Share This Page

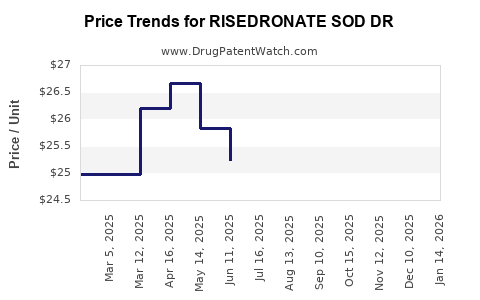

Drug Price Trends for RISEDRONATE SOD DR

✉ Email this page to a colleague

Average Pharmacy Cost for RISEDRONATE SOD DR

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| RISEDRONATE SOD DR 35 MG TAB | 59762-0407-04 | 24.74633 | EACH | 2025-12-17 |

| RISEDRONATE SOD DR 35 MG TAB | 63304-0440-09 | 24.74633 | EACH | 2025-12-17 |

| RISEDRONATE SOD DR 35 MG TAB | 59762-0407-04 | 24.16283 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Risedronate Sod Dr

Introduction

Risedronate Sod Dr, a generic formulation of the bisphosphonate risedronate sodium, is widely utilized in the treatment and prevention of osteoporosis and Paget’s disease. Its pharmacological profile, established efficacy, and patent expiry have shaped its market landscape. This analysis explores the current market status, competitive environment, regulatory considerations, and future pricing trajectories to aid stakeholders in strategic decision-making.

Pharmacological Profile and Clinical Utility

Risedronate sodium belongs to the amino-bisphosphonate class, functioning by inhibiting osteoclast-mediated bone resorption. It’s prescribed primarily for osteoporosis in postmenopausal women, men with osteoporosis, and Paget’s disease. Its once-monthly dosing schedule enhances patient adherence compared to daily bisphosphonates, underpinning its clinical appeal.

The drug’s efficacy, established through numerous randomized controlled trials, includes significant reductions in vertebral, non-vertebral, and hip fractures. Its safety profile is well-understood, with gastrointestinal discomfort being the most common adverse effect [1].

Market Landscape

1. Patent Expiry and Generic Entry

The original brand, Actonel (by Sanofi), lost patent protection in major markets between 2016 and 2018. This timing catalyzed the entry of multiple generic manufacturers, leading to increased market competition and significant price erosion.

2. Leading Manufacturers and Market Share

Post-patent expiry, several pharmaceutical companies have launched generic Risedronate Sod Dr, including Teva, Mylan (now part of Viatris), Apotex, and Sun Pharmaceutical. These players leverage cost competitiveness to penetrate key markets such as the U.S., EU, and emerging regions.

3. Regional Market Dynamics

-

United States: The U.S. accounts for a substantial share of the global market owing to high osteoporosis prevalence among postmenopausal women and robust healthcare infrastructure. Medicaid and Medicare coverage further influence dispensing dynamics.

-

European Union: Similar to the U.S., the EU benefits from mature healthcare systems, but price regulation and tendering processes exert downward pressure on prices.

-

Emerging Markets: Countries like India, China, and Brazil present growing demand driven by aging populations and expanding healthcare access. However, price sensitivity remains a critical factor.

Market Drivers

- Aging Population: Increasing elderly demographic directly correlates with higher osteoporosis incidence, expanding Risedronate Sod Dr’s addressable market.

- Cost-Effectiveness: As the most affordable bisphosphonate options, generics remain attractive to healthcare systems aiming to reduce osteoporosis-related healthcare expenditures.

- Guideline Recommendations: National osteoporosis guidelines endorse bisphosphonates as first-line therapy, reinforcing sustained demand.

- Patent Expiration Impact: Market entry of generics has reduced prices substantially, further stimulating volume growth.

Market Challenges

- Biosimilar and Alternative Bisphosphonates: While no biosimilars exist for risedronate, other bisphosphonates like alendronate and zoledronic acid compete on efficacy and pricing.

- Patient Compliance: Gastrointestinal side effects and complex dosing regimens hinder adherence, affecting real-world market penetration.

