacting Future Market and Pricing

- Emergence of Biosimilars: Several biosimilars for risperidone are in development, which could challenge Risperdal Consta’s market dominance by offering lower-priced alternatives.

- Regulatory Approvals: Approval of long-acting formulations with better safety profiles or simplified administration could influence pricing strategies.

- Reimbursement Policies: Value-based reimbursement models may favor newer, more convenient formulations, potentially decreasing prices of existing products.

- Market Access Programs: Janssen’s patient assistance and copay programs could mitigate cost barriers, indirectly affecting pricing strategies.

Strategic Recommendations

- Monitor Biosimilar Development: Stakeholders should track biosimilar pipeline advancements and regulatory milestones in major markets.

- Invest in Formulation Innovation: Developing extended-duration formulations and improving product adherence may justify premium pricing.

- Market Expansion: Focus on emerging markets where initial penetration can sustain higher prices pending increasing adoption.

- Engage with Payers: Demonstrate cost-effectiveness and improved patient outcomes to negotiate favorable reimbursement practices.

Key Takeaways

- Risperdal Consta remains a dominant LAI antipsychotic with stable demand, but faces imminent pricing pressures from biosimilar competition starting circa 2025.

- Pricing in the U.S. averages around $750–$900 per 28-day dose, with international prices generally lower but trending downward.

- Future price projections indicate gradual declines driven by biosimilar entry, cost containment policies, and evolving reimbursement models.

- Market expansion efforts, formulation innovations, and strategic payer negotiations will be critical to sustaining revenue streams.

- Stakeholders should prepare for escalating competition while leveraging product differentiation and market expansion opportunities.

Frequently Asked Questions

1. When will biosimilars for Risperdal Consta likely enter the market?

Biosimilar risperidone products are in various stages of development, with expected approval timelines around 2024–2026 in key markets like the U.S. and Europe.

2. How does patent expiration influence Risperdal Consta's pricing?

Patent expiration typically enables biosimilar manufacturers to introduce lower-priced alternatives, exerting downward pressure on Risperdal Consta's price commencing approximately 2–3 years post-expiry.

3. What factors could sustain higher prices for Risperdal Consta?

Factors include formulation innovations (e.g., less frequent injections), market expansion into emerging regions, and demonstrations of superior adherence and outcomes.

4. How do international pricing strategies compare with U.S. trends?

International prices are generally lower due to different reimbursement frameworks, but they tend to follow U.S. trends scaled by local economic factors, with potential for significant variation based on market maturity.

5. What are the key considerations for stakeholders when planning for future adoption?

Stakeholders should monitor biosimilar pipelines, stay adaptive to policy changes, invest in value demonstration, and explore patient-centric formulations to optimize market positioning.

References

- IQVIA. Global Long-Acting Injectable Antipsychotics Market Report 2022.

- MarketsandMarkets. Long-Acting Injectable Antipsychotics Market Analysis. 2023.

- GoodRx. Risperdal Consta Prices and Reimbursement Data, 2023.

More… ↓