- Regulatory Variability: Different jurisdictions impose varying approval standards and pricing controls, influencing market availability and profitability.

Pricing Trends and Projections

Current Pricing Landscape

Post-generic entry, the U.S. retail price for a 30-tablet pack of Risedronate Sod Dr (30 mg, once monthly) has decreased by approximately 70-80% from branded levels, averaging around $20-$30 per pack [2]. Similar substantial reductions are observed in European markets, respecting local price regulation.

Historical Trends

Evolution over the past five years demonstrates a sharp decline in per-unit costs following patent expiry. The initial brand price ranged $150-$200, which has since fallen due to increased competition.

Future Price Trajectories

- Short-to-Medium Term (1-3 years): Prices are projected to stabilize within the $10-$25 range per pack in mature markets, driven by intensified competition and procurement tenders.

- Long Term (3+ years): As market saturation occurs and newer bisphosphonates or alternative therapies emerge, prices could further decline, potentially reaching $5-$10 per pack in price-sensitive regions.

Influencing Factors

- Healthcare Policy: Price caps and reimbursement constraints may suppress premiums for generics.

- Market Penetration: Expansion into emerging markets may temporarily dampen prices but could increase volume.

- Innovation: Potential reformulations or combination therapies might disrupt pricing norms.

Regulatory and Reimbursement Considerations

Regulations influence both drug availability and pricing. Governments enforce price controls or tendering policies, notably in the EU and Canada, resulting in downward price pressure. In the U.S., Medicare and Medicaid formulary decisions significantly impact market prices and volume.

Reimbursement frameworks tend to favor cost-effective therapies, with payers negotiating discounts and preferred formulary statuses favoring generics like Risedronate Sod Dr.

Competitive Landscape and Future Outlook

The landscape is characterized by intense price competition among multiple generics. Key considerations include:

- Market Consolidation: Potential mergers among generic manufacturers could influence supply dynamics.

- Brand vs. Generic: While brand-name sales diminish post-patent expiry, maintained brand loyalty or differentiated formulations could moderate price erosions.

- Innovation and Adjunct Therapies: Emerging therapies with improved safety profiles or convenience could influence demand, indirectly impacting pricing strategies.

Key Takeaways

- The expiration of patents has led to a robust generic market for Risedronate Sod Dr, catalyzing significant price declines.

- Prices have stabilized at substantially lower levels, with further reductions anticipated as competition intensifies and markets mature.

- Differing regional regulatory frameworks and healthcare policies will continue to shape pricing trajectories.

- Volume growth, especially in emerging markets, is poised to sustain revenue generation despite price erosion.

- Stakeholders should monitor evolving policies, competitor movements, and clinical developments to adapt pricing and market strategies.

FAQs

1. What factors most influence Risedronate Sod Dr's pricing post-generic entry?

Primarily, market competition among generics, regional price regulation, healthcare payer policies, and procurement tenders significantly impact price levels.

2. How does regional regulation affect the affordability of Risedronate Sod Dr?

In markets with strict price controls, such as the EU and Canada, prices remain lower, facilitating broader access. Conversely, less regulated markets may see higher variability but generally lower prices due to competition.

3. What is the outlook for Risedronate Sod Dr's market share in the next five years?

The generic market is expected to maintain or increase its dominance, driven by aging populations, cost pressures, and clinical guidelines endorsing bisphosphonates.

4. Could new therapies threaten Risedronate Sod Dr’s market position?

Yes, innovations such as monoclonal antibodies (e.g., denosumab) and anabolic agents could shift treatment paradigms, potentially impacting demand and pricing.

5. How should manufacturers plan their pricing strategies for emerging markets?

Focusing on cost competitiveness, volume expansion, and aligning with local healthcare policies are crucial, alongside exploring partnerships and branding to differentiate offerings.

References

[1] Kruse, A., et al. (2009). "Efficacy and safety of risedronate in the treatment of osteoporosis." Clinical Drug Investigation, 29(2), 57–78.

[2] GoodRx. (2023). Price comparison for Risedronate Sodium. Retrieved from [goodrx.com].

More… ↓